Bitcoin flashes rare ‘double super signal’ – Why this is important

- Bitcoin’s back-to-back ‘Super Signals’ hint at explosive gains—last seen before 10,000% rallies.

- Over 94% of Bitcoin holders were in profit as volume trends suggested strong bullish sentiment ahead.

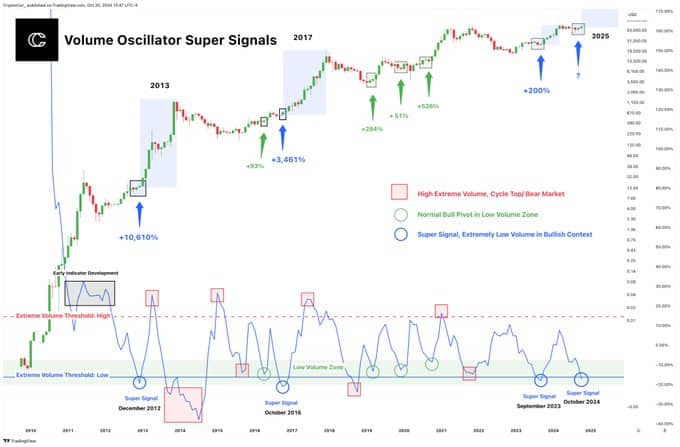

Bitcoin’s [BTC] volume oscillator has recently signaled back-to-back ‘Super Signals,’ a rare event that has only occurred during major bull runs.

Historically, such signals preceded massive rallies, including gains of over 10,000% in 2012 and 3,000% in 2016.

The latest occurrence, seen in September 2023, followed a +200% rise in Bitcoin’s price, with another super signal appearing in October 2024.

The ‘Super Signal’ appears when trading volume is extremely low in a bullish market. Analysts suggest that these conditions indicate accumulation, as sellers dwindle while buying interest remains steady.

The absence of prior high-volume spikes further supports a bullish outlook, differentiating this phase from bearish low-volume patterns.

Bitcoin’s price gains and market data

As of press time, Bitcoin was priced at $68,378.05, with a market cap of $1.35 trillion and a 24-hour trading volume of $24.5 billion.

This marks a 5.96% increase over the past seven days, showcasing steady gains. Bitcoin’s circulating supply stands at 20 million BTC.

Open Interest in Bitcoin Futures has risen by 2.39%, at $40.69 billion at press time, indicating increased trading activity and potential bullish sentiment.

CoinGlass data showed a 90.33% jump in trading volume to $42.62 billion, while options volume soared by 182.07% to $1.60 billion.

Options Open Interest also increased by 2.29%, now at $24.31 billion. The alignment of these metrics with Bitcoin’s price movements suggests growing optimism among traders.

Bullish sentiment

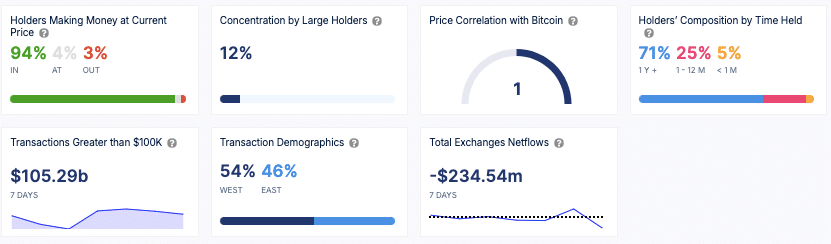

Data from IntoTheBlock showed that 94% of Bitcoin holders were in profit at current prices, signaling positive market sentiment.

The analysis also revealed that 71% of Bitcoin holders have maintained their positions for over a year, suggesting strong long-term holding behavior.

Meanwhile, 12% of Bitcoin’s supply were held by large holders, indicating a moderate concentration of ownership among whales.

Additionally, there has been a net outflow of $234.54 million from exchanges over the past week, pointing to potential accumulation as investors move assets into cold storage.

Over $105.29 billion in transactions greater than $100K occurred over the last week, driven by institutional investors and large traders.

Read Bitcoin’s [BTC] Price Prediction 2024 – 2025

The geographical distribution of transactions is fairly balanced, with 54% from Western regions and 46% from Eastern regions.

Overall, the presence of back-to-back super signals a unique event in Bitcoin’s history, creating anticipation for potential price movements similar to previous bull cycles.