Bitcoin: Is FUD against BTC justified or should you expect another rally?

- FUD around Bitcoin increases as BTC pushes past $30,000.

- Whales get impacted, but traders remain optimistic.

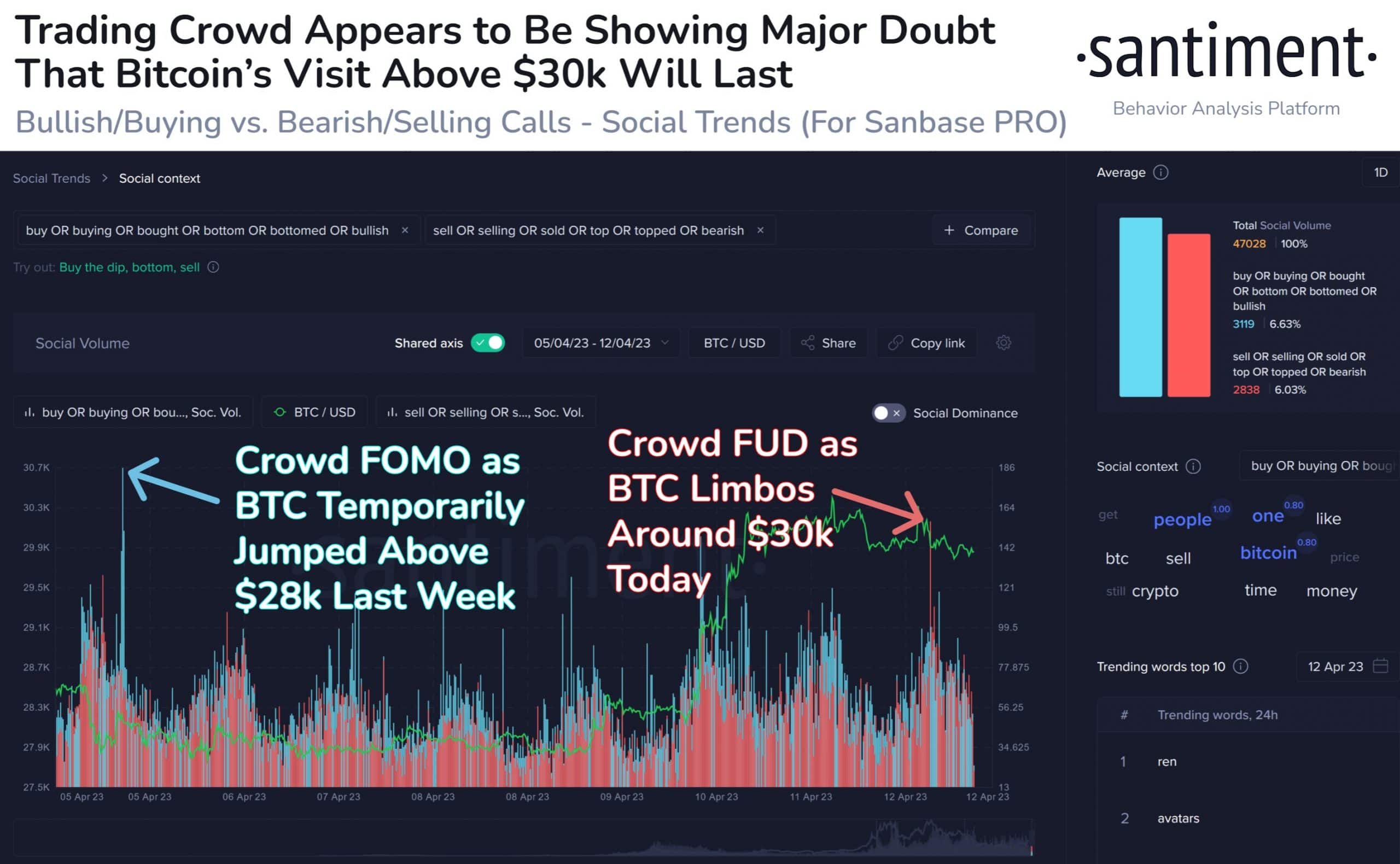

As Bitcoin’s [BTC] price surpassed the $30,000 mark, skepticism around the leading cryptocurrency’s price became more pronounced. Santiment’s data showed that the Fear, Uncertainty, and Doubt (FUD) surrounding Bitcoin amplified in recent days.

