Bitcoin: How can BTC push its price past the $106k resistance?

- Bitcoin price surged to $102K as buying pressure increased, signaling sustained upward momentum

- Strong market participation and positive sentiment suggested Bitcoin may challenge new resistance levels soon

Bitcoin [BTC] is seeing a significant surge in buying pressure, signaling the potential for a sustained upward trend.

With new investor confidence fueling this momentum, experts are speculating that Bitcoin could be on the verge of another bullish phase.

As the market responds to these changes, all eyes are on whether Bitcoin can maintain its momentum and push toward new highs.

Bitcoin price: Recent performance and market dynamics

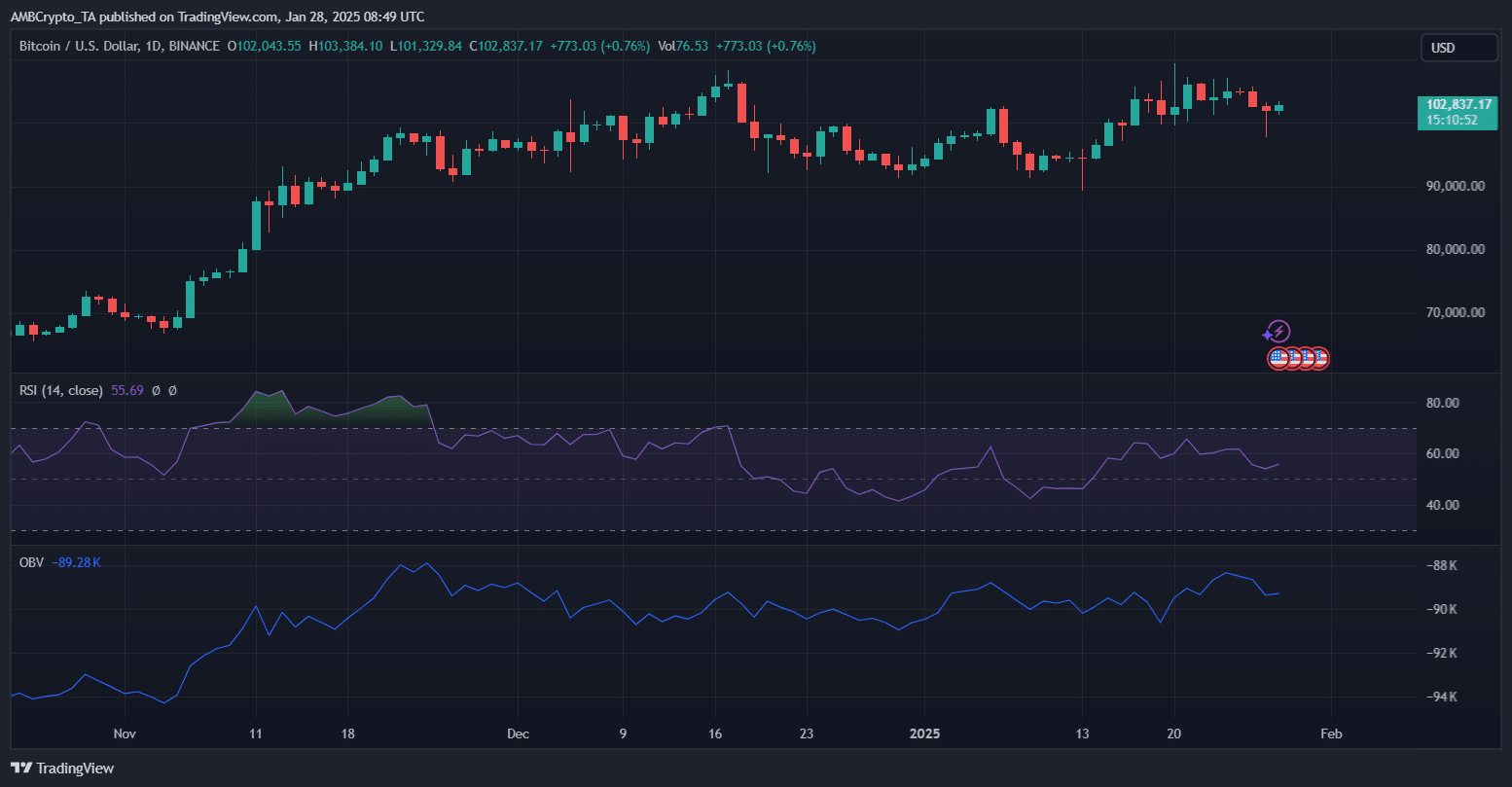

Bitcoin has shown resilience, with its price climbing to $102,837. There has been a gradual uptrend since November, marked by consistently higher lows. The RSI is currently at 55.69, indicating neutral momentum with room for growth.

OBV trends suggest increasing accumulation, possibly fueling buying pressure.

The recent surge can be attributed to the new pro-crypto U.S. administration, sparking renewed interest among investors.

Historically, January often acts as a foundation month for bull runs, setting the stage for potential rallies.

Coupled with positive sentiment and historical patterns, Bitcoin’s upward trajectory may soon face tests around psychological resistance levels.

Buying pressure rebounds

The Buy/Sell Pressure Delta chart shows significant fluctuations in market sentiment over the past few days.

Notably, there was a sharp increase in buy pressure around the 24th of January, coinciding with a price surge toward $106K.

However, this momentum was short-lived as sell pressure intensified, leading to a sharp decline below $100K on the 27th of January. This drop was accompanied by high trading volume, suggesting heavy liquidation and potential stop-loss triggers.

As Bitcoin approached $98K, buy pressure rebounded significantly, aligning with the current recovery to $102K. This suggests buyers are stepping in at key support levels, reinforcing market confidence.

If this trend continues, Bitcoin may stabilize above $102K and attempt another breakout toward the previous resistance level of $106K.

The trading volume aligns with these shifts, indicating strong market participation during both rallies and corrections. This hints at heightened investor activity.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Market sentiment analysis

Bitcoin’s exchange inflows provide valuable insight into investor sentiment. Recent data suggests a relatively stable trend.

Historically, large spikes in exchange inflows often precede sell-offs, as investors move BTC to exchanges for potential liquidation.

However, the current inflows remain moderate despite Bitcoin’s rally past $102K, indicating that holders are not rushing to sell, reinforcing bullish sentiment.

At the time of writing, the Fear & Greed Index stood at 72, placing the market firmly in the “Greed” zone.

This suggests strong investor confidence but also raises caution, as high greed levels can precede corrections.

If inflows remain steady and greed doesn’t overextend, Bitcoin could sustain its momentum, with the potential to challenge new highs.