Bitcoin hits $93K: Will the rally push BTC over $100K now?

- Bitcoin rally is approaching a pivotal point, with the strength of the bulls being put to the test.

- A short-squeeze could be the catalyst needed to push Bitcoin towards the next key level of $110K.

The market is in extreme euphoria as Bitcoin [BTC] hits a new ATH at $93,490, and social media is ablaze with $100K+ price predictions. Historically, hype at peak sentiment often signals caution – savvy traders know that euphoria can mark a top.

Recently, a slight bearish divergence hinted at a possible pause, as BTC briefly dipped 0.57%, consolidating around $87K. However, the bulls swiftly reclaimed control, fueling a 3% rally the next day to set a fresh all-time high.

It was a pivotal moment – the bulls rallied with conviction, cutting through market skepticism and setting their sights firmly on the legendary $100K milestone.

Now, as BTC pushes even higher, selling pressure is sure to follow. Therefore, the real test for the bulls lies ahead, as inevitable pullbacks loom on the horizon.

Key resistance factors in Bitcoin’ rally to $100K

As Bitcoin continues to surge, traders are sitting on significant unrealized profits, which increases the likelihood of a rally coming to a halt and a price correction setting in.

Psychologically, after reaching extreme price peaks, uncertainty tends to create caution. With ongoing concerns about regulatory changes, many traders may choose to lock in their gains and minimize losses, which could add downward pressure to the market.

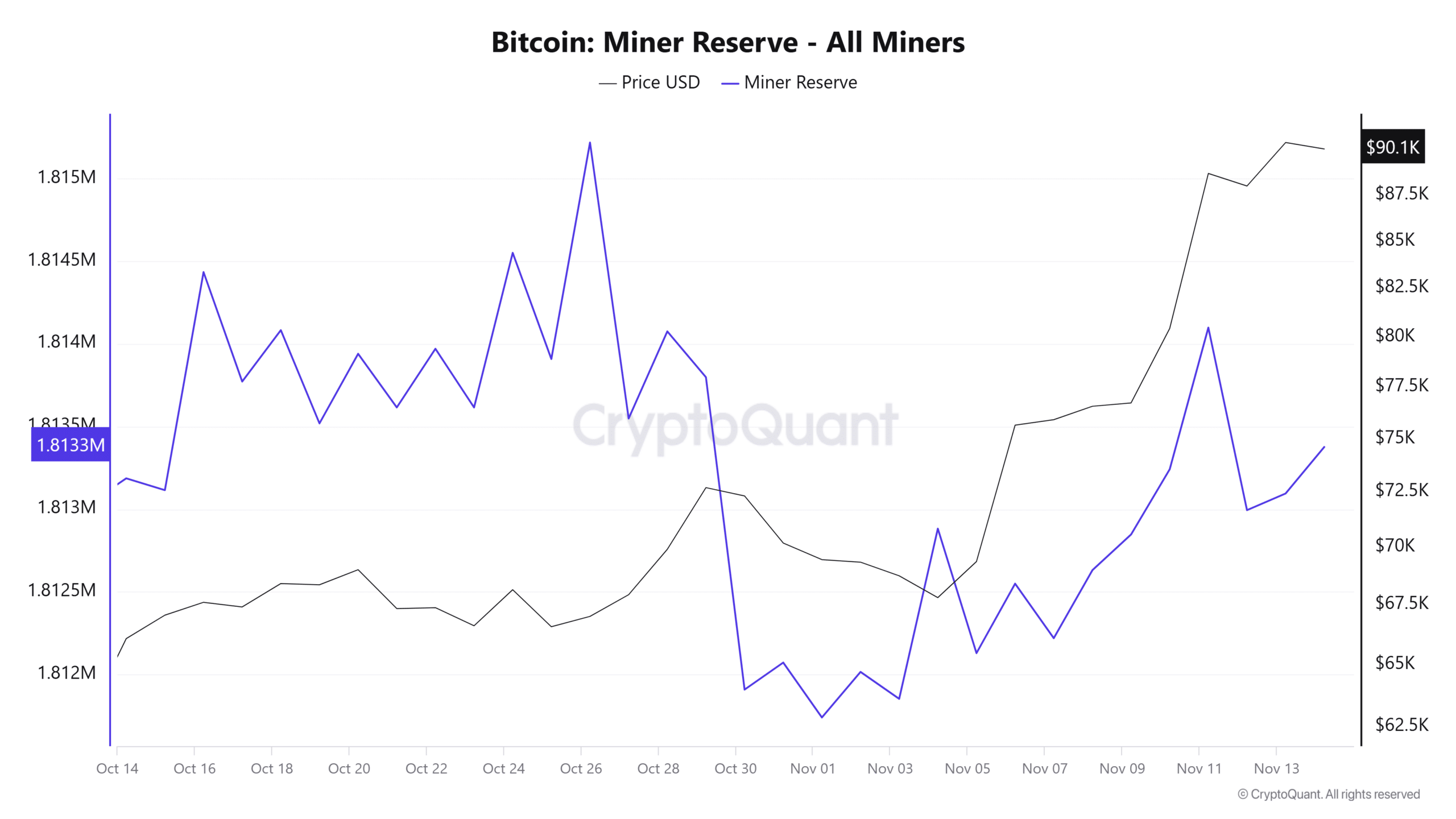

A classic example of this is Bitcoin miners offloading their holdings.

On the same day the rally stalled for the first time in this post-election cycle, with Bitcoin dipping as low as $82K after posting a new ATH of $87K the previous day, miners saw an extreme outflow of 25,000 BTC.

Put simply, miners might be uncertain about Bitcoin reaching $100K. As a result, they may be looking to capitalize on the current high prices, locking in profits – especially to break even on their expenses – before market volatility sets in.

