Bitcoin in Q3: Does the Fed’s rate stance mean trouble?

- Market observers offer mixed signals on the Fed’s macro outlook impact on BTC and crypto.

- BTC dropped to $67K after the Fed’s decision and threatened to post more losses.

Bitcoin [BTC] struggled to hold above $67K after the Fed decided to maintain the current 5.25% to 5.5% interest rate for the seventh time.

However, the Fed’s economic projection and forward guidance during the meeting have stirred divergent macro views on the impact on risk assets like BTC.

A JPMorgan commentary stated that the Fed’s ‘monetary outlook remained uncertain.’ This was based on the possibility of only one cut by the end of 2024, unlike the three cuts forecasted in the March meeting.

Is BTC facing macro risk in Q3?

The uncertainty was further cemented by Fed’s chair Jerome Powell’s ‘lack of confidence’ in recent inflation data. The chair noted,

“It is probably going to take longer to get the confidence that we need to loosen policy.’

On his part, Quinn Thompson, founder and CIO of crypto hedge fund Lekker Capital, viewed the Fed’s outlook as a risk to crypto assets. Forecasting a similar liquidity crunch that hit BTC before US tax season in April, the executive said,

‘I believe the ‘liquidity air pocket’ that began at the end of Q1 prior to tax season is still with us until there is either another month or so of better inflation data to reinforce the current disinflationary trend’

Expanding on the potential risk for crypto assets, the hedge fund executive added,

‘I think there is serious cascade risk in crypto, and in particular, expect most altcoins to be taken out back. The market seems to have lost any ability to bounce.’

Further casting doubt on BTC prospects in summer, Thompson stated that the king coin has failed to gather enough strength to break above its all-time high.

However, other market observers, like crypto trading firm QCP Capital, acknowledged the Fed’s ambiguity but remained bullish for the rest of 2024. In a recent Telegram update, the firm noted,

‘We maintain a structurally bullish outlook for the remainder of the year, driven by the anticipated ETH ETF S-1 approval and potential rate cuts in September and at the year-end.’

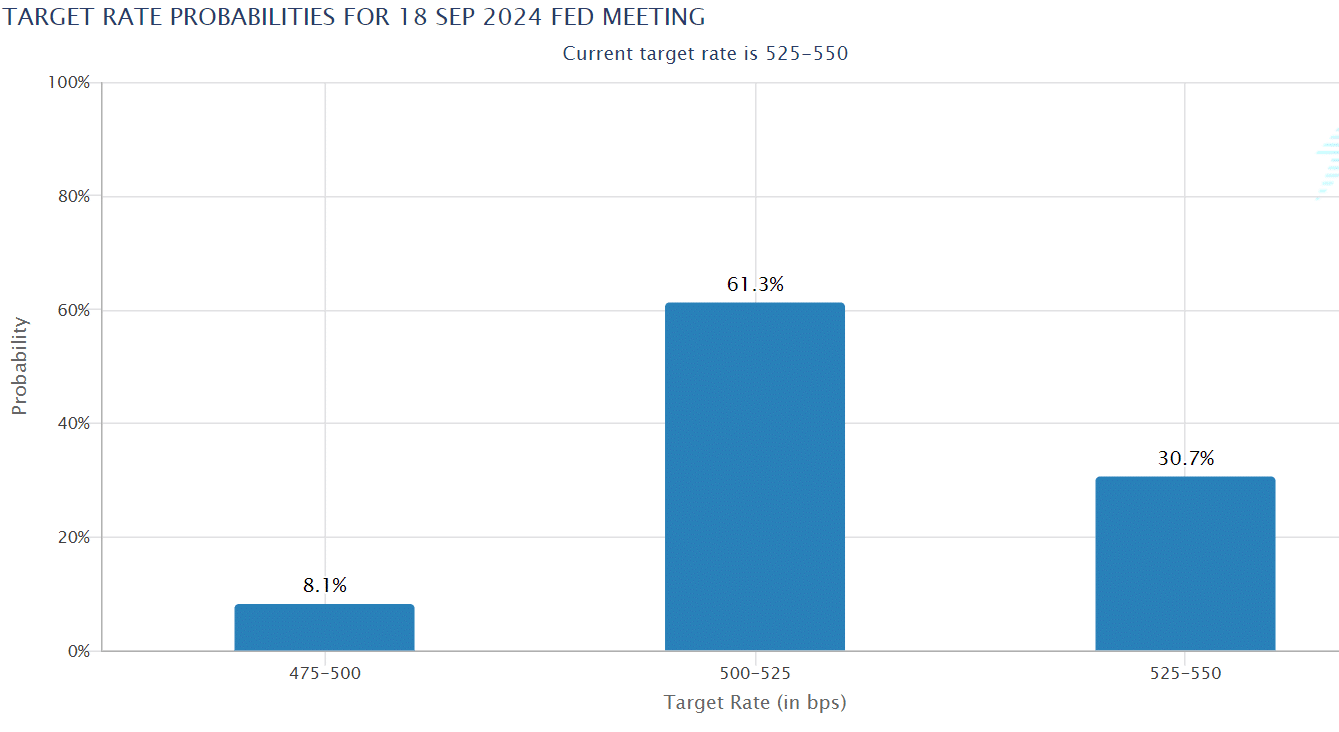

As of press time, the odds of the September rate cut were up +60% against 30% for keeping current rates unchanged.

