Bitcoin: How Mt. Gox’s $9B BTC transfer failed to stir the market

- The Mt.Gox BTC transfer was worth over $9 billion.

- The BTC price has now dropped below the $68,000 range.

Recently, analysts observed significant Bitcoin [BTC] movements originating from the defunct crypto exchange Mt. Gox. Despite these notable transfers, data indicates that the BTCs have yet to enter the market and have had no impact so far.

The Mt.Gox Bitcoin move

Analysis of Mt. Gox’s Bitcoin holdings on CryptoQuant revealed a recent substantial decline in their holdings.

According to an analysis of the chart, approximately 140,000 BTC, valued at around $9.4 billion, were transferred from the defunct exchange.

The analysis showed that these transfers reduced the Mt. Gox supply on exchanges to around 0.1 BTC.

Mt. Gox infamously suspended trading closed its website, and filed for bankruptcy protection in February 2014, following the loss of approximately 850,000 Bitcoin, partly due to a hack. Despite this recent movement, exchange flow has remained normal.

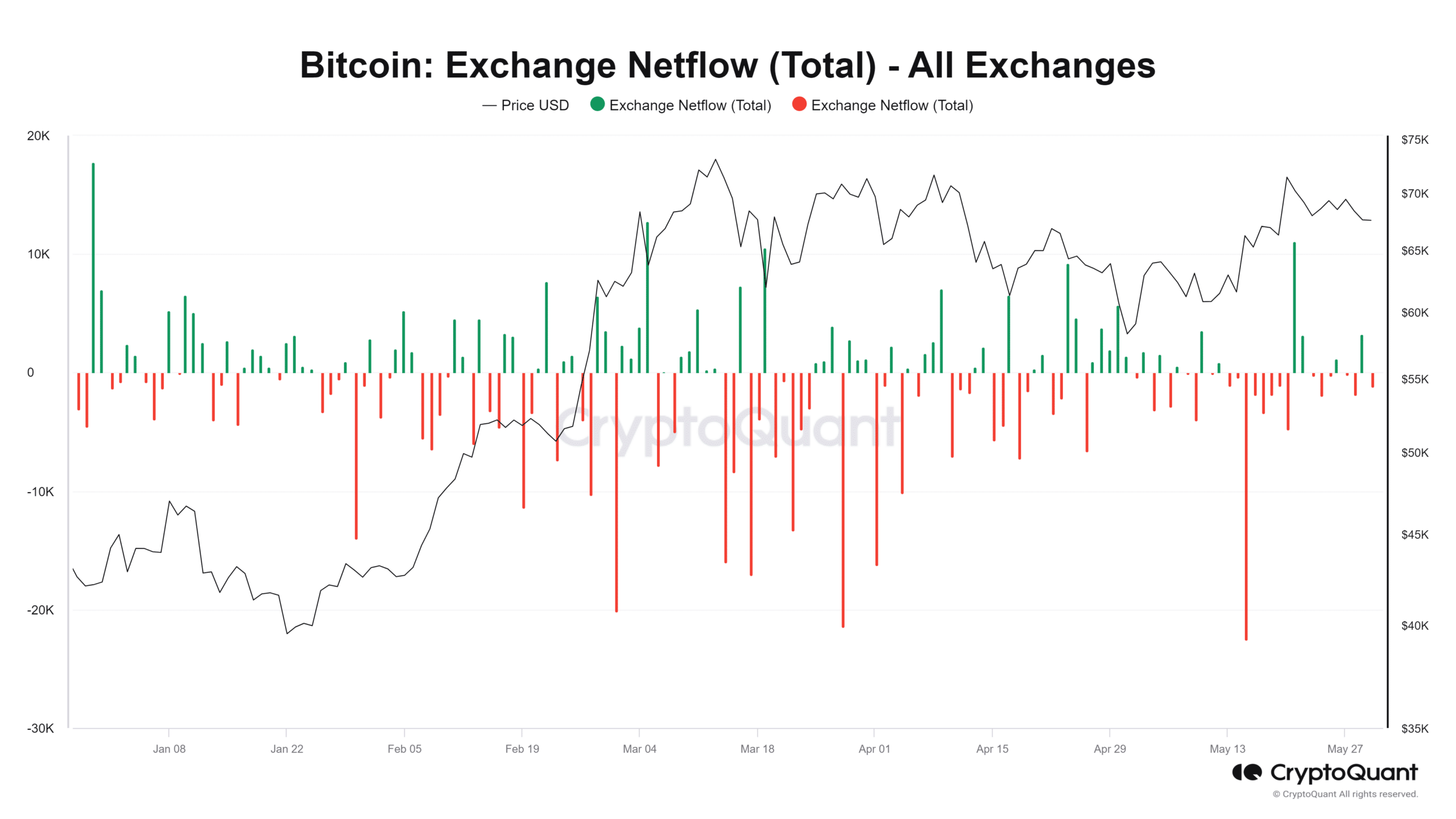

Analysing impact on Bitcoin exchange flow

The analysis of Bitcoin Netflow on CryptoQuant indicated no significant trend in recent days. On 27th May, there was a negative flow of approximately 178 BTC, valued at over $12 million.

Conversely, on 29th May, there was a positive flow of around 3,270 BTC, worth over $248 million. While these figures are notable, they do not stand out as extraordinary.

Therefore, the recent movement from the defunct exchange did not have any significant impact on the market.

