Bitcoin hashprice at $48: Will it hold despite difficulty rise and fee slump?

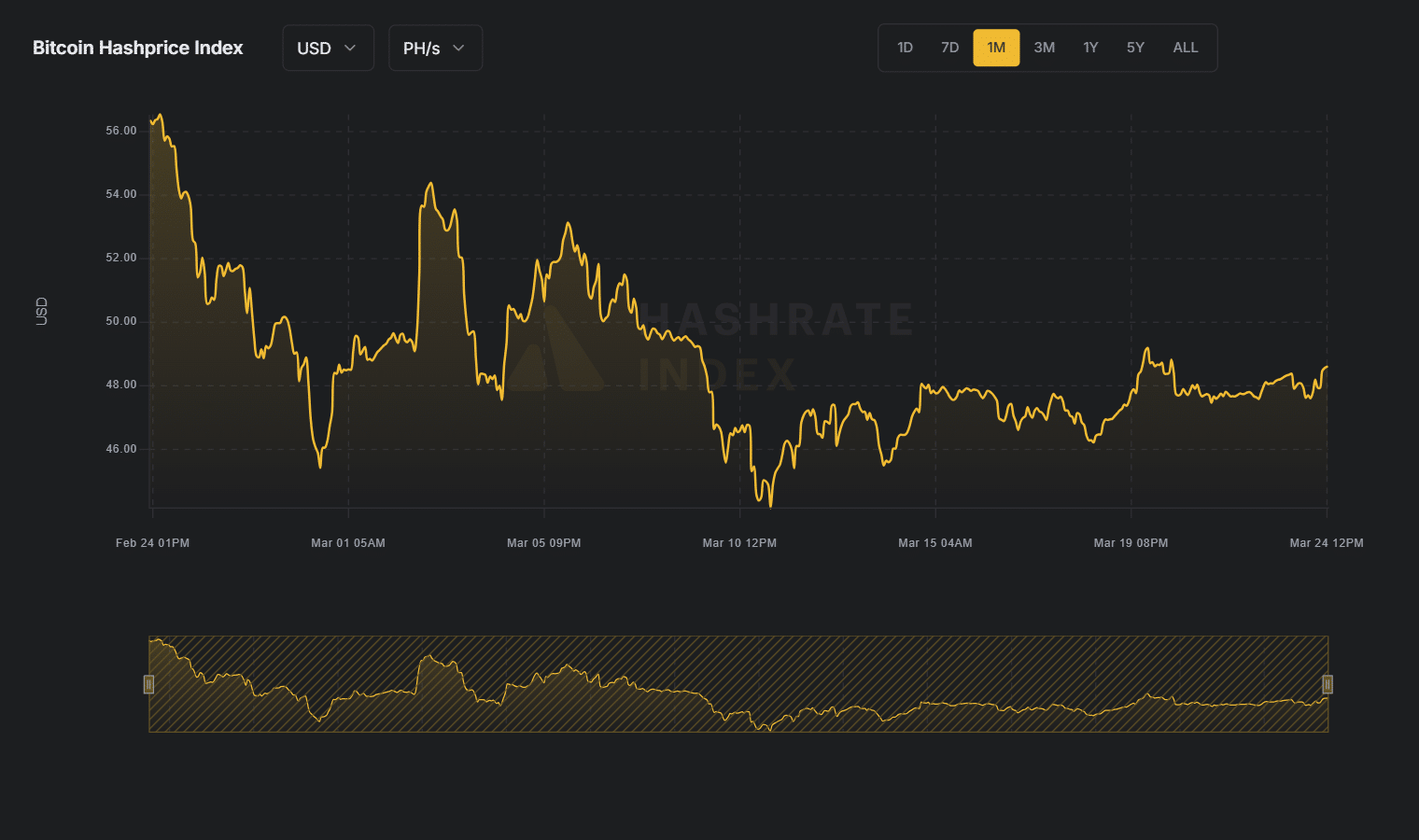

- Bitcoin mining hashprice has stabilized at $48 despite rising difficulty and falling transaction fees.

- A projected 4.3% difficulty drop may provide short-term margin relief.

Bitcoin’s [BTC] mining hashprice has stabilized at $48 per petahash per second (PH/s), following a 1.4% rise in difficulty to 113.76 trillion at block 889,081 on the 23rd of March.

The increase came as the network hashrate dropped below 800 EH/s, reversing a brief rise to 840 EH/s earlier this month.

That’s not the only metric tightening miner profitability.

A recovery in price, but not in pressure

Bitcoin’s price dipped to $80,000 on the 10th of March, recovering to $85,172 by the 24th of March. But the hashprice remains under the $50 threshold many miners rely on for sustainable operations.

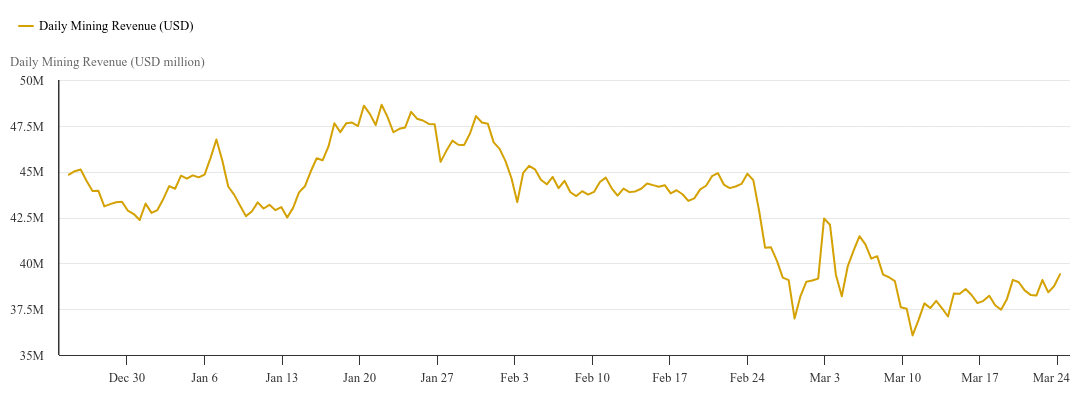

Daily mining revenue reached $39.23 million, a slight rebound from the $36.27 million low earlier in the month.

