Bitcoin holding hits one-year ATH: ARK Invest

- A recent report published by ARK Invest shed light on institutional Bitcoin holding.

- The sentiment of institutional and large capital investors has been bullish for months now.

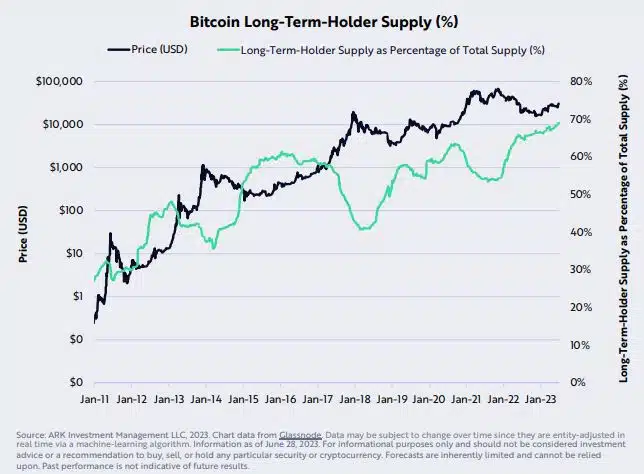

If the latest figures are to be believed, 70% of the 19 million Bitcoin [BTC] in circulation has not moved in over a year. The figure represented a one-year all-time high (ATH) in both relative and absolute terms.

The finding has been revealed in a report published by ARK Invest titled, The Bitcoin Monthly- The Dawn of the ETF Era?

During the crypto winter of 2022, investors held on to around 70% of the total BTC supply.

Nearly 8,000 BTC is live on over-the-counter (OTC) exchanges, registering an impressive rise of 60% this quarter. ARK uses OTC as an index to monitor institutional investment activity. The OTC figure corresponds to the Bitcoin holdings of institutional and large capital investors.

As we can see, the sentiment of institutional and large capital investors has been bullish for months now. The report, on its part, mentioned,

“In our view, increased balances on OTC desks suggest that institutions and other large capital allocators are focused increasingly on Bitcoin.”

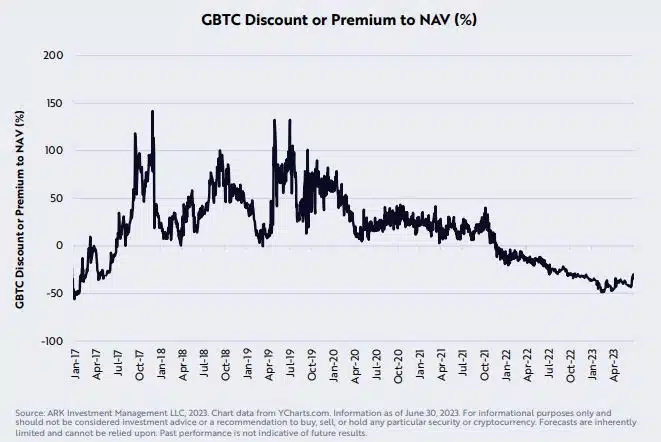

BTC ETF filings lead to discount to NAV on GBTC

The report inspects the Grayscale Bitcoin Trust (GBTC), one of the largest BTC trust firms catering to large investors. GBTC’s discount to net asset value (NAV) hit 30% in June 2023.

It means that the share price of GBTC is 30% lower than the price of the underlying asset, i.e., BTC. Again, the discount is the lowest in nearly one year.

The report attributes the drop in discount to NAV to the leading asset management firm BlackRock filing for spot BTC exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC).

Readers will remember that Grayscale has filed a complaint against the SEC for denying its application to convert GBTC into a spot Bitcoin ETF.

BlackRock isn’t the only traditional finance (TradFi) company to file for spot BTC ETF. Other asset management firms like Fidelity, VanEck, 21Shares and WisdomTree have also done so recently.