Bitcoin: Is ‘paper handing’ BTC the way to go?

- Many retail BTC holders decreased their balance.

- Open Interest decreased, suggesting that BTC might retrace from $70,000.

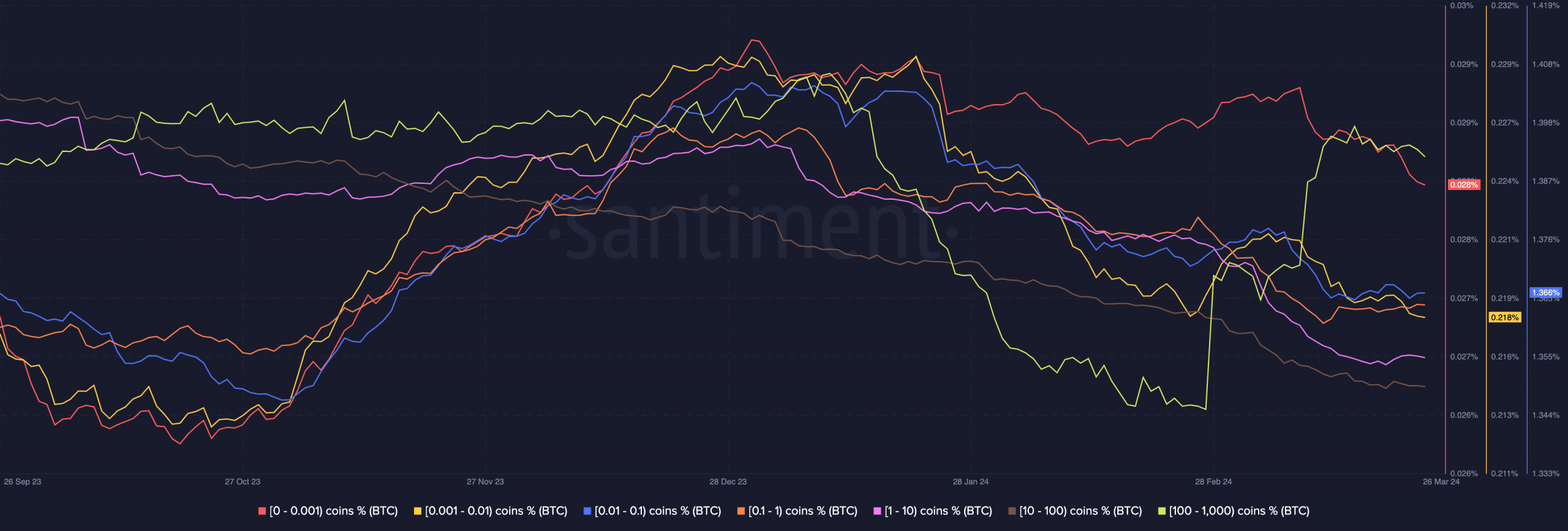

Unlike their whale counterparts, Bitcoin [BTC] addresses holding between 0.0001 to 1000 coins are downsizing. AMBCrypto discovered this after analyzing the balance of addresses on-chain.

On the 26th of March, we checked the BTC supply distribution. From our findings, the retail cohort was “paper handing” their coins while whales scooped them up at cheaper prices since the 20th of March.

Here is the likely “why”

In crypto, paper handing is a term used to describe the sale of a coin before it reaches its full potential. When this group started selling, the price of Bitcoin had dropped below $62,000.

But at press time, the value was back above $70,000, suggesting that the decision was a rash one.

At the same time, one cannot blame them considering how events centered around BTC have been bearish of late. Several times, AMBCrypto reported how the spot Bitcoin ETFs impacted the price action.

But since last week, outflows have been terrifying.

As such, these holders thought it was time to book some profits and possibly buy back cheaper.

However, SoSoValue’s data showed that the situation with the ETFs had gotten better as inflows have started to increase.

