Bitcoin hashrate plunges: Do miners continue to threaten BTC’s future?

- Bitcoin hashrate declined significantly over the last few days, which may result in miner capitulation.

- Activity on the Bitcoin network also fell significantly

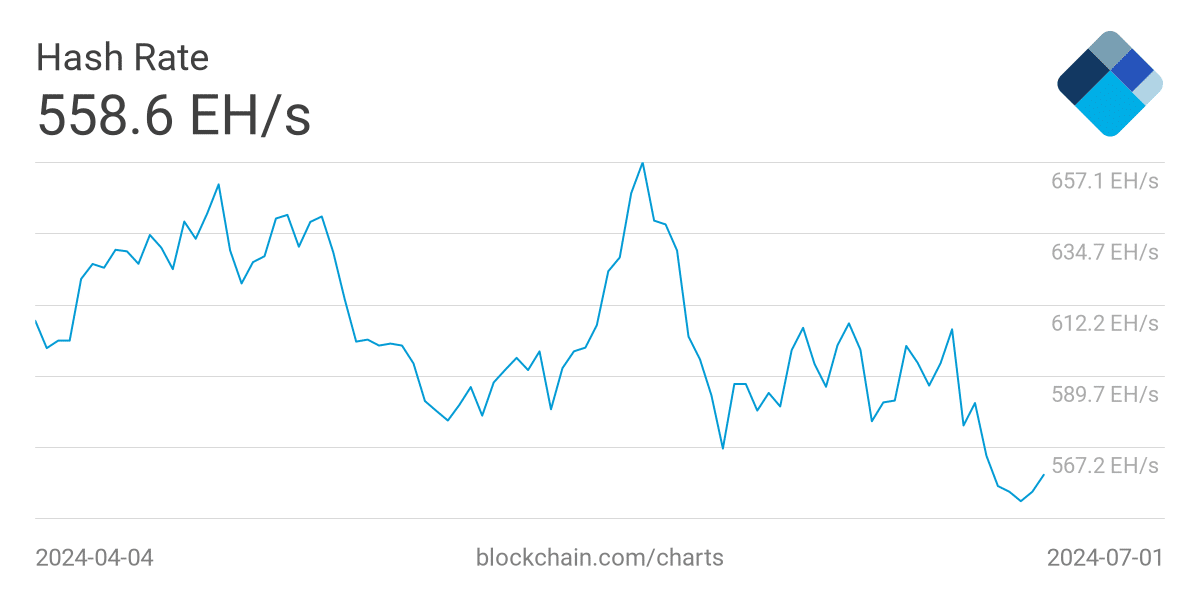

A key indicator of the Bitcoin [BTC] network’s processing power, the hashrate drawdown, has plunged to its lowest point since December 2022.

Bitcoin hashrate declines

Per Blockchain.com, there was a significant decline in Bitcoin’s hashrate this month, bringing it down to levels reminiscent of the tumultuous period surrounding the FTX exchange collapse in late 2022.

However, there’s a crucial distinction between the two scenarios. The current hashrate decline comes on the heels of Bitcoin’s recent halving, which sliced miner rewards in half to 3.125 BTC per block mined.

This drop in hashrate suggested that some miners may be struggling to stay afloat. Bitcoin miner capitulation occurs when miners are forced to shut down their operations due to unsustainable costs.

This typically happens when the cost of mining Bitcoin, which includes electricity, hardware, and maintenance expenses, surpasses the revenue generated from mining rewards.

The recent halving has undoubtedly exacerbated this challenge for miners, as they’re now earning less Bitcoin for the same amount of work.

The current hashrate decline could be a sign that some miners are capitulating, leaving the network.

If expenses continue to rise, and miners are forced to sell their holdings, downward pressure on BTC could be created which may cause a significant correction.

