Bitcoin index funds: Should Grayscale be worried?

2020 has been an incredible year for many firms trying to incorporate Bitcoin into their larger financial systems. Grayscale took the leap first, in the minds of many, with Coinshares and Bitwise making noise as well. These Crypto-Index Funds are regulated and their main focus has been the market’s institutional investors.

For context, Grayscale currently holds over 2% of the total Bitcoin in circulation, and it is extremely appealing for investors that do not want to hold Bitcoin directly and purchase through an IRA or brokerage account.

However, there are certain downsides and in this article, we will try to figure out if these crypto-index funds might face any competition in the future.

Is the future of Crypto-Index Funds Decentralized?

Bitcoin as an asset is based on the foundations of being decentralized, away from anyone’s control. Hence, these regulated crypto-trusts kind of take the idea of holding Bitcoin in a different direction for the market’s investors.

Now, even though the likes of Grayscale, Bitwise, and Coinshares are sizable businesses, these corporations fall under the extremities of the prevailing regulations. Ergo, they are not tradable on major exchanges. So, it is basically holding Bitcoin, which is harder to access and possibly less liquid due to its untradable nature.

In light of the complications around regulated crypto-funds, the rise of DeFi and its financial products might have a lot to say down the years.

DeFi-based Index Funds to take over?

Source: bankless.substack

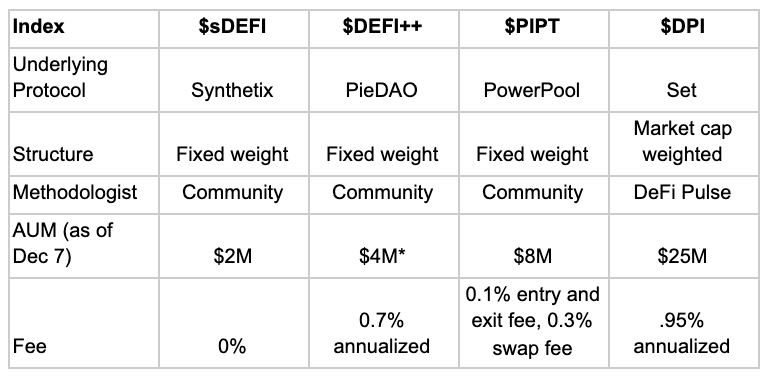

The attached chart highlights a few DeFi index funds that have emerged to allow investors to get passive and diversified exposure to the crypto-industry. Some of the most prominent indices include sDeFi, DEFI++, $PIPT $DPI.

Now, some of the clear advantages for these indexes are that they are built on protocols that have processed more than $1.5 billion in trading volume. So, liquidity will never be an issue for the investor. Secondly, some of these indices also produce yield through trading fees and they are redeemable for the underlying assets.

The transparency is quite clear and DeFi protocols take out errors based on human judgment. While these indices can possibly take over on paper, their drawbacks are pretty evident as well.

For example, DeFi leads the banner of ‘impermanent loss’ on various products as perfection is still far from achieved. If the market of sDEFI is observed, its AUM is less than $2 million. For Grayscale, such a number is not even considered pocket change at the moment.

Verdict: What does the future look like?

For now, it is quite difficult for institutional investors to bestow interest in DeFi’s decentralized crypto-indexes. Institutional Interest has only arrived for Bitcoin, Ethereum in 2020, and Grayscale, Bitwise are clearing running away with high demand at the moment. So, while the future could move towards more decentralization with better emerging crypto-indexes, for the time being, Bitcoin will reach the hands of these accreditors via regulated corporations only.