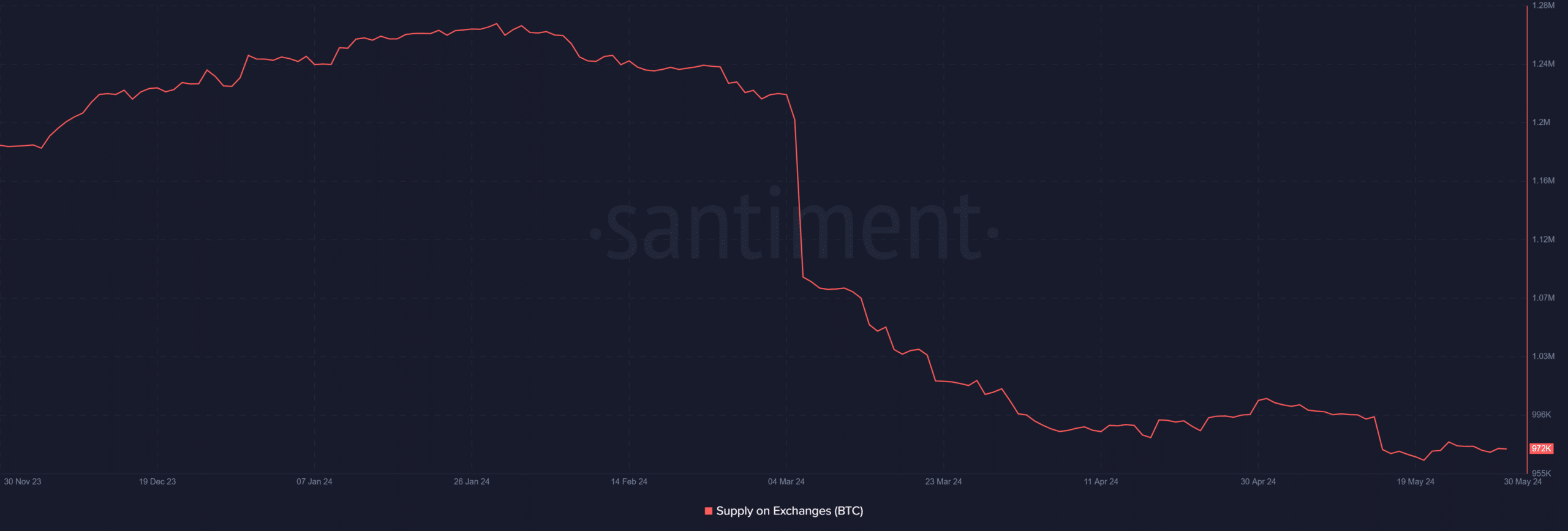

Additionally, analysis of the Bitcoin supply on exchanges using Santiment data revealed no significant movements.

The chart indicated that between 27th May and the present, the supply on exchanges increased by approximately 2,000.

While this suggests that more Bitcoin entered exchanges over the last three days, the increase was not substantial enough to influence prices. As of the current writing, the supply on exchanges stands at over 972,000.

Bitcoin sentiment remains positive

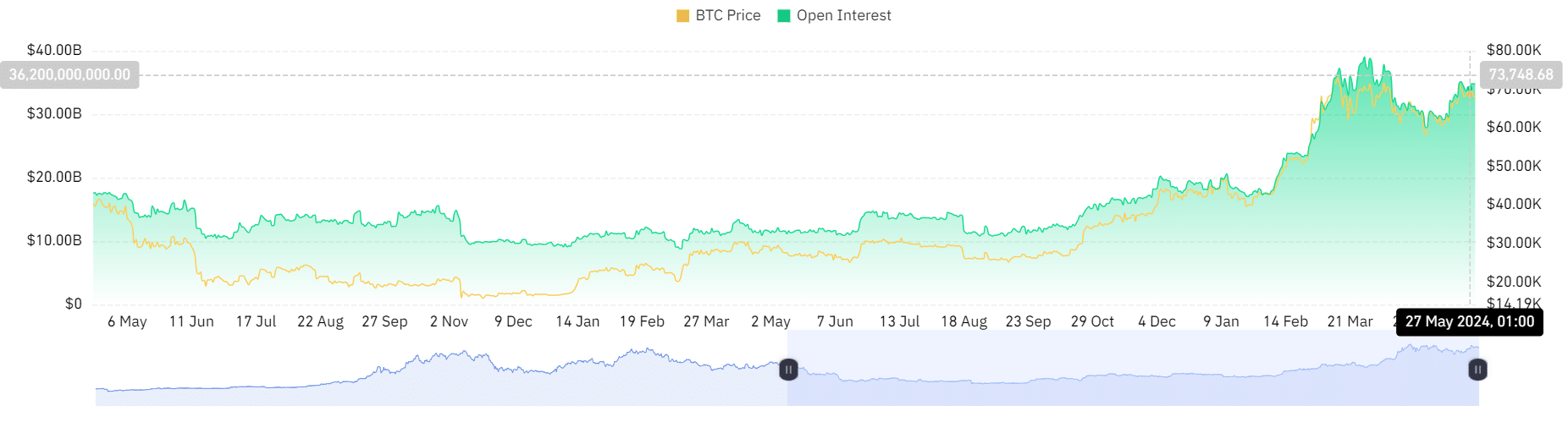

Analysis of the Bitcoin Open Interest on Coinglass indicated a notable volume of interest, suggesting increased cash flow into it.

As of the current assessment, the Open Interest was almost $35 billion, with its peak in recent months reaching around $39 billion.

Additionally, examining the funding rate trend revealed that it has remained above zero, signifying a positive rate at present, with buyers dominating the market sentiment.

Overall, these indicators suggest that sentiment surrounding Bitcoin remains positive despite the recent transfers from Mt. Gox.

Read Bitcoin (BTC) Price prediction 2024-25

As of the latest update, Bitcoin was trading at around $67,120, experiencing a decline of over 1%.

Analysis of its daily time frame chart revealed that it continued to uphold a bullish trend, as evidenced by its Relative Strength Index (RSI).