Read Bitcoin’s Price Prediction 2023-2024

Between FOMO and FUD

When the price of BTC was at $28,000, FOMO (Fear of Missing Out) was exhibited by addresses, thanks to the bullish sentiment increase. However, as prices reached $30,000, the uncertainty around the king coin started becoming visible.

Santiment’s data suggested that historically, high FUD has been preceded by the bullish movement of BTC as the direction of the markets tends to be contrary to the expectations of the crowd.

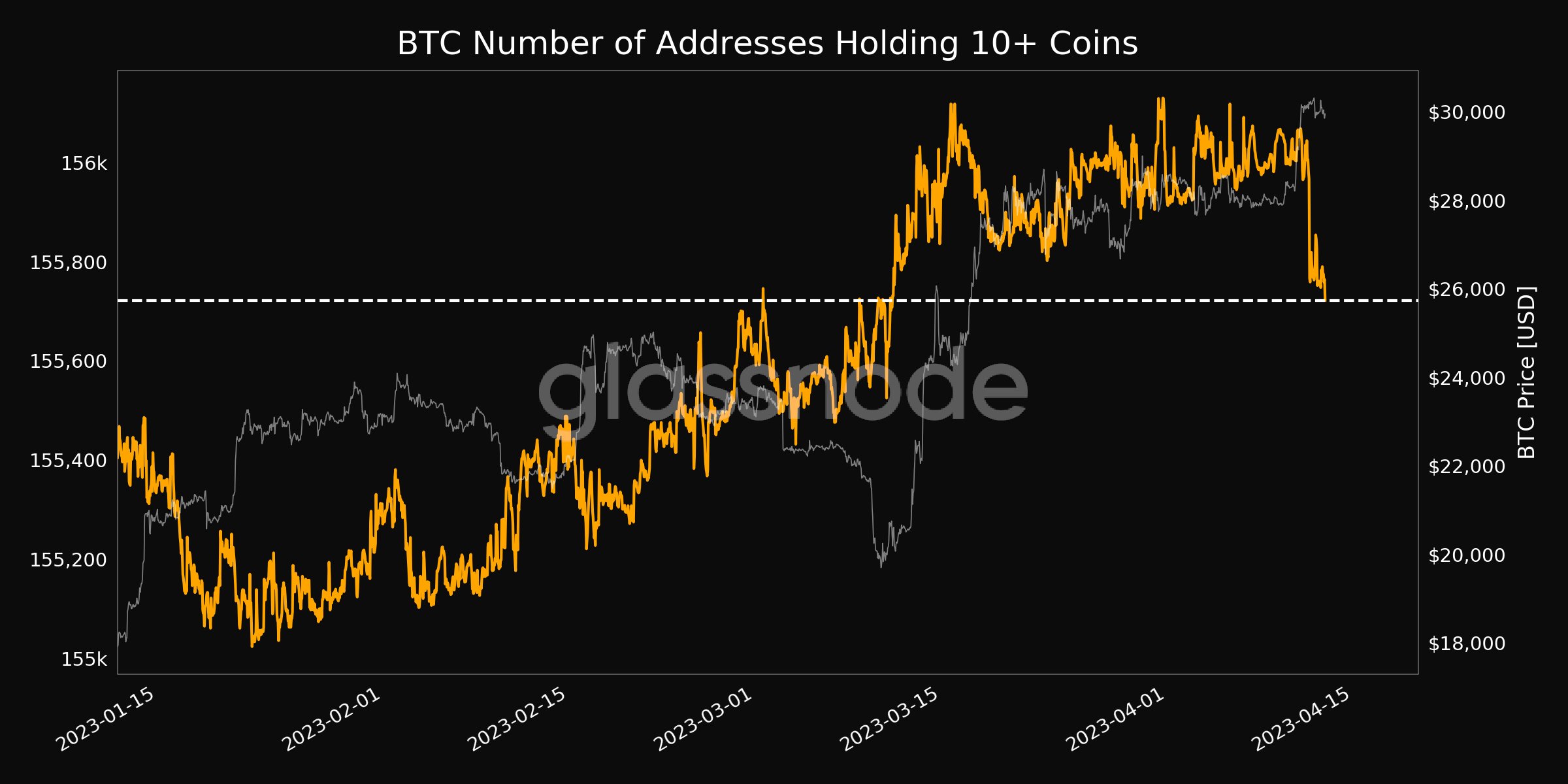

However, it appears that the whales were struck by the FUD surrounding the market. According to data provided by glassnode, the number of addresses holding more than 10 BTC declined and reached a one-month low, at the time of writing.

Now, with the increasing number of BTC addresses in profit, there was also a rise in the motivation for investors to sell their holdings, which may lead to an escalation of selling pressure on Bitcoin.

