Bitcoin ‘is back’ in this phase; what does it mean for the market

The cryptocurrency market, at press time, was neither bullish nor bearish as some coins jumped into the green zone while others remained in the red. Bitcoin, for instance, was trading sideways for quite a while now. Post a consolidation phase, buyers seized the initiative and continued pushing its rate up. In the last 24 hours, BTC witnessed a surge of about 2%, trading at the $34.3k price level.

According to a Glassnode metric, “Liveliness,” the bitcoin market went through a transition phase in terms of long-term investors’ “macro HODLing” behavior. The said metric provides insights into the shifts in the macro HODLing behavior, helping to identify trends in long-term holder accumulation or spending.

#Bitcoin is back in an accumulation phase.

Liveliness decreasing means coins are being hodled.

Bitcoin Liveliness = (ΣCoin Days Destroyed)/(ΣCoin Days Created). pic.twitter.com/whwr9RBVJ2

— ?Dylan LeClair? (@BTCization) July 10, 2021

As discussed above, the “Liveliness” metric witnessed a setback, resembling a dormant HODLing behavior. Moreover, a similar pattern was observed through other metrics too. Long-time holders showcased their positive outlook towards Bitcoin. As stated by analyst Willy Woo in his newsletter,

“It’s very clear to see that long-term holders are mopping up the speculative coins at a strong pace. It’s now a waiting game until this is reflected in the price action, the data is confidently pointing to an accumulation bottom forming.”

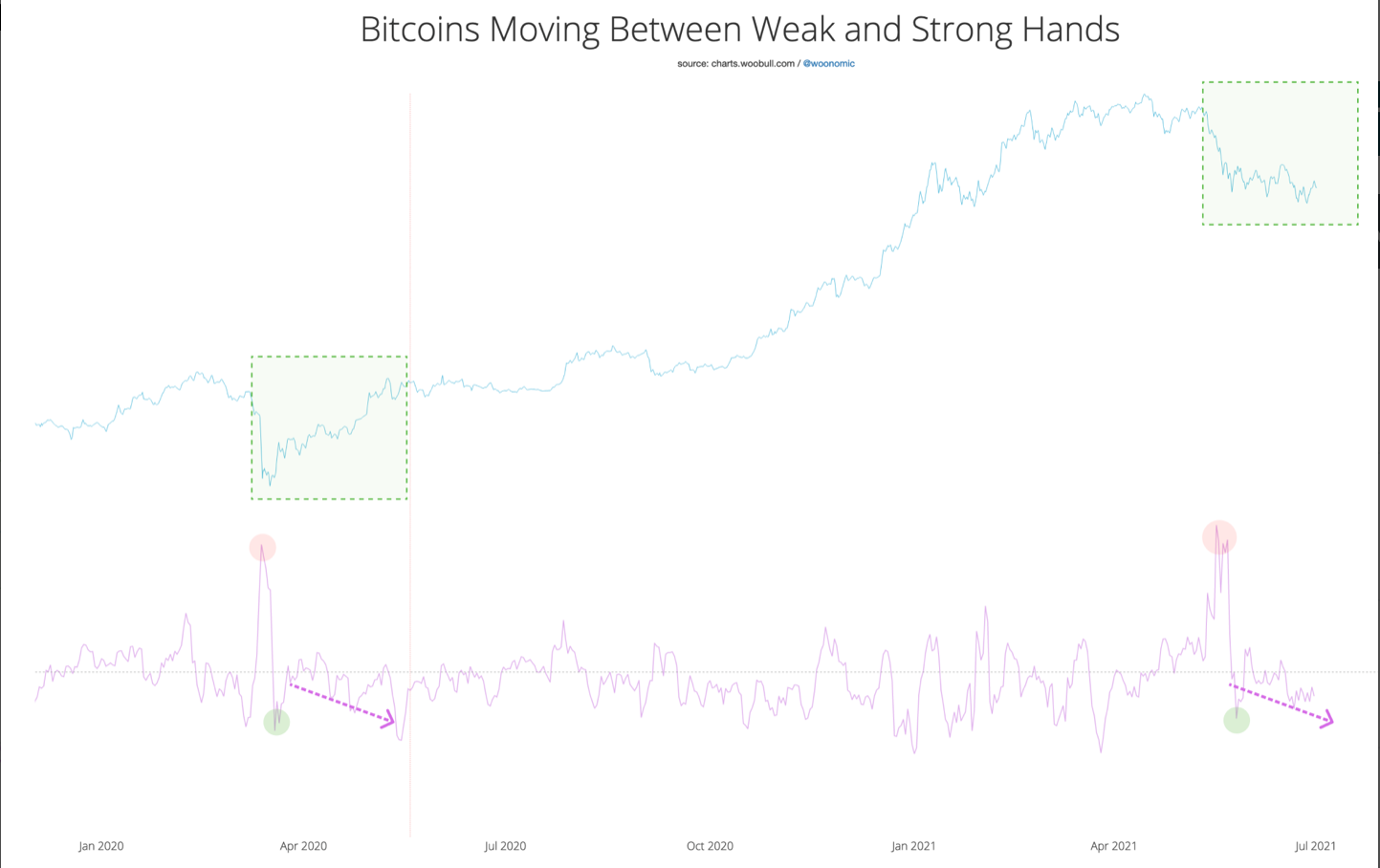

In addition to this, he used the “Rick Astley” chart that depicted Bitcoin’s movement between strong and weak hands,

As seen above, Bitcoin moved from weak hands to strong hands, i.e. short-term participants started bartering their new coins to long-term holders.

The timing of the said development was interesting as it came right after a few firms invested a significant amount in Bitcoin.

Recently, Lincoln Avenue Capital, a US-based family-owned developer, and investor in affordable housing bought 1,000 Bitcoins (BTC) at the $33,525 level.

Lincoln Avenue Capital has acquired 1,000 #Bitcoin at an average price of $33,525.

The purchase represents 5% of the firm’s AUM as of July 10, 2021.

The company may invest up to 20% of total AUM in the asset class in the future, per its investment mandate.

— Lincoln Avenue Capital (@LincAveCapital) July 10, 2021

Meanwhile, an investment firm purchased a massive share in MicroStrategy (MSTR), an enterprise software company co-founded by Bitcoin bull Michael Saylor. As per the official filing with the U.S. Securities and Exchange Commission (SEC), Capital International acquired 953,242 MSTR shares.

Similarly, as reported by Bitcoin Treasuries, different corporations across the globe have invested a good chunk toward accumulating Bitcoin in their portfolios.

![Why Chainlink [LINK] and Polygon [MATIC] are more similar than you realise](https://ambcrypto.com/wp-content/uploads/2024/04/Chainlink_and_Polygon-1-400x240.webp)