Bitcoin

Bitcoin forms a local bottom: Can BTC trend higher from here?

Bitcoin shows strength; demand rises, whales hold, upward price trend likely ahead.

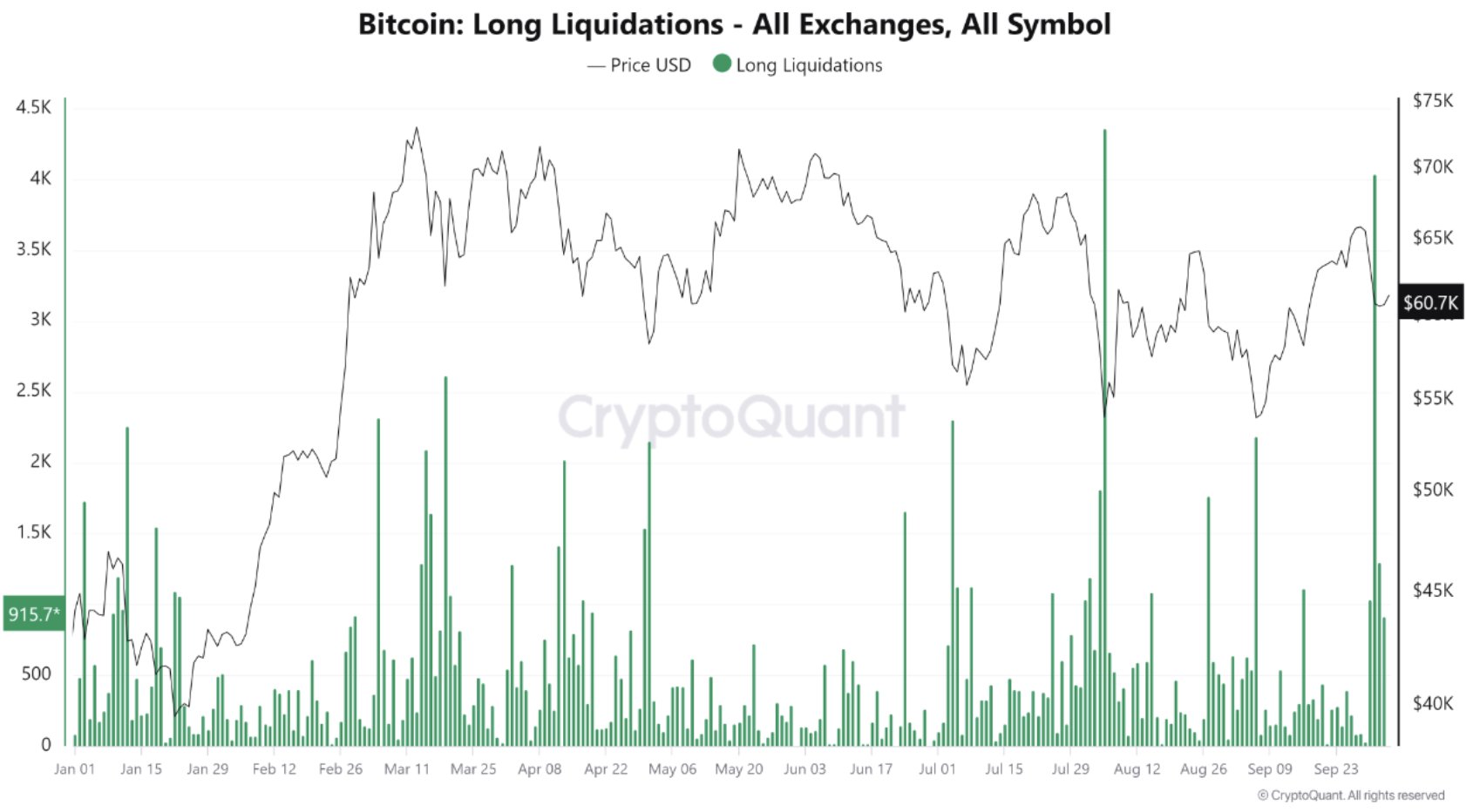

- Bitcoin Long liquidations lead to formation of local bottom.

- Short-term price increase for Bitcoin seems to be imminent.

Bitcoin [BTC] has shown resilience after a sharp decline following geopolitical tensions between Israel and Iran. Trading at around $62K at press time, Bitcoin was displaying signs of reclaiming the $63K level.

The recent liquidation of long positions may have established a local bottom, indicating that BTC could be set for a further upward move, with this bottom serving as the month’s low.

During significant declines, long contracts often drop sharply due to liquidations, reducing selling pressure.

Key liquidity levels remained firm between $68,900 and $69,300 above the press time price, and $56,800 to $57,400 below.

A new liquidity cluster was also emerging in the $66,500 to $66,800 zone, suggesting that the price may target this area soon.

While BTC’s price action has oscillated between $55K and $75K for over 200 days, Bitcoin remained in a solid position.

It was trading above the 100-week moving average (100MA) on the weekly chart, maintaining strength on the macro level.

Notably, BTC is now 170 days past the latest Bitcoin halving, and historical patterns show that new all-time highs (ATHs) tend to form approximately 1,080 days after the previous cycle’s peak.

This suggests that, if history proves to be right, Bitcoin may likely to trend higher from its current level.

Coinbase Premium indicator

Adding to this bullish outlook is the Coinbase Premium tool on CryptoQuant, which highlights a short-term BTC increase.

When a golden cross is formed, as shown in previous price movements, Bitcoin often experiences a short-term boost. This indicator adds further evidence that BTC could rise from its current local bottom.

US Bitcoin spot ETFs demand

Demand for Bitcoin from U.S. spot ETFs has also been rising. In early September, spot ETFs were net sellers, but by the end of the month, they had purchased 7K BTC, the highest level since July 2021.

In the first quarter of 2024, spot ETFs bought nearly 9K BTC daily, pushing prices to new highs. If this buying trend continues, Bitcoin’s price could rise even further in the final quarter of 2024.

Whales holding steady

Additionally, large Bitcoin holders, or “whales,” have shown historically low levels of profit-taking, indicating confidence in future price growth.

Whales have been distributing their BTC across different addresses, with only 1,975 addresses now holding between 1,000 and 10,000 BTC.

Despite some recent selling, whales have taken minimal profits compared to previous cycles, further supporting the notion that BTC’s price will rise from here as they seek to maximize their gains.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

A combination of liquidations, increasing demand from ETFs, and strong whale activity suggests that Bitcoin is poised for further gains from its current local bottom.

All these factors point towards a likely upward trend for BTC in the near term.