Bitcoin hashprice hits record low – Is a new miner crisis coming?

- Bitcoin’s hashprice has hit a record low, stroking fears of another round of miner crisis.

- Network Difficulty was up 10%, and daily miner revenue has tanked by 50%.

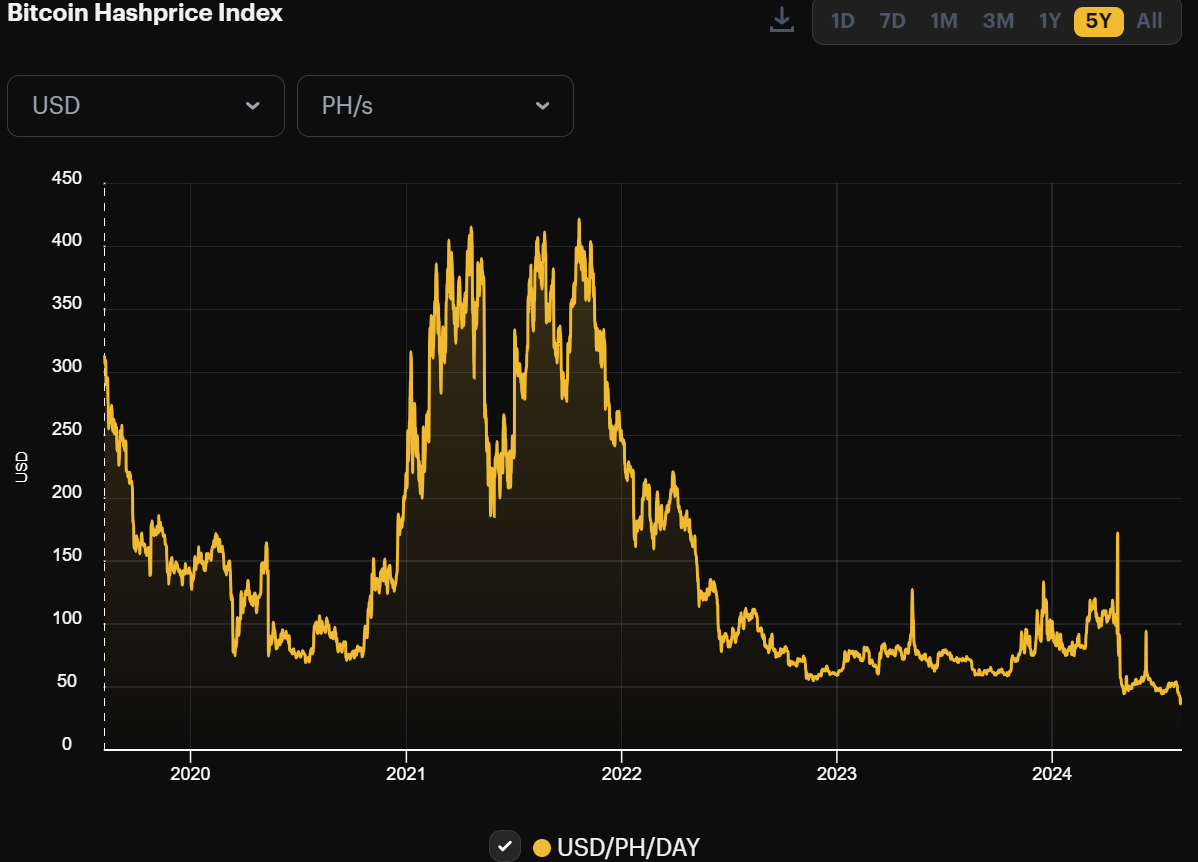

Bitcoin’s [BTC] hashprice, which tracks miner revenue, has dropped to a record low, raising fears that BTC miners could face another profitability crisis.

According to the Hashrate Index data, the hashprice dropped to $40 per computing power unit per day on the 8th of August.

This was below even the 2022 crypto winter, which bottomed out at $60 per unit amidst a huge BTC miner crisis.

With the falling hashprice, the BTC Miner Revenue Per Day also declined from $40 million on the 29th of July to around $24 million on the 7th of August, per YCharts data.