Still, revenue has declined 17% since December, when miners earned over $47 million daily.

Fees vanish, margins vanish faster

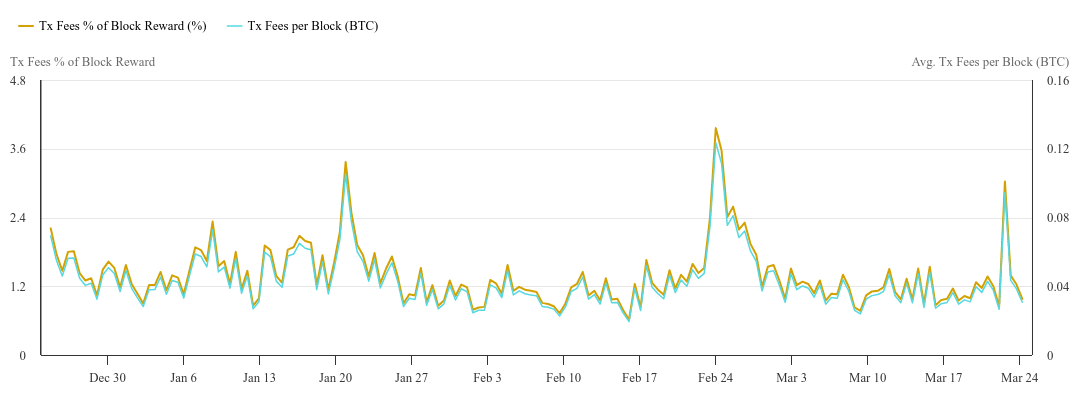

Transaction fee income has also dried up.

As of the 24th of March, fees made up just 1.12% of block rewards, the lowest share since January 2022. Per-block fee income now averages 0.04 BTC, removing a key revenue stream for miners during price weakness.

The pressure has pushed many operators toward efficiency upgrades.

Older-generation machines like the Antminer S19 XP and S19 Pro now yield $0.088 and $0.067 per kilowatt-hour, which falls below typical electricity rates in many regions.

That puts thousands of units at risk of becoming unprofitable. Meanwhile, newer models continue to perform.

According to Braiins, rigs like the Antminer S21 Hyd still deliver over $4.50 in daily earnings, offering greater margin protection under current hashprice conditions. But the difficulty rise complicates matters.

Difficulty climbs, but timing betrays the miners

Bitcoin’s protocol recalibrates difficulty every 2,016 blocks. The latest increase reflects past network activity, not the current slowdown.

This timing gap has left miners facing rising difficulty just as hashrate falls.

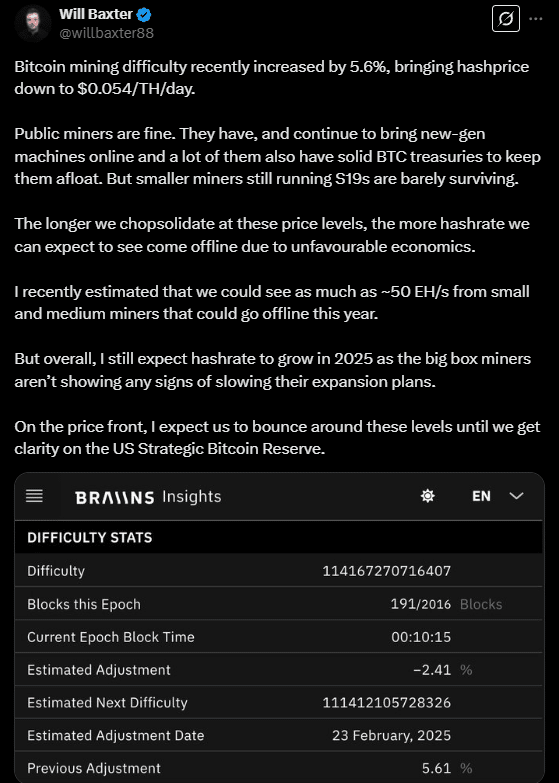

Will Baxter, EVP at Braiins, confirmed that difficulty recently rose 5.6%, driving hashprice down to $0.054/TH/day.

He noted that public miners remain insulated by newer hardware and treasury holdings, while smaller miners still using S19s are “barely surviving.”

“The longer we chop sideways at these price levels, the more hashrate we can expect to see come offline.”

Baxter estimated ~50 EH/s of small and medium-sized mining capacity could shut down this year.

Still, he expects hashrate growth in 2025 as “big box miners” continue expanding.

Relief on the horizon?

The next adjustment, projected for the 7th of April, may drop difficulty by 4.3% to 108.86 trillion.

That forecast aligns with the current 10.45-minute average block time, which exceeds the target and signals a downward recalibration.

Still, miners remain divided.

Institutional players with modern rigs and cheap power continue operating. Others with older hardware and higher costs are scaling back, as shown in the falling hashrate.

Without a price rebound or a spike in transaction fees, hashprice may remain under pressure.

The upcoming difficulty adjustment will be critical in shaping short-term margins—especially with the next halving expected within a year, which will further reduce block rewards.