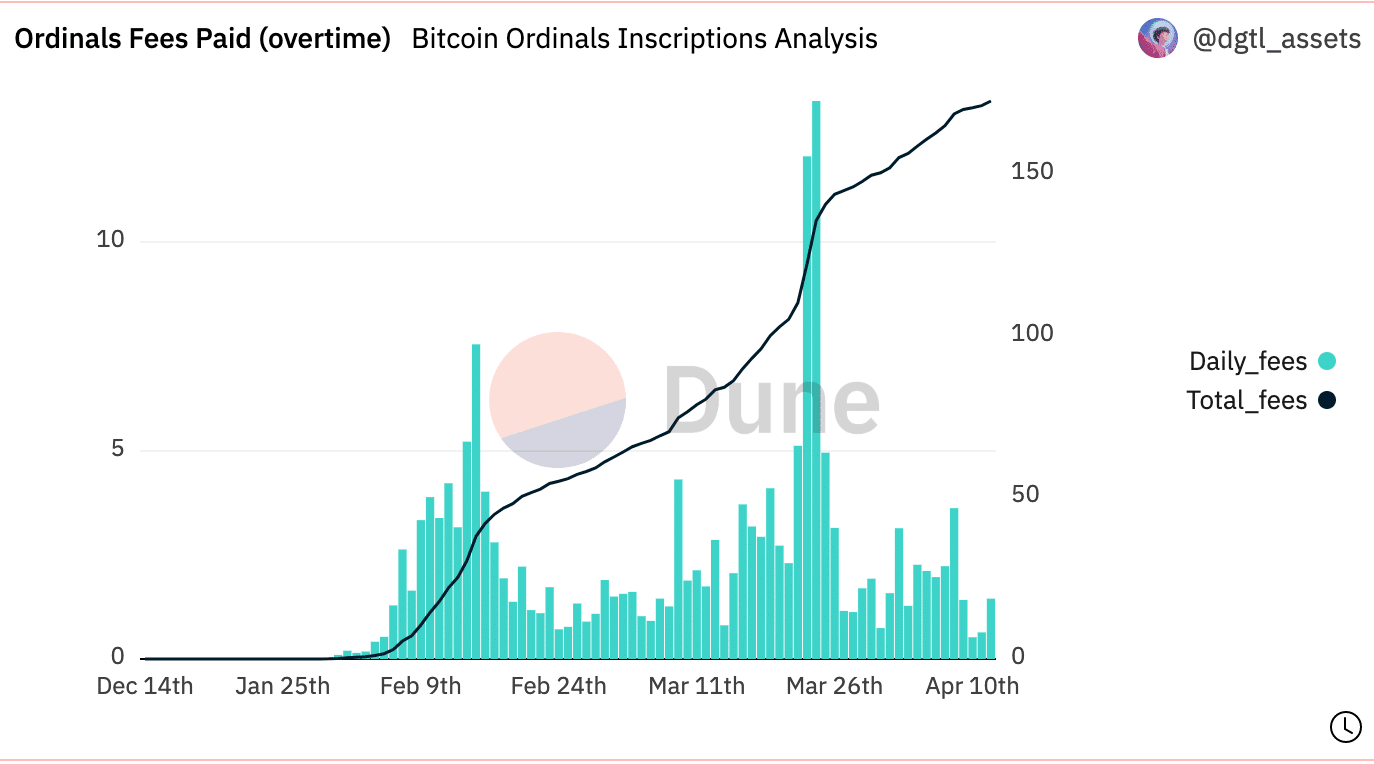

On the other hand, the enthusiasm for Bitcoin ordinals and inscriptions also appeared to be waning. Dune Analytics data indicated a notable decline in fees generated through Bitcoin ordinals, which suggests a reduced interest from addresses.

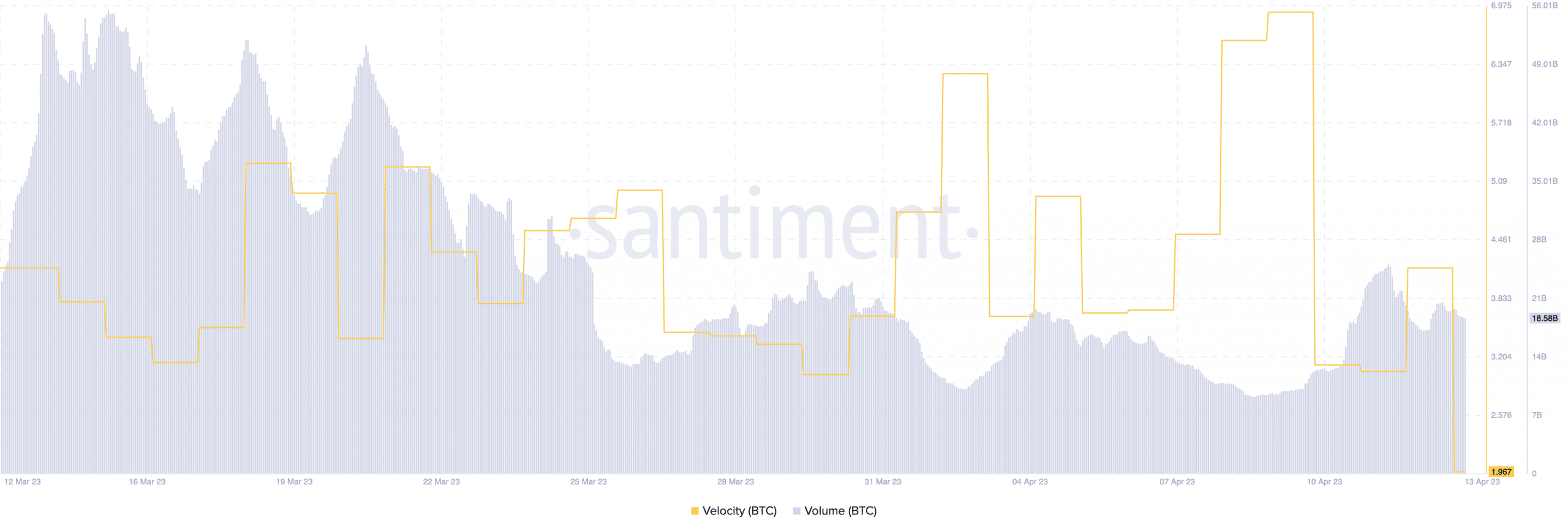

Regarding BTC activity, a reduction in the coin’s velocity was noted, indicating a decrease in the frequency of BTC trading. Furthermore, the volume of Bitcoin also dropped from 55.82 billion to 18.58 billion.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Despite these factors, traders were unfazed and persisted in taking long positions for Bitcoin. As of this writing, 51.3% of all Bitcoin positions taken were long as per Coinglass’ data.

It remains to be seen whether the trader’s optimism will pay off in the long run or if the FUD surrounding BTC will lead to the bears taking dominance.