Bitcoin network difficulty increases

Miners’ woes have been compounded by rising BTC network difficulty, which has hit a record high of 90 trillion in August, up from 80 trillion in mid-July.

This means that the computing power needed to mine BTC or find a block has increased by nearly 10%.

This could put subscale miners under much pressure and tip them to sell their BTC holdings to cover operational costs or shut down.

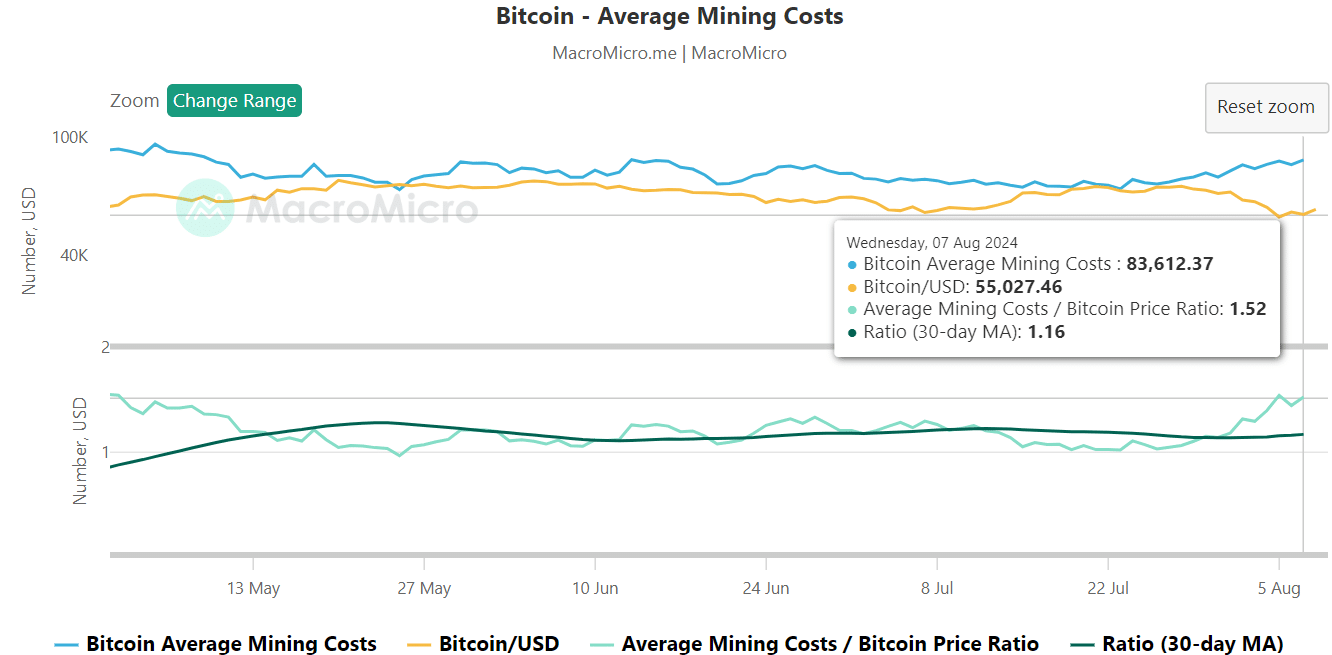

On the 7th of August, the average mining cost was $83.6K against the BTC price of $55K, per MacroMicro data. That’s a whopping +$23K shortfall.

However, well-scaled and optimized miners, like Marathon Digital, have an average mining cost of $43K.

According to CryptoQuant founder Ki Young Ju, it meant that they could only be worried if BTC dropped below the price for way too long.

