All the reasons why Bitcoin investors should celebrate

- BTC’s price was close to BTC’s 1 million to 3 million realized price – UTXO Age Bands.

- The king coin increased by 1.7% in the last 24 hours and was trading at $27,331.54, at press time.

Bitcoin’s [BTC] price has followed a sideways path for quite some time as its volatility remained low. This stirred fear among many investors, as they expected BTC to continue its Q1 performance in Q2.

However, CryptoQuant’s recent analysis pointed out quite a few factors that hinted a price uptick could be in the making. So the most pertinent question here is- Can BTC now finally breach its sideways path?

Is your portfolio green? Check the Bitcoin Profit Calculator

Bitcoin is resting before a bull rally

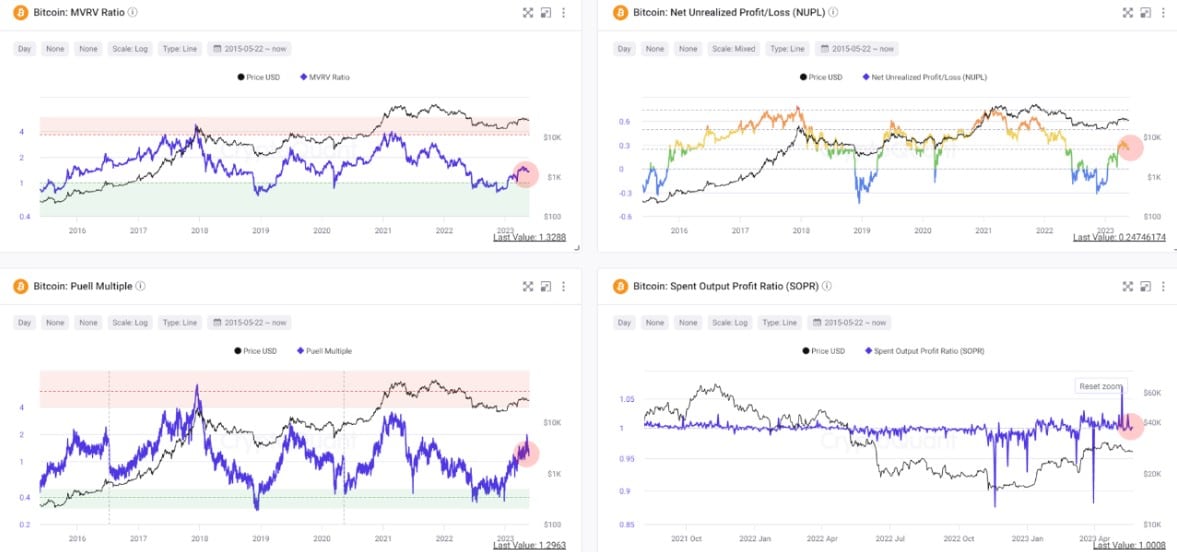

MAC_D, an author and analyst at CryptoQuant, pointed out quite a few factors that suggested an uptrend. A look at various on-chain cycle metrics such as MVRV and SORP, revealed that the current interval was a recession, meaning a recovery phase. Therefore, in the long run, BTC’s price can be seen to be more upward.

Apart from that, growth was also noted in terms of Bitcoin’s intrinsic value. As per the analysis, there has been a recent adjustment trend, but this seems to be a short-term phenomenon due to network overheating.

Overall, a look at BTC’s hashrate and difficulty suggested that the blockchain was actually growing. The analysis also mentioned that the coin’s price was close to BTC‘s 1 million to 3 million realized price – UTXO Age Bands.

It was noted that during the last recovery period, the average unit price of these short-term holders acted as a critical support line for a price correction. This increased the chances of a price uptrend in the coming days.

Should investors get excited yet?

To better understand the ground scenario, let’s have a look at BTC’s other on-chain metrics to see whether BTC is preparing for a bull rally.

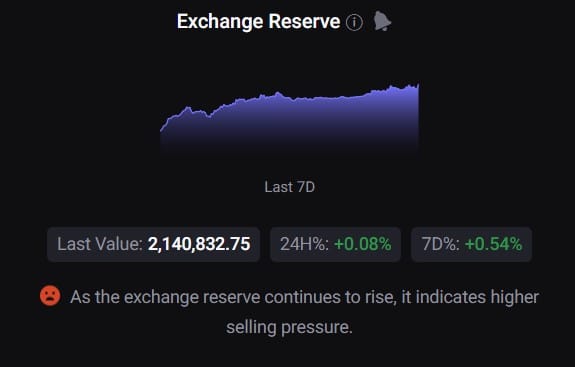

According to CryptoQuant, BTC’s exchange reserve was increasing, suggesting that the coin was under selling pressure. BTC’s aSORP was also red, which revealed that more investors were selling at a profit.

