Bitcoin: How this cohort has helped BTC stay above $60K

- The year so far has seen a rally in BTC whale accumulation.

- The recent hike in the coin’s price has caused miners to take profits.

Bitcoin [BTC] has seen a significant rise in whale accumulation since the beginning of the year, IntoTheBlock noted in a recent post on X (formerly Twitter).

This trend, coupled with the general market’s bullish sentiment, has pushed the leading cryptocurrency to exchange hands at a three-year-high.

At press time, BTC exchanged hands at $61,969. In the last month, the coin’s value has rallied by almost 50%, according to the data from CoinMarketCap.

AMBCrypto found that this period has been marked by a significant uptick in the coin’s large holder inflow.

According to IntoTheBlock, BTC’s large holders refer to investors with over 0.1% of the coin’s circulating supply.

When the coin’s large holder inflow increases, it suggests that there is strong buying activity among this investor cohort.

In the last month, BTC large investor inflow has increased by a whopping 573%.

This suggested BTC investors, with over 0.1% of the coin’s circulating supply, have accumulated a significant amount of the coin on centralized exchanges and transferred their acquisitions into cold storage.

Conversely, during the same period, the outflows from this BTC investor class plummeted, per IntoTheBlock data. In the last 30 days, BTC large holder outflow has fallen by 95%.

Miners cash in their profits

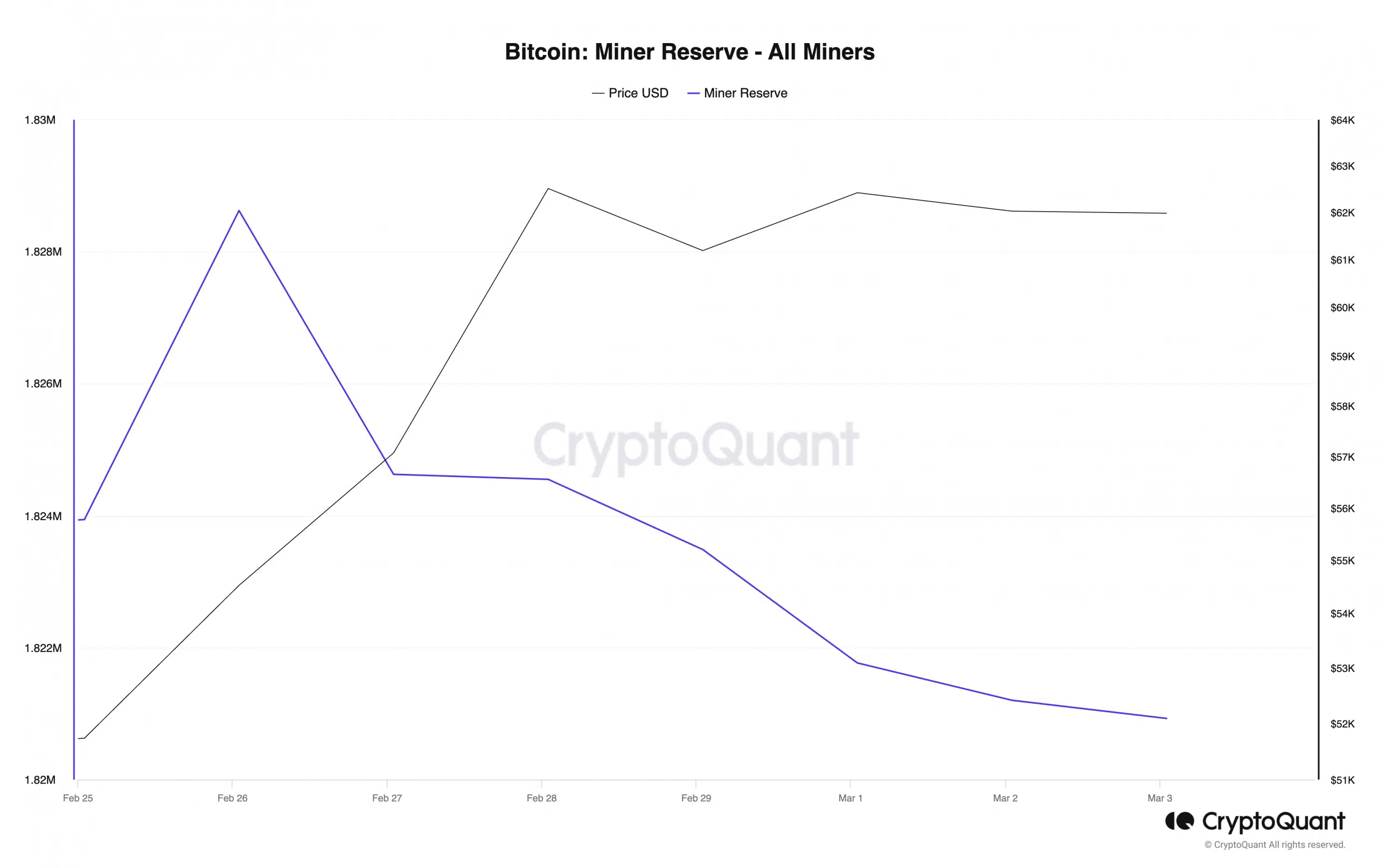

BTC’s recent rally above $64,000 has resulted in an uptick in profit-taking activity among the miners on the network.

According to data from CryptoQuant, BTC’s Miner Reserve, which measures the amount of coins held in affiliated miners’ wallets, witnessed a slight decline in the last week.

During this period, the amount of coins held in these wallets fell by 0.4% As of this writing, 1.8 million BTCs were held in miner wallets, its lowest since March 2021.

When this metric declines, it suggests a rally in coin sell-offs among network miners.

Likewise, the period under review saw an uptick in miner-to-exchange flow.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

In fact, the metric climbed to a three-month high on the 1st of March when 2,349 BTCs were sent to exchanges for onward sales from miners’ wallets.

The metric tracks the amount of coins flowing from miners to exchanges. When its value increases, it means that miners are selling more BTC than they are mining for profit.