Bitcoin ecosystem in trouble

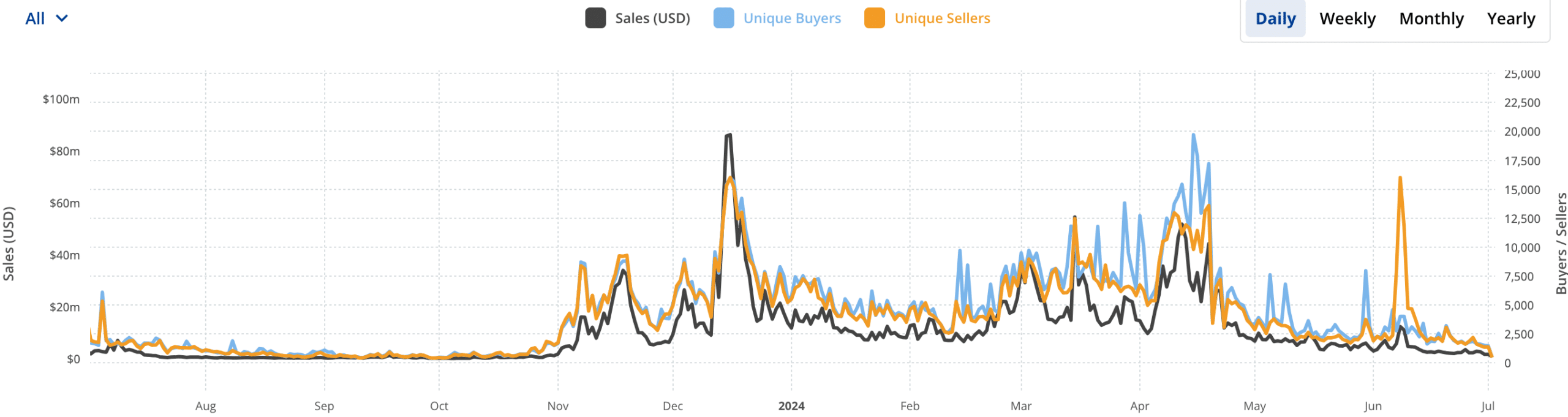

Miners are also grappling with reduced revenues from alternative sources as network activity diminishes. Initially, they benefitted from high fees during the Bitcoin-based Runes protocol frenzy post-halving.

However, earnings have sharply declined as network activity slowed.

Daily Rune transactions have plummeted, marking a drastic 90% decrease. Consequently, total miners’ earnings from Rune transactions have fallen materially as well.

Along with that, the overall NFT transactions occurring on the network also declined significantly in the last few days. CryptoSlam’s data indicated that the sales volume for these NFTs had fallen to 68.32% in the last month.

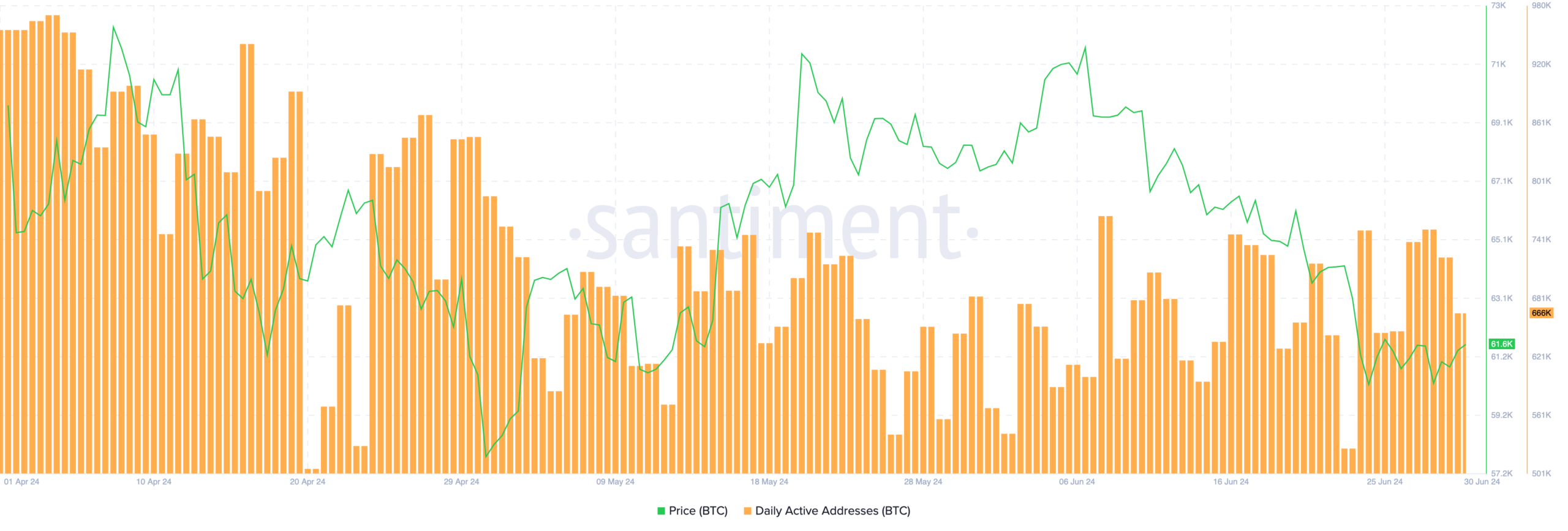

Moreover, the activity on the network had also declined.

Read Bitcoin’s [BTC] Price Prediction 2024-25

AMBCrypto’s analysis of Santiment’s data indicated that the daily active addresses on the network had declined materially over the last 30 days, decreasing from 955,000 a day, to 666,000 a day.

This decline in activity can further impact the ability of miners to generate significant amounts of revenue.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)