Bitcoin Futures reach new highs: Big moves ahead?

- BTC’s Funding Rate reached a multi-month high.

- BTC investors were accumulating the coin, hinting at a possible upcoming price rise.

Bitcoin [BTC] has again managed to cross the $65k resistance level after plummeting under that a few days ago. This recent price uptick must have stirred up bullish sentiment in the market.

The better news was that a key metric reached a multi-month high, further suggesting a massive rise in positive sentiment around the king coin.

Bitcoin reaches new highs

BTC’s price action has witnessed green over the last few days as its price increased by more than 4% in the last seven days.

At the time of writing, the king coin was trading at $65,561.08 with a market capitalization of over $1.3 trillion.

The king coin’s trading volume also increased while its price surged, which generally acts as a foundation for a bull rally.

While all this happened, BTC’s Futures reached new highs. To begin with, BTC’s Funding Rate touched a multi-year high.

When the Funding Rate rises, it means that more money is flowing into a network, which hints at a rise in bullish sentiment.

Apart from that, Ali, a popular crypto analyst, recently posted a tweet revealing yet another achievement in the futures space.

As per the tweet, BTC’s Open Interest across all exchanges just hit a new all-time high of $19.75 billion! A spike like this often signals big price moves ahead, with more capital on the line.

Therefore, AMBCrypto planned to check the king coin’s on-chain data to find out whether this newfound interest in BTC would result in a continued price hike.

What’s next for BTC?

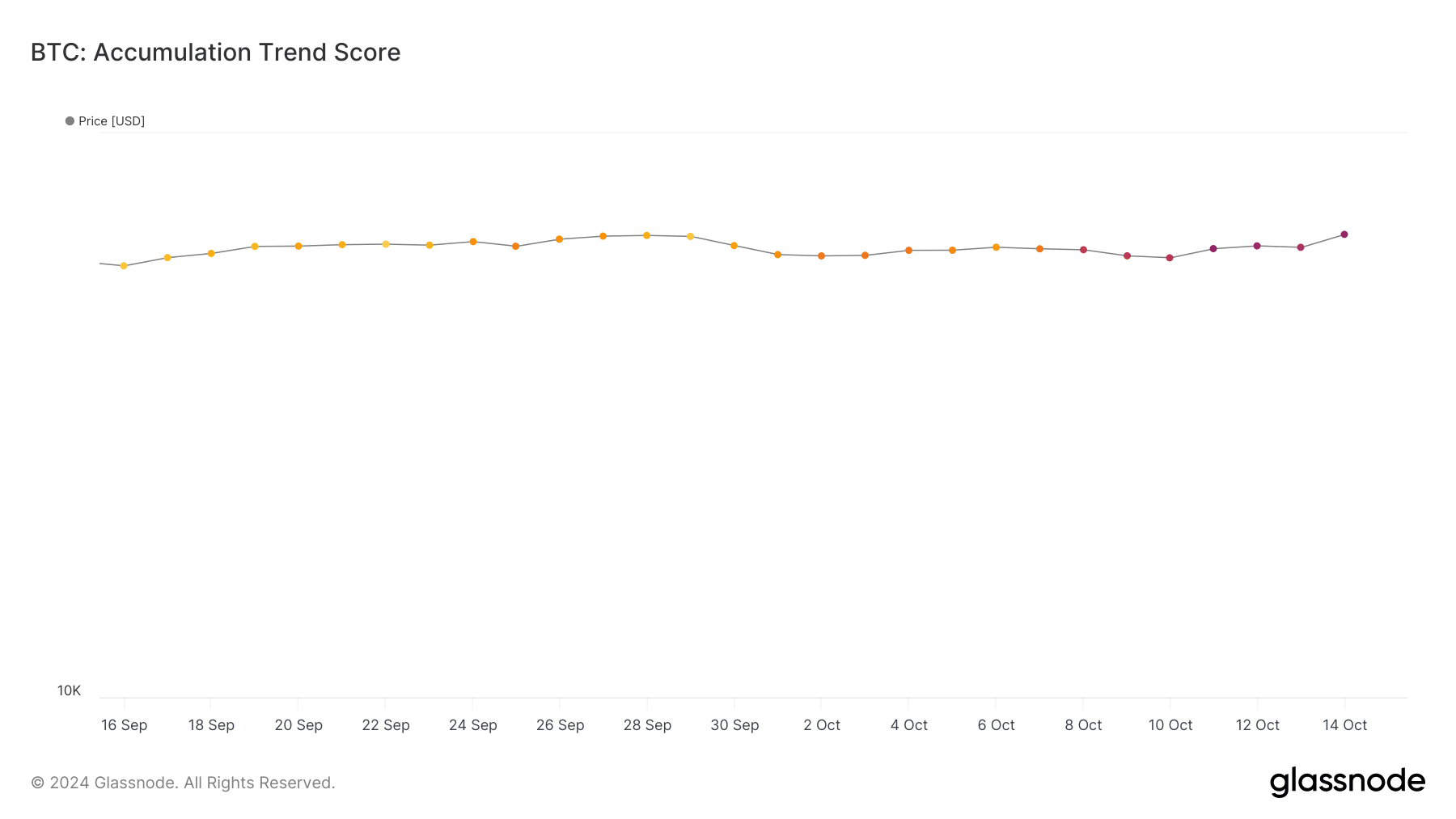

As per our analysis of Glassnode’s data, investors’ interest in BTC also reflected in accumulation. We found that BTC’s accumulation trend score increased from 0.2 in late September to 0.6 in October.

