Bitcoin

Bitcoin: How Mt. Gox’s $49.3M move is shaking up BTC markets

Mt. Gox’s Bitcoin redistribution leaves the market balancing between sell-off fears and recovery hopes.

- Bitcoin trades near key support as Mt. Gox movements stir market uncertainty.

- Rising derivatives activity hints at cautious optimism despite bearish technical indicators.

Mt. Gox’s transfer of $49.3 million in Bitcoin [BTC] has sent ripples across the market, sparking fears of heightened volatility. The redistribution saw $19 million transferred to fresh wallets and $30.6 million moved to a final wallet.

This massive movement raises critical questions about whether it signals a wave of sell-offs. At press time, Bitcoin was trading at $94,435.63, reflecting a 0.72% dip in the last 24 hours.

Can BTC break resistance or risk losing support?

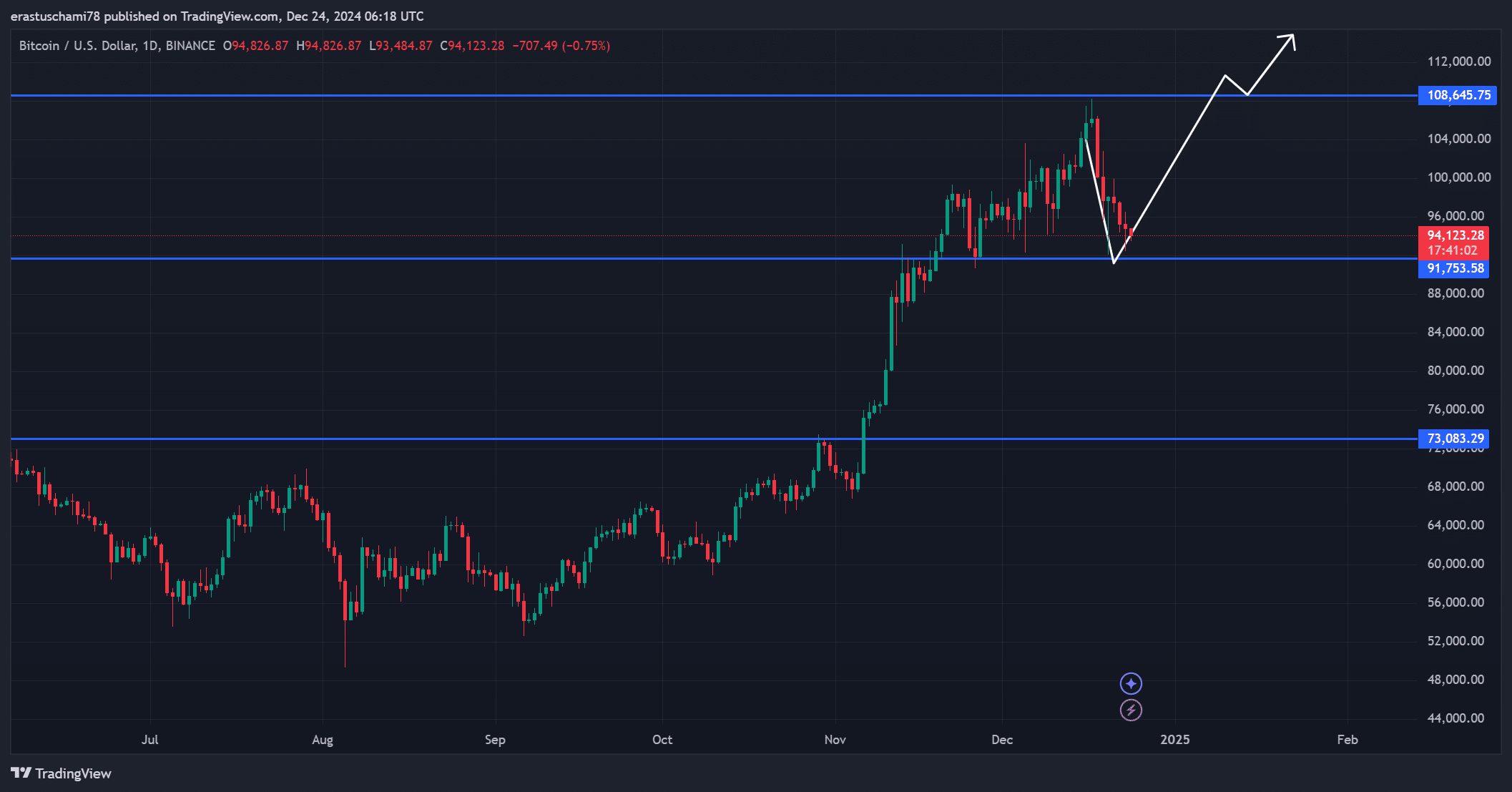

Bitcoin is trading within a critical range, with support at $91,753 and resistance at $108,645. A break below $91,753 could open the door to a plunge toward $73,083, signaling bearish dominance.

However, if Bitcoin manages to climb past $96,000, it could build momentum toward the $100,000 milestone. Therefore, this period of consolidation will likely determine whether Bitcoin rallies or retreats further in the coming days.

Active addresses show rising engagement

Bitcoin’s active addresses increased by 1.21% in the last 24 hours, reaching 9,747K, reflecting heightened engagement. This rise suggests more participants entering the market, likely driven by speculation surrounding the Mt. Gox movement.

Additionally, increased network activity is a positive sign for demand, as it often correlates with stronger market health. Therefore, sustained growth in active addresses could support Bitcoin’s recovery in the near term.

Is BTC undervalued? MVRV ratio insights

The MVRV ratio, currently at 2.4 after a 1.17% decline, hints at a cooling-off phase in speculative pressure. Historically, a lower ratio has aligned with healthier price levels, attracting long-term investors.

However, further declines might indicate waning confidence among participants, keeping traders cautious. Therefore, the MVRV ratio remains a crucial metric for gauging Bitcoin’s market position.

Exchange inflows suggest caution

Exchange net inflows surged by 39.93%, totaling 19.545K BTC, raising concerns about potential sell-offs. Inflows to exchanges often signal that traders are preparing to liquidate holdings, although not all inflows result in immediate selling.

Therefore, monitoring exchange activity closely will be vital in determining whether this surge translates into bearish momentum or remains neutral.

ADX and MACD reveal mixed signals

The ADX, currently at 30.53, indicates a moderately strong trend in the market. Meanwhile, the MACD shows bearish momentum following a crossover below the signal line.

However, the MACD’s position near the zero line suggests potential for a reversal if buyers regain control. Therefore, the technical indicators highlight the market’s delicate balance between bullish and bearish forces.

Derivatives data reflects cautious optimism

BTC derivatives activity has seen a notable uptick, with options volume rising by 39.63% to $2.94 billion. Open interest increased by 0.69% to $61.03 billion, while options open interest grew by 8.52% to $42.25 billion.

These figures reflect growing speculative interest, though the modest rise in open interest indicates limited directional conviction. Therefore, derivatives data suggests optimism but with an air of caution.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Mt. Gox’s Bitcoin redistribution has created a climate of uncertainty, leaving the market on edge. BTC’s ability to hold critical support and navigate rising exchange inflows will determine whether this movement triggers a sell-off or inspires confidence.

For now, Bitcoin remains at a crossroads, balancing between fear and opportunity.