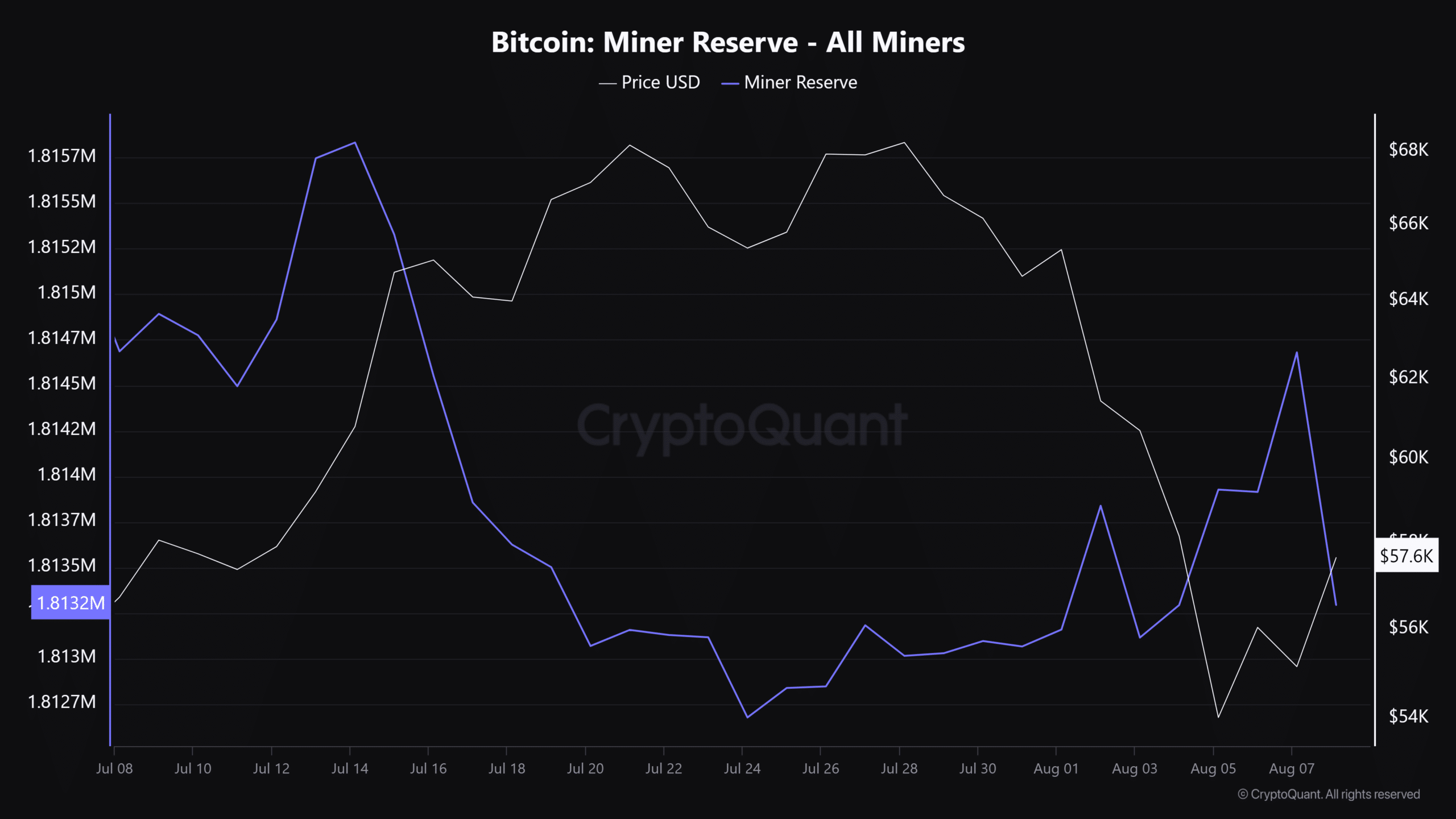

Meanwhile, BTC Miner Reserve dropped by over 1,100 BTC on the 7th of August, denoting that some miners sold off part of their holdings.

Is your portfolio green? Check out the BTC Profit Calculator

The metric tracks total BTC miner holdings, which have risen since late July. It denotes that they were holding even during last week’s dump.

However, miner sell-offs could also put pressure on BTC prices. As of press time, BTC traded above $58K and could eye the previous range-low at $60K. However, a sustained miner dump could derail the recovery.