Another macro analyst, TedTalksMacro, shared the positive outlook and viewed the May US CPI print as ‘disinflationary’ and short-term bullish for crypto.

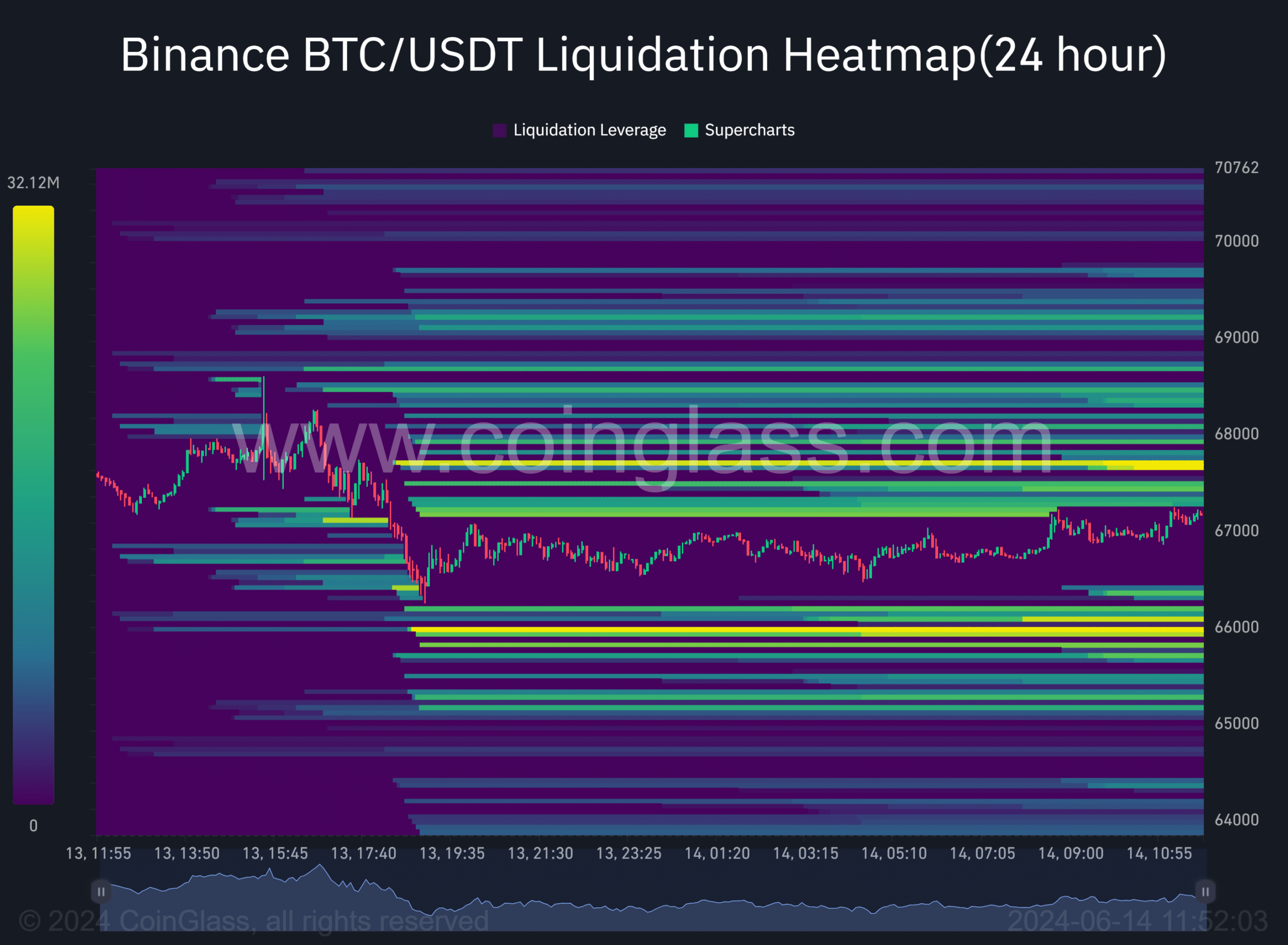

In the meantime, the daily liquidation charts showed considerable liquidity clusters at $66K and $68K (marked orange) as of press time.

Typically, price action targets these liquidity areas, and it suggested that a retest of the $66K and $68K levels was feasible in the short term.