Bitcoin

Bitcoin falls to 9-week low – So why is this key group not worried?

Bitcoin has historically tended to recover strongly in July, but a cocktail of dampers stands in its path this time.

- Institutional interest in Bitcoin has remained unchanged even as retail sales persisted.

- Bitcoin whales have continued steady accumulation in the face of price dips below $60K support.

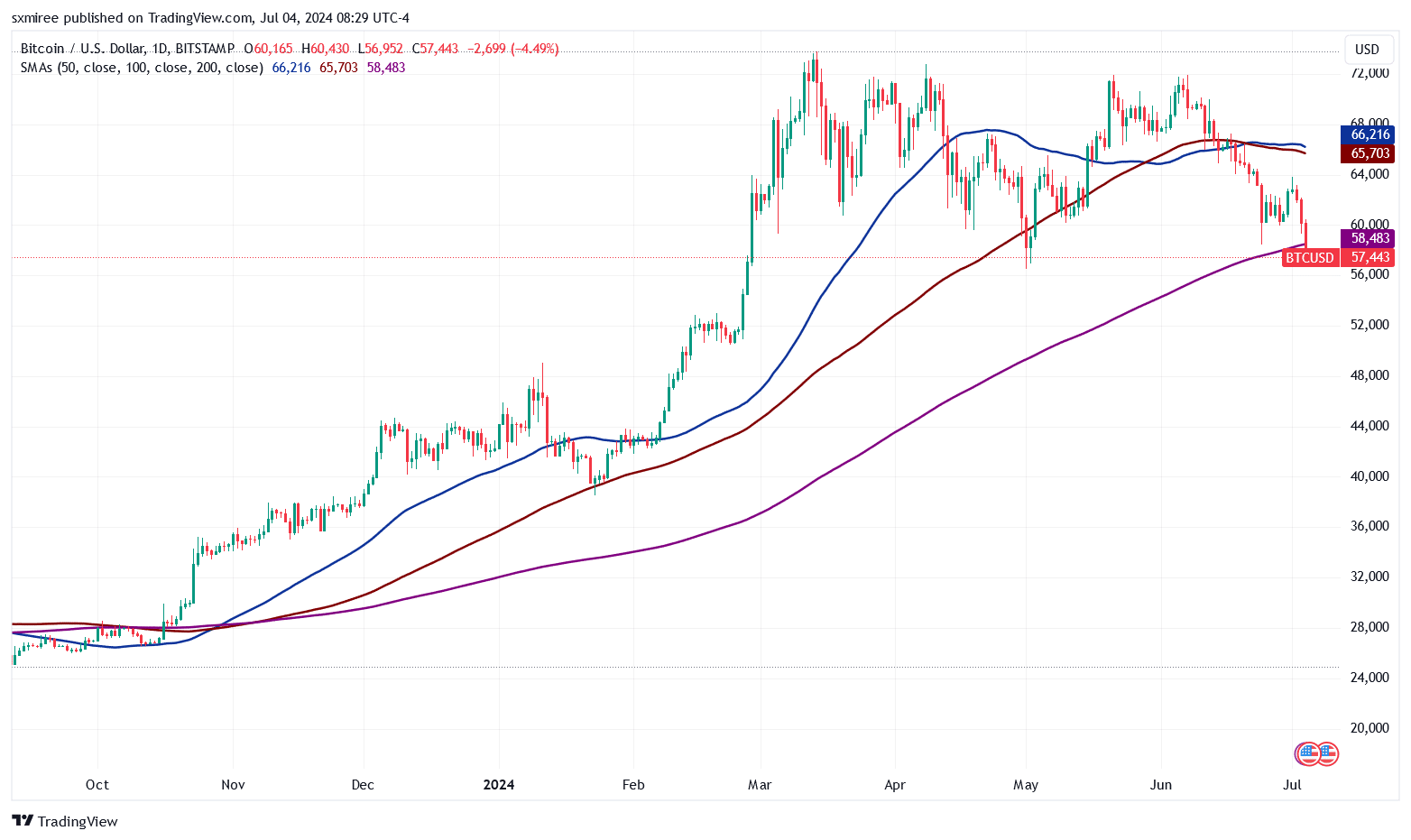

Bitcoin [BTC] retraced for a third straight day on the 4th of July, printing a huge red candle on the BTC/USDT daily chart as it sharply fell through $58,000.

This decline saw Bitcoin hit a nine-week low and lose its footing above the 200-day simple moving average (SMA) for the first time since October.

The latest downside has been ascribed to a lack of clear direction in the spot markets, hawkish comments from Fed Chair Jerome Powell, and steady sell-side pressure

arising from several factors.German government selling BTC

Continued Bitcoin selling by the German government has mounted more supply-side pressure in the market.

Per on-chain analytics platform Arkham Intelligence, the German government transferred 1,500 BTC on the 1st of July.

The wallet moved a further 832.7 BTC in four individual transactions on the 2nd of July, and has followed up with 3,000 BTC moved on the 4th of July.

Large holders are still taking up more coins

Interestingly, deep-pocket investors have been buying more of the flagship crypto, undeterred by the market’s volatile price swings.

Market intelligence platform Santiment observed earlier this week that wallets holding at least 10 coins had added 1.07% to their collective stash over the last six months and reached a record high of 16.17 million BTC.

Changes in the wallets of massive USDT and USDC holders support the activity of these large BTC holders.

Wallets holding between 100,000 and 1 million USDT account for 30.3% of the total Tether supply, while those with 100,000 and 1 million USDC hold 34.2% of USD Coin supply.

Santiment noted that these figures represent 5.37% and 1.99% declines respectively compared to half a dozen months ago.

Bitcoin whales have notably been active in accumulating during dips below $60,000.

Per IntoTheBlock data, large Bitcoin whales holding more than 0.1% of the Bitcoin supply have registered a positive flow of more than 55K BTC over the past 30 days.

Institutional interest

Even as Bitcoin exhibited signs of weakness, publicly traded companies have continued to acquire more of the asset.

Data from BitcoinTreasuries.net showed that public companies around the world cumulatively owned 321,802 BTC as of the 4th of July, led by

MicroStrategy, which held 226,331 BTC.Japan-based Metaplanet, this week, announced the addition of 20.2 BTC to its treasury holdings.

The investment firm has made Bitcoin purchases in the last three months -on the 23rd of April, the 10th of May, and the 10th of June. The latest buy marks the company’s fourth, bringing its total holdings to 161.27 BTC.

El Salvador has similarly kept up with its streak of buying 1 BTC every day. In March, President Nayib Bukele transferred a large volume of the country’s BTC holdings to a cold wallet stored in a physical vault.

BitInfoCharts data shows this wallet held 5,600 BTC, worth over $400 million, at press time.

Bitcoin price action

The retest of the critical support MA for the first time in 10 months underscored market fears

of a cycle top. Alternative.me’s crypto Fear and Greed Index tracker has dropped nine points since the 1st of July to 44 at the time of writing.BTC was changing hands at $57,580, down 16.51% over the last 30 days and almost 22% from an all-time high above $73,700 set in March.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Zooming in, the YTD chart showed that further sell-offs below the current prices could trigger a 12% decline towards $51.5k, where it consolidated in February.

A potential breakout will only be on the cards if BTC price can rise from the downtrend that has extended since mid-June.