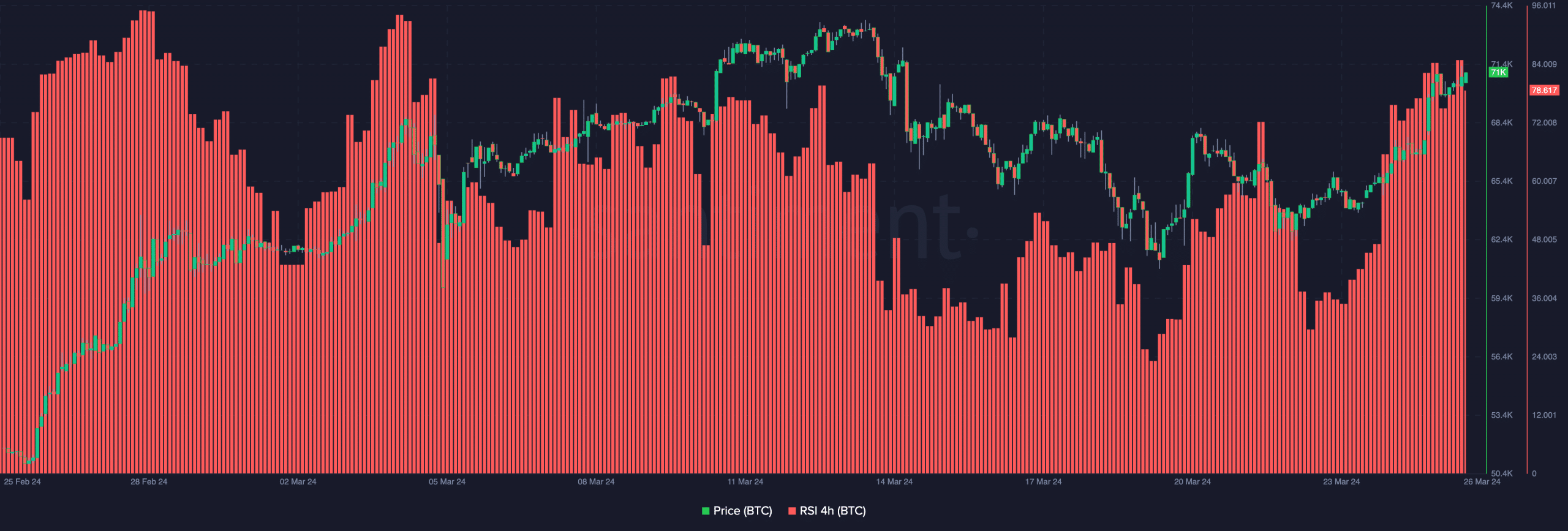

If the inflows continue to increase, then Bitcoin’s price might also follow. However, the Relative Strength Index (RSI) showed that another buying opportunity might appear.

But whether these investors would capitalize on the chance remains unknown. At press time, the RSI reading was 78.61, indicating that the token was overbought.

With this condition, BTC might retrace. In a highly bullish scenario, the value of the coin might drop to $64,800. However, if bears fail to tug back the price, the coin might rally toward $73,000.

Is Bitcoin set to cool off?

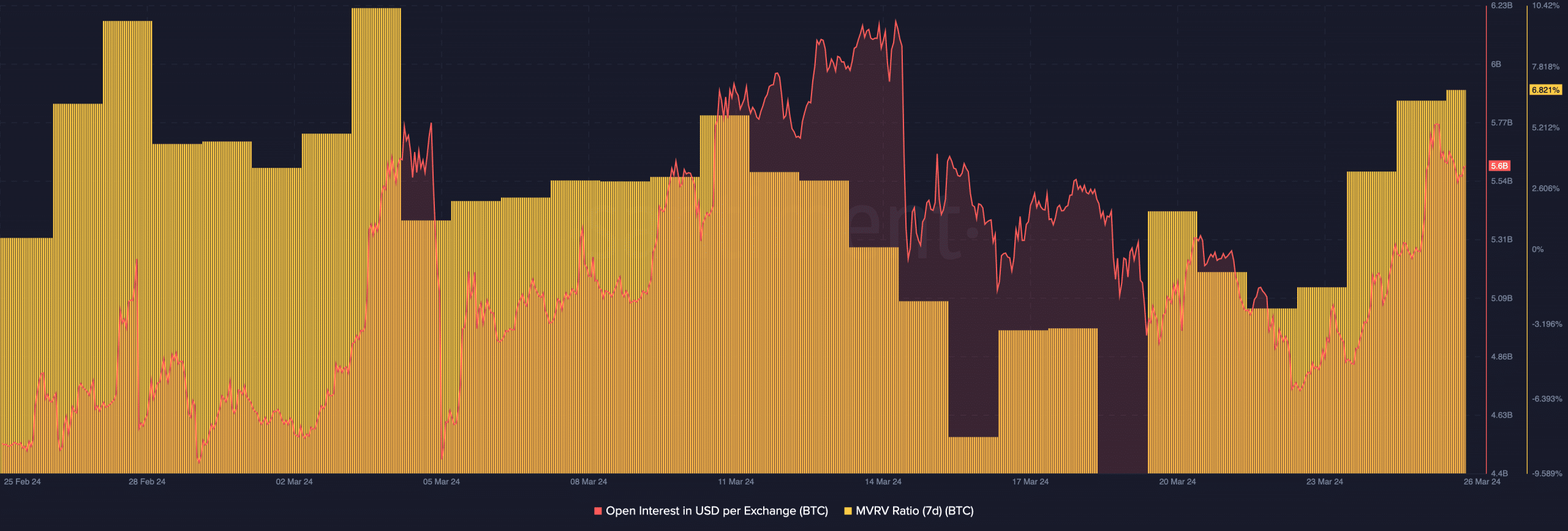

Furthermore, AMBCrypto went ahead to check the Open Interest (OI). As of this writing, the Open Interest had dropped to $5.60 billion. On the 25th of March, the value of the indicator was higher.

OI increases or decreases based on net positioning. Therefore, the decrease means that market participants are decreasing their net positioning. It also implied that sellers are becoming aggressive.

With the price increasing and OI decreasing, the strength of the uptrend might become weak, and Bitcoin might retrace. Another metric we evaluated was the Market Value to Realized Value (MVRV) ratio.

Is your portfolio green? Check out the Bitcoin Profit Calculator

In the last 24 hours, the MVRV ratio had increased. The more the ratio increases, the more the willingness to sell. If traders decided to realize some recent gains, BTC might experience a decline.

In addition, volatility around the coin might jump. Therefore, traders might need to exercise caution in opening contracts related to the cryptocurrency.