Bitcoin: How much influence can these investors hold

Bitcoin is speculated to have a major bull run this year. But the question remains – who really is heading this rally? When compared to the previous bull market some interesting observations can be seen.

Bitcoin follows who?

Back in 2017, it was whales. Whales led the bull market of 2017, which placed BTC from $990 to $13,400. This year that leader needs to change as the entity which should be leading the bull market needs to be you and me – the retail investors. In the last 7 months, Bitcoin has become a major store of value.

However, in order to become a stable and sustainable currency of the future, it will need increased participation from retail investors. Organic growth is the only way it could last long and become a viable option as a legal tender in the future. And surprisingly such is the case.

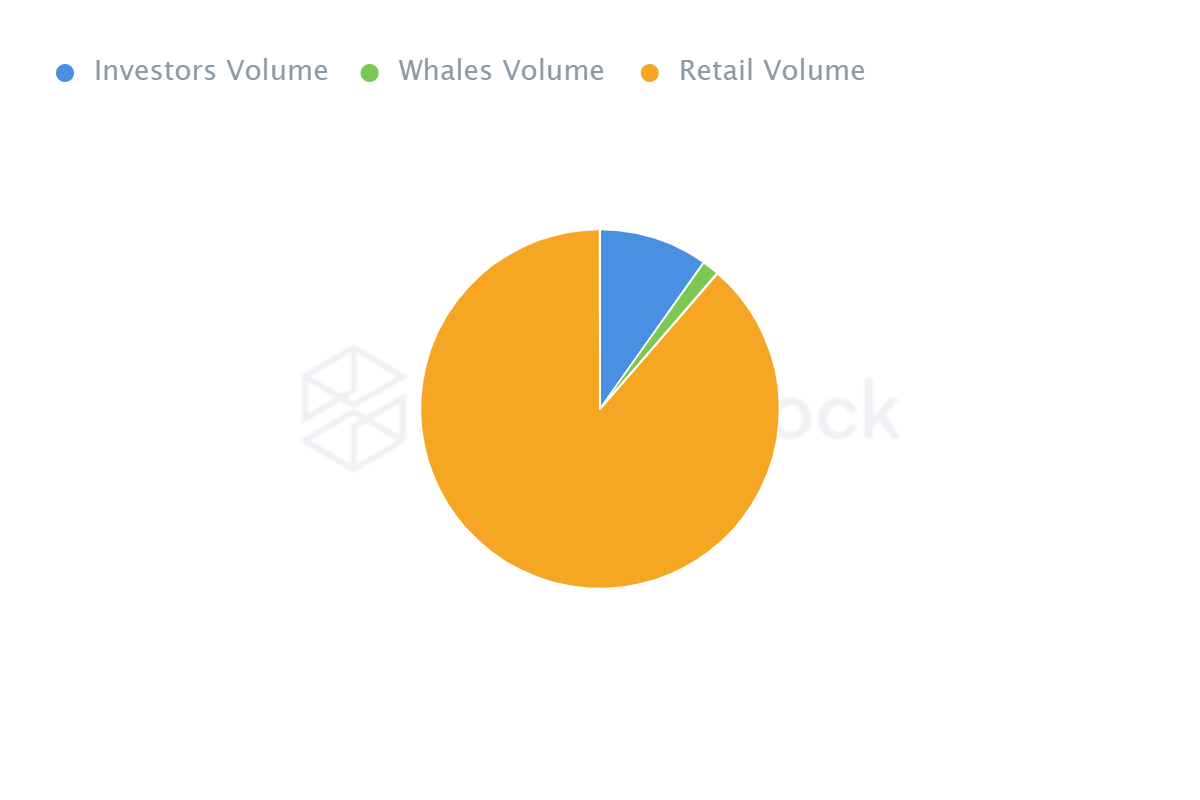

Bitcoin Address distribution by concentration | Source: Intotheblock – AMBCrypto

Currently, retail investors are dominating the market. In terms of addresses, whales have a mere concentration of 1.53%, whereas retail holders have an 88.64% dominance today. At the same time when it comes to balance, these whales only have 288k cumulatively.

Retail investors, on the other hand, hold 16.65 million BTC altogether. These are the biggest signs of retail domination which is exactly the need of the moment. If their participation grows, the next rally can be led by retail investors.

Are retail investors participating though?

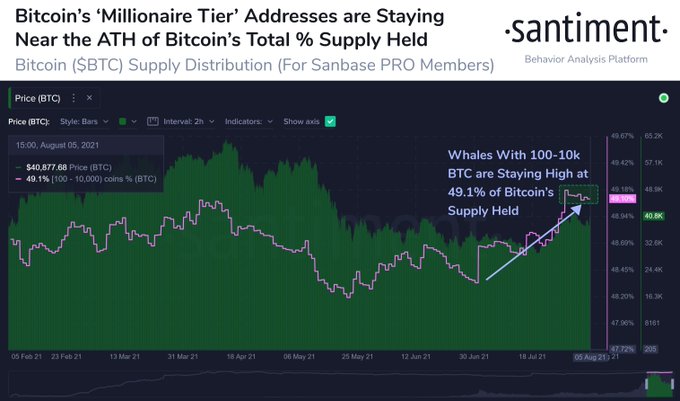

On exchanges, it can be seen that selling is active in the market. At the moment, whales’ balance is close to its all-time high. Whale addresses possessing 100-10k BTC hold 49.1% of Bitcoin’s supply. This shows that selling from their end is close to none.

Bitcoin whales balance at an all-time high | Source: Santiment

Since whales aren’t selling, naturally, all the selling witnessed in the market comes from the retail section. This is a strong sign of participation. And talking about participation, for the retail sector to be successful, Zero Balance Addresses (ZBA) need to come down.

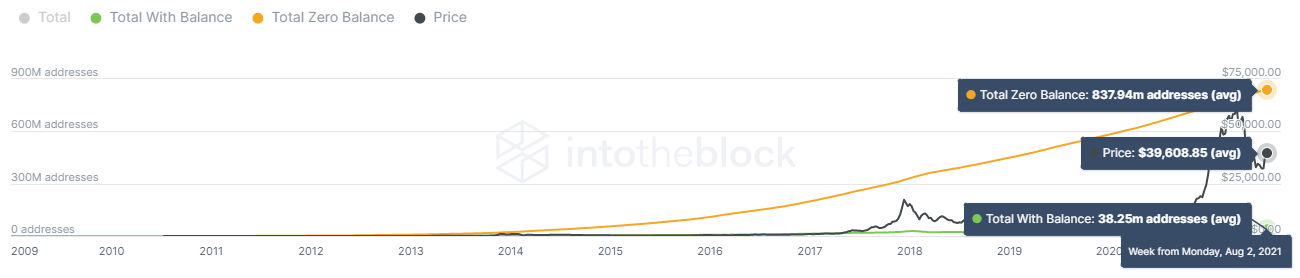

Presently addresses with balance come up to 35 million while ZBA is at 838 million. This dominance ruins the potential for any serious growth of the retail section which is crucial to the bull run.

Bitcoin zero balance addresses stand at 838 million | Source: Intotheblock – AMBCrypto

![Hedera [HBAR] defies market trend - All you need to know about altcoin's 27% hike!](https://ambcrypto.com/wp-content/uploads/2025/03/Hedera-1-400x240.webp)