However, at press time, BTC’s taker buy/sell ratio was green, indicating that buying sentiment was dominant in the market. Moreover, BTC’s funding rate was also good, which looked encouraging.

Interestingly, BTC’s fear and greed index was in a neutral position. This was ambiguous, as it suggested that BTC’s price could head in any direction in the near term.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Market indicators are bullish

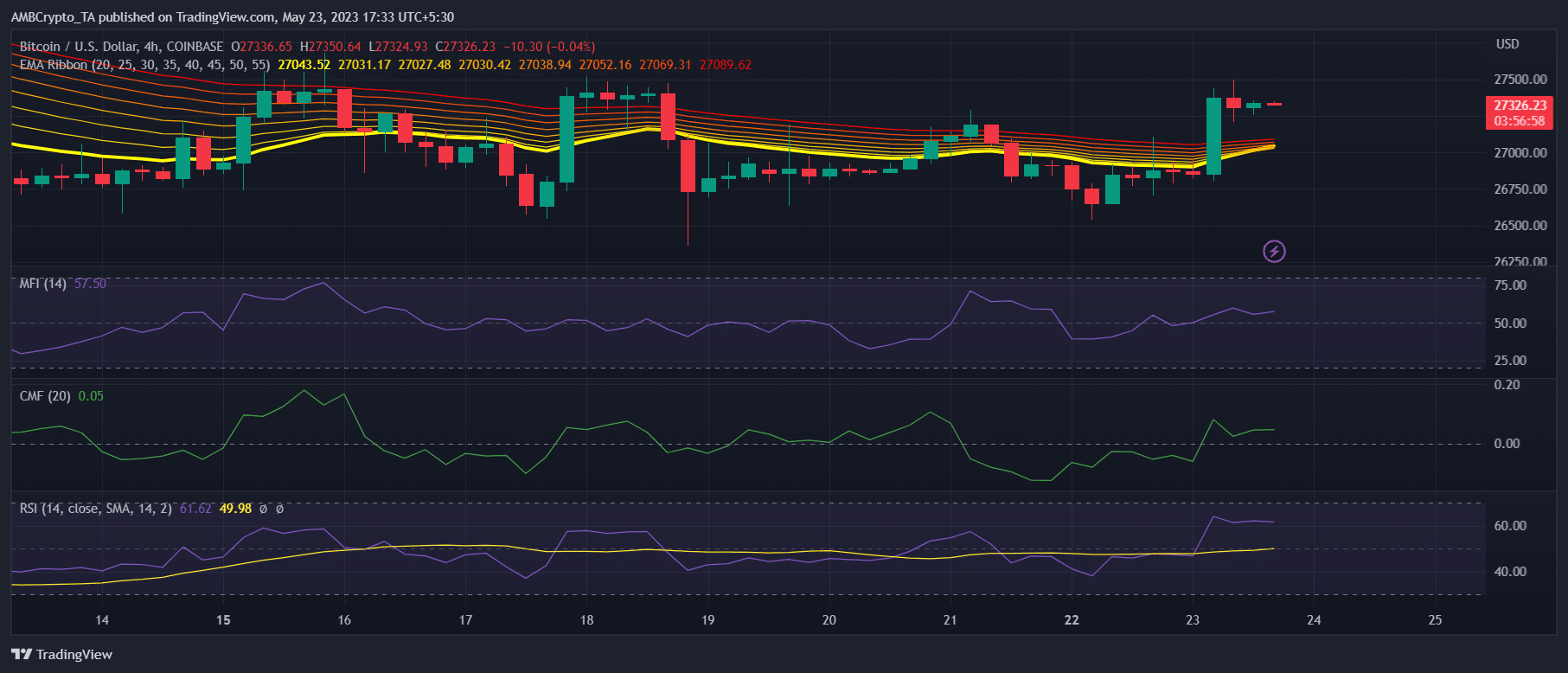

Furthermore, the Exponential Moving Average (EMA) Ribbon’s data showed that the distance between the 20-day and 55-day EMA was declining, which increased the chances of a bullish crossover.

BTC’s Chaikin Money Flow (CMF) also registered an uptick, as did its Money Flow Index (MFI). The Relative Strength Index (RSI) was well above the neutral mark, further increasing the chances of a price uptrend.

In the last 24 hours, BTC went up by over 1.7%. At the time of writing, it was trading at $27,331.54 with a market capitalization of $529 billion.