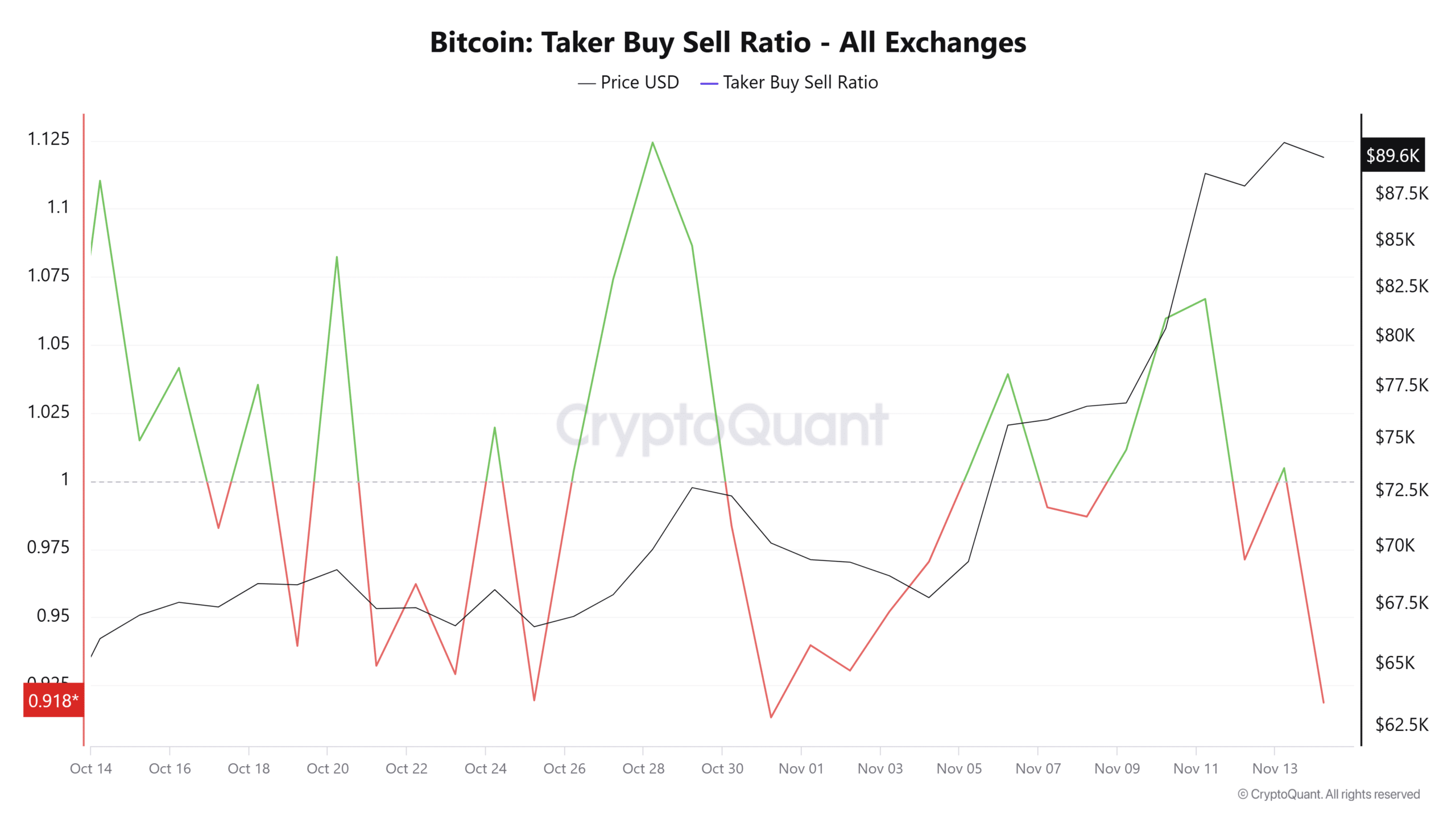

Apart from the volatility driven by miners, the derivative market is also showing a shift in dominance, with high sell orders gaining traction. This is evident from the notable red stick pointing southward.

To keep the Bitcoin rally unchallenged, reversing this trend will be crucial. As mentioned earlier, resistance is inevitable with high selling pressure building across various metrics.

However, the key will be to watch for a potential parabolic run, which seems increasingly likely. As the recent 3% surge suggests that the bulls have counteracted the pressure by engaging in heavy accumulation.

$100K seems inevitable, what is next?

Considering the current market sentiment, it appears to be bullish for several key reasons. The bulls saw the $82K dip as an ideal buying opportunity, preventing a halt in the push toward $100K.

In addition, whales are holding 62% of the long positions in the perpetual futures market, signaling strong institutional confidence.

On top of this, retail investor demand has surged to a 52-month high, with a notable 30-day increase, indicating robust interest from both large investors and retail traders.

As a result, the $100K benchmark seems within reach, with minor pullbacks along the way. What’s interesting now is what happens after the target is reached.

Historically, whales tend to go against the crowd, buying when others are fearful and selling when they’re exuberant. Over the past week, whales have accumulated 100K Bitcoin, valued at over $8.60 billion, according to a prominent analyst.

Read Bitcoin (BTC) Price Prediction 2023-24

From a psychological perspective, once Bitcoin hits the $100K mark, panic selling is likely to kick in across various metrics, combined with bears attempting to initiate a long squeeze.

This will be the real test for the bulls. As short-sellers seize the opportunity to bet against Bitcoin and FOMO starts to fade, the bulls will need to hold strong. If they manage to do so, a massive short liquidation could be triggered, potentially setting the stage for a Bitcoin rally toward $110K.