‘Bitcoin is cheap’ and these guys (know it and) are taking advantage of it!

Bitcoin’s price has been trying to recover from the last week’s fall and was currently trading at $35,331. However, the hash power has continued to drop and suggested that the holders had capitulated at the lows.

Bitcoin’s price was already going through a period of high volatility. As the value of BTC dropped, the market capitulated once again and realized a new all-time high of $3.45 billion in losses, as per data provided by Glassnode. This meant that a large volume of coins that were ‘underwater’ were also spent this week.

Source: Glassnode

It should be noted that almost all Long-Term Holders [LTHs] were in profit and as per data, their spending actually offset nearly $383 million in net losses. This would bring the total realized loss to a massive sum of $3.833 billion. Nevertheless, LTHs were holding only 2.44% of the current circulating supply at an unrealized loss.

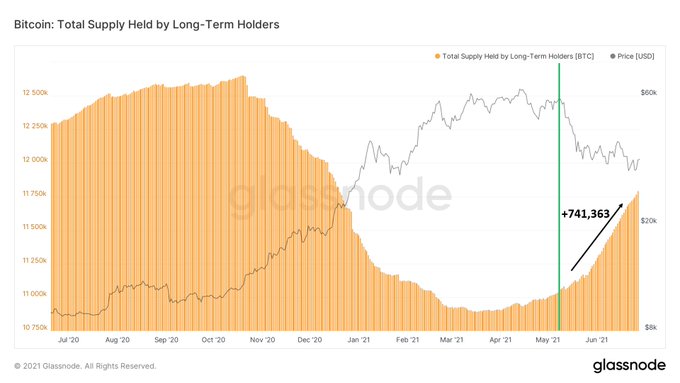

LTHs have been around other bull cycles and witnessed drastic price swings in the market earlier. Therefore, they were still in the market holding on to Bitcoin. In fact, data suggested the LTHs had added 741,363 BTC to their holdings since the initial price drawdown in late May.

On-chain analyst, @WClementelll noted:

“Bitcoin is cheap and Long-Term BTC Holders know it.”

Source: Twitter

The analyst also made an important note that some of the STHs were aging into LTHs now, which would add to the bullish sentiment for the digital asset.

Meanwhile, chartist @woonomic also echoed the positive sentiment in the market and stated:

“We’ve been bullish for weeks.”

However, the Spent Output Profit Ratio [SOPR] for LTHs and STHs could be point of concern. While LTH-SOPR suggested great volatility, STH-SOPR noted deep capitulation.

Source: Glassnode

Although STHs realized lesser losses compared to March 2020 capitulation event. LTHs, on the other hand, were willing to spend coins with an average cost basis fluctuating between $9.2k and $16.3k this week. This indicated a high degree of uncertainty between holders.

The spending of holders suggested that coin age continued to break down towards the pre-bull levels. LTHs were impacted by the sudden loss of value and were triggered to panic sell. Meanwhile, 23.5% of all circulating supply are owned by STHs and was underwater.

The bullishness as predicted by some analysts is yet to translate in the market as the short-term holdings age into long-term holdings. Till then, the spot traders will have to wait for the spot market to recover and on-chain metrics to gain more strength.