For starters, the accumulation trend score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 1 means that buying pressure is rising.

However, not everything was in Bitcoin’s favor.

AMBCrypto’s look at CryptoQuant’s data revealed that BTC’s net deposit on exchanges was high compared to the last seven-day average, suggesting that selling pressure increased in the last few days.

Whenever selling pressure rises, it hints at a price correction.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

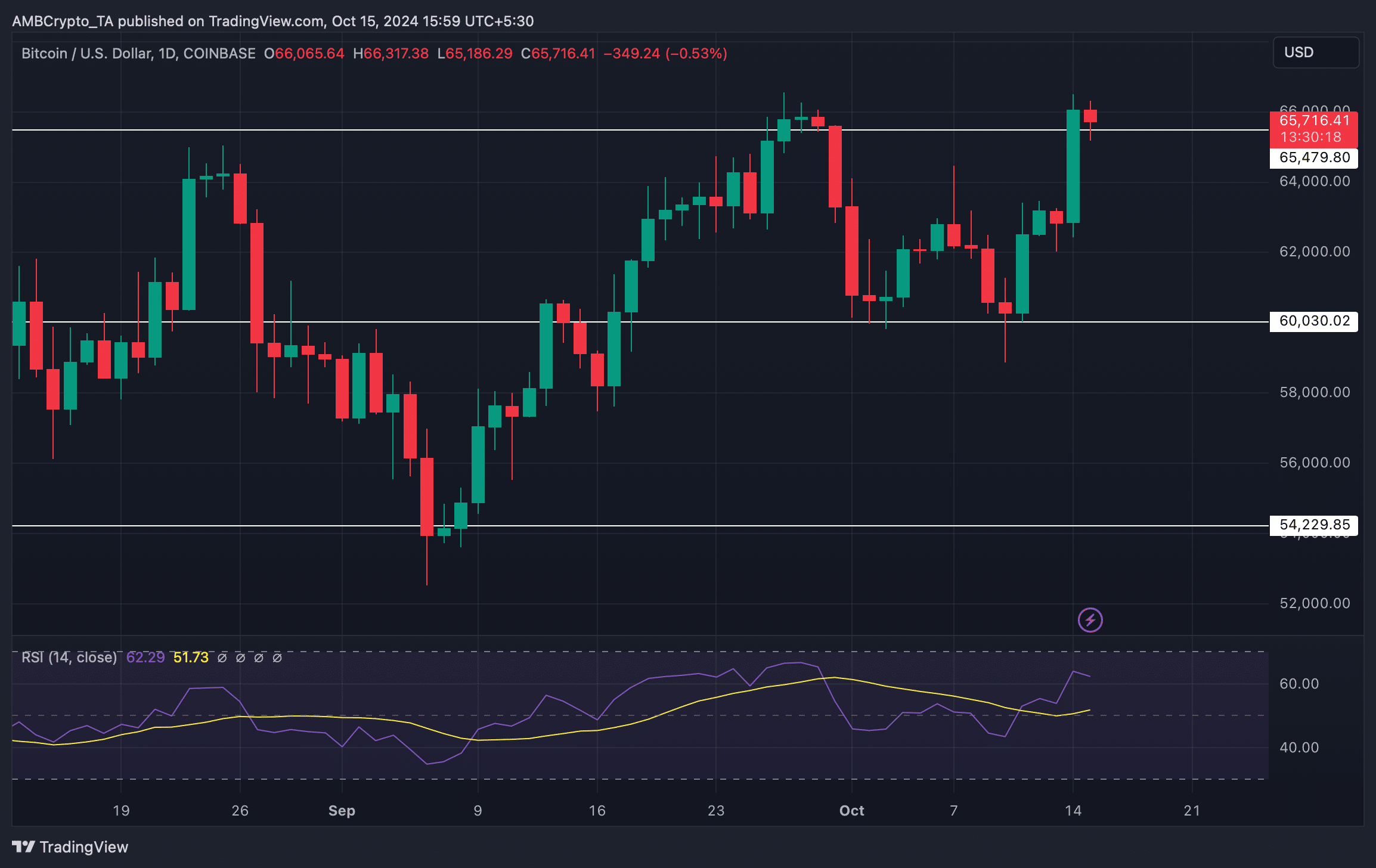

Therefore, AMBCrypto assessed BTC’s daily chart to better understand what to expect. We found that after breaking a resistance, BTC turned the same level into its support.

However, the Relative Strength Index (RSI) registered a downtick. This suggested that BTC might not hold its support.