Bitcoin: Historical precedents point at a price rally in 2023 with this condition

- BTC’s price might see a further upward movement as the year progresses.

- Many investors currently hold the king coin at a profit.

According to two analysts from CryptoQuant, history suggests that the value of Bitcoin [BTC] is poised to surge in 2023. The experts have shared their predictions based on historical trends and patterns observed in the BTC’s price movements in the 2018 – 2019 market cycle.

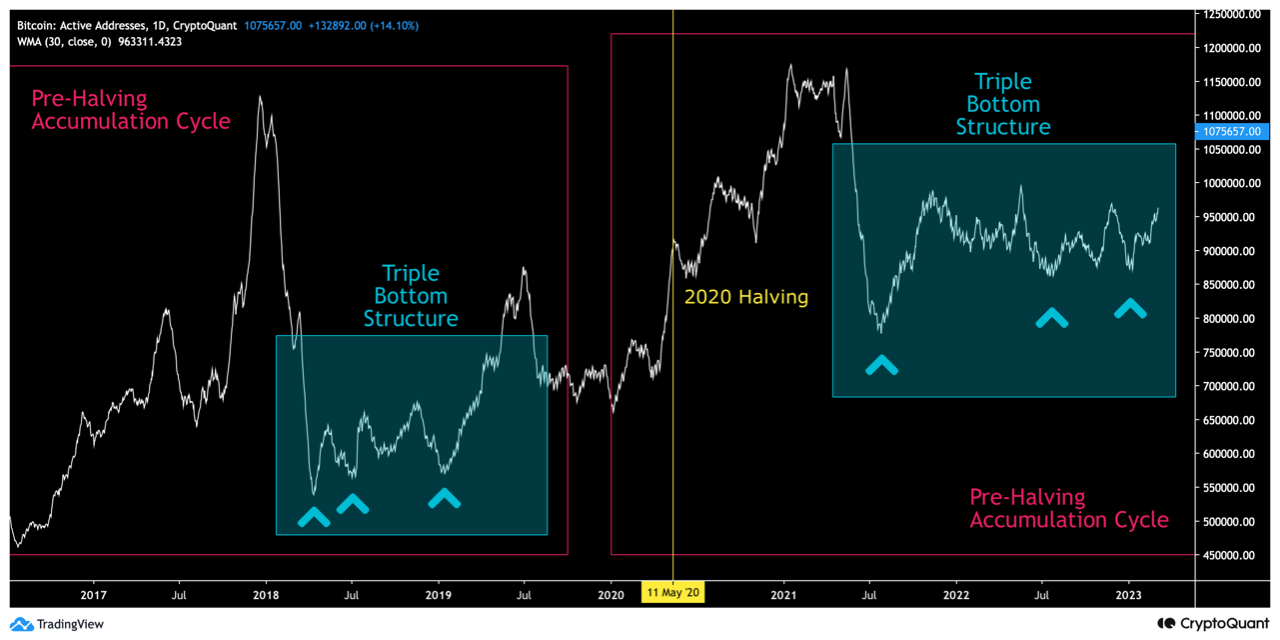

Pseudonymous analyst oinonen_t looked at BTC’s on-chain active address data during the 2018-2019 cycle and found that it generated three individual bottoms as part of the reversal process.

According to the analyst, the 2021-2023 cycle has also shown a similar structure as active addresses reached three individual lows.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Therefore, the market may see incremental price growth throughout 2023, following the triple bottom structure of the last major cycle, oinonen_t opined. The analyst further noted,

“If bitcoin follows the triple bottom structure of the last major cycle, we’re about to see incremental price increases across 2023. Bitcoin’s current “fair price” is at $43 598, closely aligned with our last price projection of $46 092.”

