Bitcoin hits $76,849 ATH amid new Fed rate cut: Future predictions?

- Bitcoin hits new highs but could be due for a leverage shakedown.

- Large holder activity signals a surge in profit-taking.

Bitcoin [BTC] achieved a new historic high at $76,849 on the 7th of November. When BTC hit its previous all-time high at $69,000 in 2021, the U.S. Federal Reserve started raising interest rates shortly after.

The narrative at the time was that there was too much liquidity in the market and inflation was ticking up.

Fast-forward to the second half of 2024 and the FED is pivoting in favor of lowering rates. The U.S. regulator just announced another 25 basis point rate cut. But why is this important?

Lower rates will continue to improve the liquidity conditions in the market, an outcome that was already evident after the previous rate cut.

The latest rate cut announcement means Bitcoin may therefore have a smoother time achieving more upside.

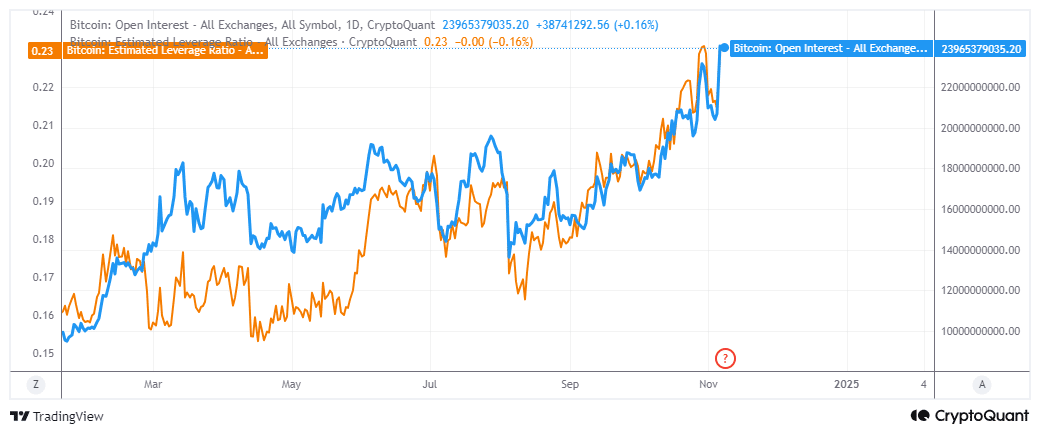

While the new rate cut may boost investor confidence, leveraged longs risk liquidation. According to CryptoQuant, Bitcoin’s Open Interest and Estimated Leverage Ratio have recently been hovering within their highest YTD levels.

The high leverage suggested that bullish expectations remain high. However, it also highlights the risk of long liquidations if the price snaps back down.

Is Bitcoin experiencing sell pressure from profit-taking?

The current situation underpinned by leveraged longs may provide an opportunity for whales to play the market. Incoming buying momentum by traders afraid of missing out if prices go higher will provide exit liquidity for sellers.

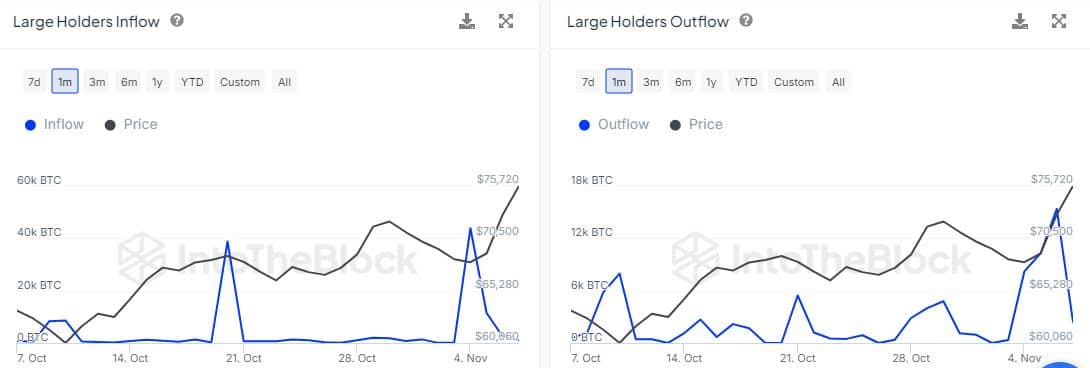

Bitcoin’s large holder inflows indicated a strong deceleration in the amount of BTC flowing into whale addresses. The figure dropped from 43,870 BTC on the 4th of November to 1,160 BTC by the 7th of November.

In contrast, large holder outflows surged to 15,370 BTC by the 6th of November. Note that this figure had dropped to 2,430 BTC on the 7th of October.

The large holder flows data confirmed that whale buying pressure dipped considerably in the last five days.

Also, the level of outflows from large holder addresses was higher than inflows, confirming that sell pressure from whales was on the rise.

Bitcoin was already overbought in the last 24 hours, thus increasing the chances of a reversal.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

While a bearish outcome could occur during the weekend, traders should also consider the other side of the coin.

Extreme optimism may lead to limited downside as more people hold on in expectation of higher prices. Nevertheless, the high level of leverage suggested that BTC was heading for volatile times ahead.