Bitcoin: How the FTX contagion reduced external factors’ impact on BTC

- Many BTC left exchange storage since the FTX exchange crashed in November.

- The king coin continues to drift away from macroeconomic policies but is still stuck to traditional correlation.

Bitcoin [BTC] holders felt the impact of the FTX collapse in the last quarter of 2022 but have stayed to the aftereffect related to the unfortunate event. Twitter’s famous on-chain analyst Ali_charts opined that the incident was a blessing in disguise for Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

The analyst based his inference on the manner the king coin exited exchanges and how holders resorted to avoidance of CEXes. Information derived from Santiment showed that about 260,000 BTC had left the exchanges’ shores since November. Also, 350,000 BTC have been kept out.

$FTX collapse was bad for the industry but great for #Bitcoin!

Since Nov. 2022, data from @santimentfeed shows that 260,000 #BTC were withdrawn from #crypto exchanges and more than 350,000 $BTC have been kept out of exchanges.

Not your keys, not your coins. It's that simple! pic.twitter.com/kc7iQ9KVYx

— Ali (@ali_charts) February 9, 2023

BTC now cares less about macro?

Recall that it was during this period that the BTC price fell below $16,000. However, Messari’s Bitcoin fourth quarter (Q4) report showed that the macroeconomic factors had minimal impact on the coin’s price.

Despite the unfavorable conditions, Bitcoin gained some positives from the collapse. For example, active addresses increased by 2% from the preceding quarter while transactions followed through in advancement. All these happened in the face of a 4.50% interest hike by the U.S. Federal reserve.

Further, BTC showed evidence of detachment from its reaction to the 9 February FOMC meeting. Although Bitcoin may be exiting its bond with the macro factors, it still correlated with the trends of the traditional markets.

How much are 1,10,100 BTCs worth today?

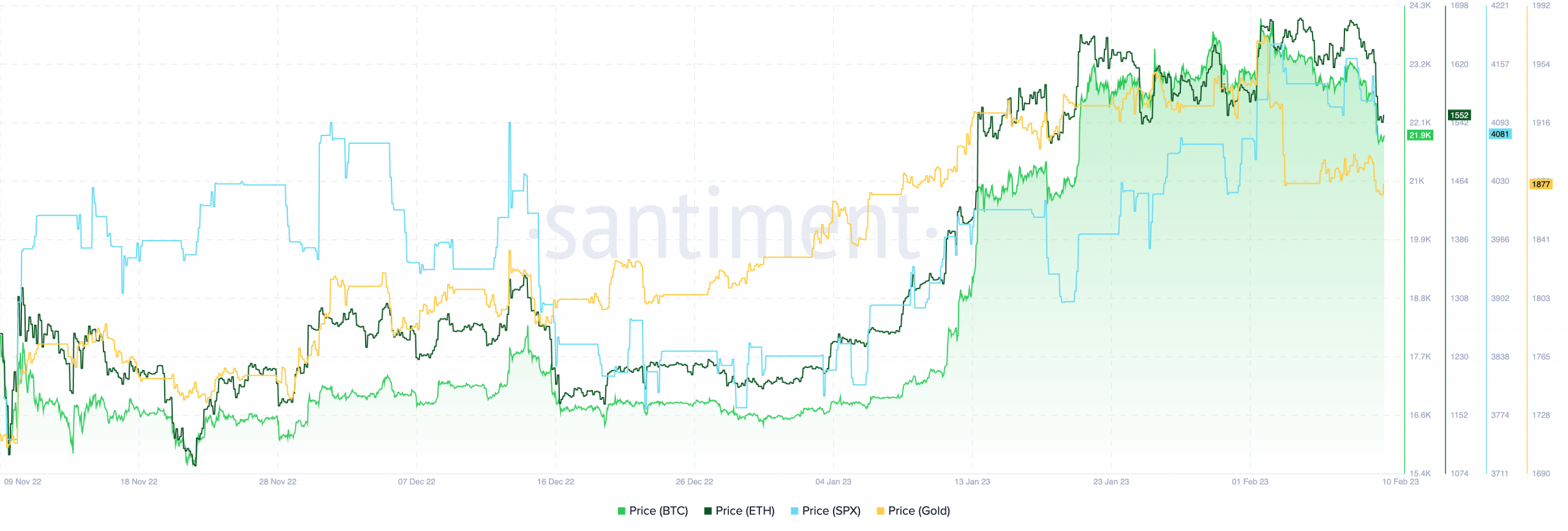

According to Santiment, the Bitcoin trend matched the one displayed by the S&P 500 Index [SPX] and gold.

At the time of writing, the BTC price was still in its weekly decline. SPX was down to 4081 while gold traded at 1877.

In the instance where the stock and gold prices continue the decline, there could be a chance that Bitcoin finds it hard to repeat its January bullish performance.

An impending endless disconnect

In a related development, the New York Fed Research released a research paper explaining the Bitcoin disconnect from the macroenvironmental elements.

Gianluca Benigno and Carlo Rosa, authors of the research, described the unhook as puzzling since most speculative assets were subject to U.S monetary policies. The authors concluded that,

“Our analysis instead shows that, while other US asset prices respond to both the target and the path of monetary policy news, Bitcoin is unresponsive to unexpected changes in the short-term rate while its reaction to news about the future path of policy is not robust.”

But the conclusion might sound too hasty. Nonetheless, the happenings in the last four months, coupled with the BTC reaction to future policies might determine if the correlation would continue to exist or not.