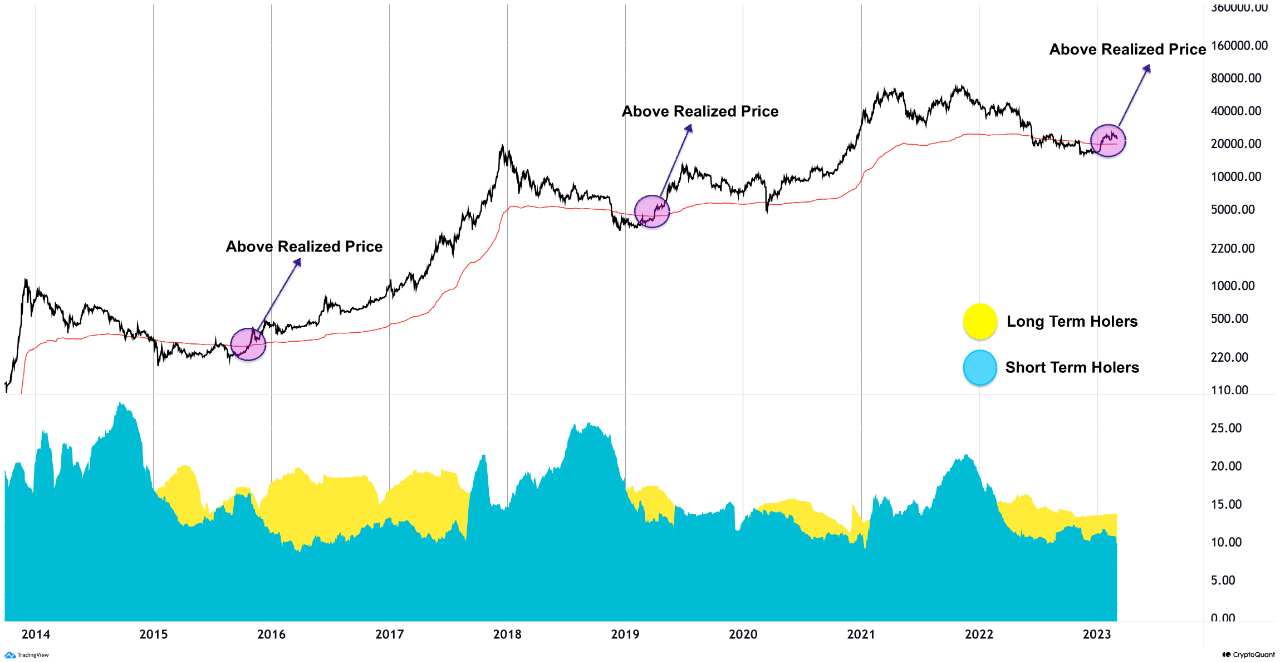

Further, another analyst Woominkyu studied the behavior of BTC long-term and short-term holders in relation to the coin’s realized price.

According to Woominkyu, historical precedents revealed that BTC long-term holders have consistently outweighed short-term holders during periods when the cryptocurrency’s price has successfully crossed the realized price.

This has often led to a rally in BTC’s price. In the current market cycle, long-term holders are expected to gain market control and boost prices gradually, Woominkyu noted.

“The situation does not appear to have materially changed from the past, and it seems that “long-term holders” will gradually gain control of the market and raise prices again.”

Good tidings for BTC holders

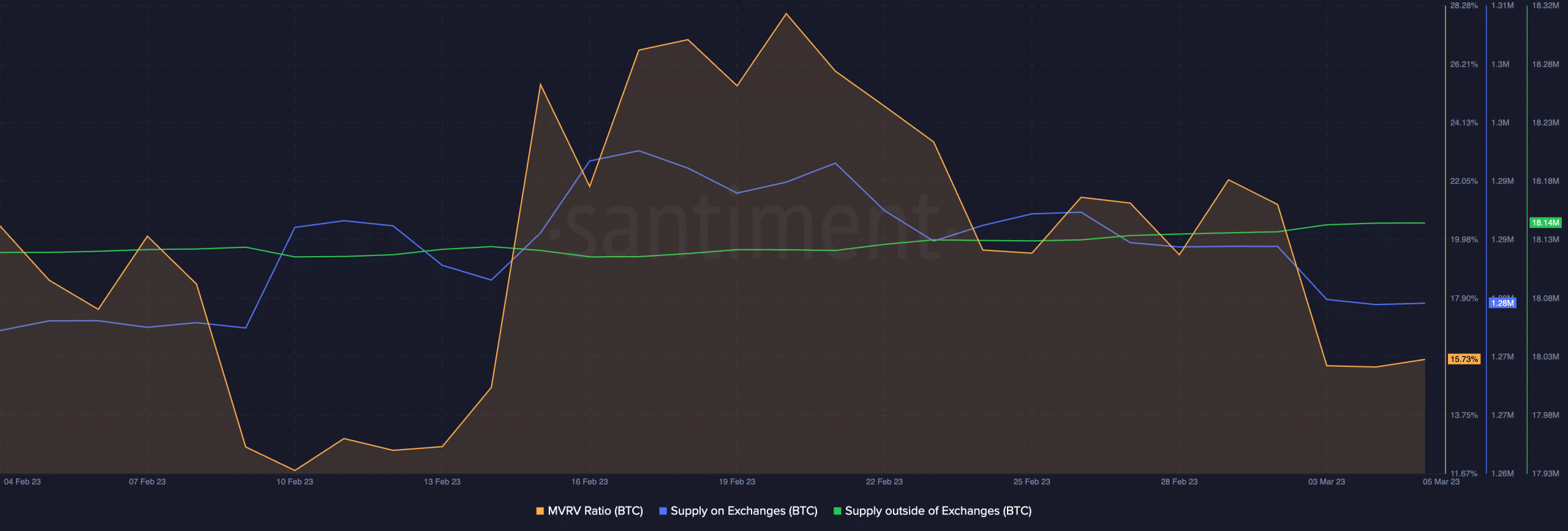

Despite the momentary slip in BTC’s price on 3 March and its failure to reclaim the $25,000 mark in the last month, on-chain data revealed that its investors continue to hold at a profit.

According to data from Santiment, BTC’s Market Value to Realized Value ratio (MVRV) remains positioned in the positive territory. In general, a positive MVRV ratio for an asset implies that if all holders sold their holdings at the current price of the asset, they would generate twice the profit on average.

Read Bitcoin [BTC] Price Prediction 2023-24

Further, a look at the king coin’s exchange activity showed an uptick in its supply outside of exchanges and a corresponding decline in its supply on exchanges.

This is typically regarded as a bullish signal as it means that more investors are interested in holding rather than selling. This can help drive up the value of an asset.