Bitcoin has lessons to learn from gold’s Spot ETF journey

- BTC surged to $31,000 for the first time in over a year.

- Gold’s value grew exponentially after its Spot ETF in 2003.

The world’s largest cryptocurrency, Bitcoin [BTC], briefly breached past the $31,000 as market optimism continued to grow in the wake of multiple applications for a Spot Bitcoin Exchange-Traded Fund (ETF).

How much are 1,10,100 BTCs worth today?

The move past $31,000 was the asset’s best performance in over a year. The bullish rally was triggered after BlackRock, the world’s largest asset management company, applied for an ETF that will directly track Bitcoin.

Since then, other TradFi players like WisdomTree and Invesco have thrown their hats in the ring as well.

The interest shown by big institutional players strengthened hopes of a BTC bull run and changed the market sentiment to greed, which was stuck at the neutral position over the last month. This begs the question – What is it with Spot ETF that has heightened traders’ hopes?

The gold example

Bitcoin’s ETF will allow buyers to invest in the king coin without buying the actual asset. Thus, they will be able to escape the hassles of cryptocurrency exchanges and crypto wallets.

Thus, ETFs help to bridge the gap between the traditional finance and the assets in question. Let’s take the example of the bullion market, specifically gold.

According to on-chain analytics firm IntoTheBlock, the launch of its Spot ETF in 2003 revolutionized gold trading. The fund made investing in the yellow metal hassle-free, resulting in a meteoric rise in its value.

Attaching a snippet from TradingView, IntoTheBlock highlighted that gold prices rose 27% in a year’s time after the launch, 172% in five years and nearly 5x in a decade. This implied that the launch of ETFs played a crucial part in attracting institutional funds.

Is your portfolio green? Check out the Bitcoin Profit Calculator

And while Bitcoin futures ETFs are already in the market, the application for Spot ETFs holds greater importance. Spot ETFs, unlike futures ETFs, will be backed by real BTC, and the price of one share on the exchange will react to the Spot price of BTC, akin to holding a BTC.

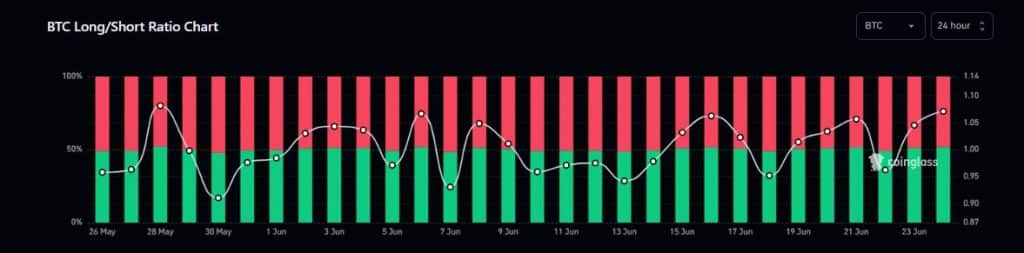

Long positions for BTC surge

The bullish sentiment pervaded the futures markets as traders positioning for price gains outpaced those looking to benefit out of price losses. According to Coinglass, BTC longs surged to 51% of the total number of active positions in the market at press time.

![Kaspa [KAS] on a long-term downtrend? Here's why it should worry investors!](https://ambcrypto.com/wp-content/uploads/2025/06/Kaspa-Featured-400x240.webp)