Bitcoin

Bitcoin investors can look out for this bullish signal

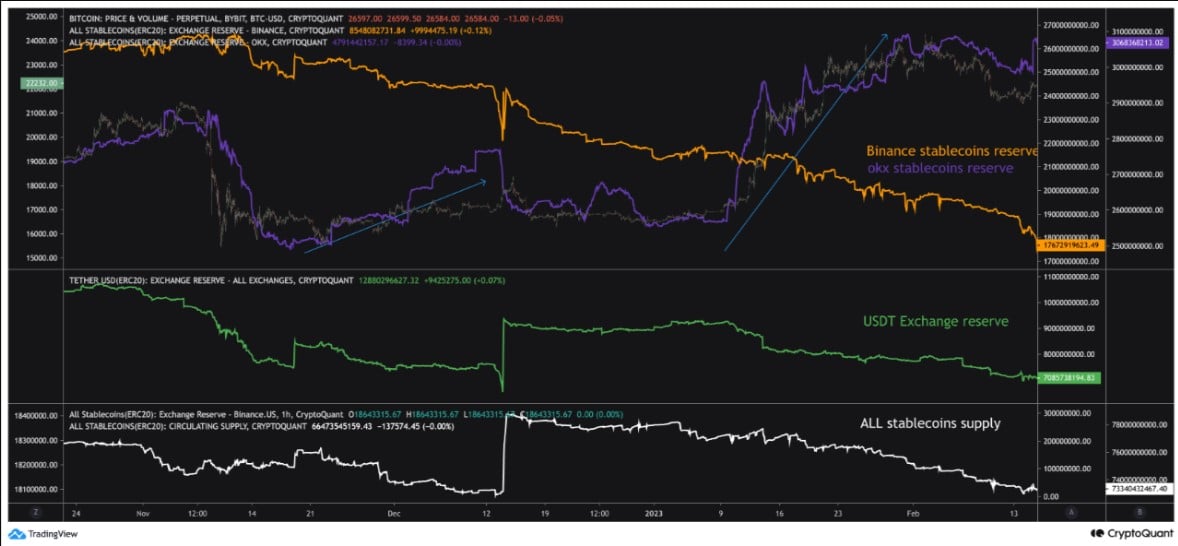

Crypto_Lion, an analyst and author at CryptoQuant, revealed in a recent analysis that top exchanges like OKX and Binance have seen an influx of stablecoins.

- OKX and Binance saw an influx of stablecoin supply ahead of price upticks

- Most metrics looked bullish as BTC’s price crossed the $26,000-level

The crypto-market has been relatively less volatile on the back of major cryptos like Bitcoin [BTC] moving sideways. However, the wind is seemingly turning as top exchanges witnessed an influx of stablecoins, something that is typically a sign of a possible bull rally. If that’s true, then Bitcoin investors might want to keep an eye on their holdings, as the chances of a price uptick seem high.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin is giving hope to investors

After multiple weeks of the coin hovering under the $26,000-mark, the king of all cryptos finally made its investors happy as it breached that level. According to CoinMarketCap, BTC was up by more than 3% in the last seven days. At press time, it was trading at $26,739.04 with a market capitalization of over $521 billion. Things might get even better soon though.

Crypto_Lion, an analyst and author at CryptoQuant, revealed in a recent analysis that top exchanges like OKX and Binance have seen an influx of stablecoins ahead of price upticks. Though there is currently no significant movement in the Stablecoins Exchange Reserve, its demand is becoming more positive. A decline in stablecoin supply means a halt in the outflow of funds, which can restrict the crypto-market from going down further – A positive sign for

BTC.Bitcoin at a key support level

Another hopeful incident was pointed out by CryptoCon as it revealed a trendline that pointed to a BTC rally. The tweet mentioned a “baseline trend” which has been tested a couple of times in history. After a drop below the trend line, whenever BTC’s price has rebounded, it has never gone back to that lower level.

The middle of the #Bitcoin cycles all balance on what I would call a "baseline trend".

It's pretty common for price to have a huge unsustainable run up early in the cycle, where the first early top (yellow dots) takes place.

There's no way these aggressive climbs can… pic.twitter.com/agUGkszudO

— CryptoCon (@CryptoCon_) September 17, 2023

At the time of writing, BTC’s price was being tested at the support level and if it manages to maintain that support, investors might see the crypto’s price hike in the coming days. Interestingly, a look at BTC’s on-chain metrics revealed the high possibility of BTC remaining above the trend line.

For instance, its exchange reserve was decreasing on the chart, meaning that the coin isn’t under selling pressure. Another bullish indicator was the Net Unrealized Profit and Loss (NUPL). Additionally, miners’ confidence in BTC is also high, as evident from its green Miners’ Position Index (MPI).

Is your portfolio green? Check the Bitcoin Profit Calculator

On top of that, Coinglass’ data revealed that while BTC’s price appreciated, its Open Interest also went up.

When Open Interest rises, it typically indicates that more capital is entering the market for that option. Therefore, the possibility of BTC continuing its uptrend is high.