Bitcoin: Is THIS support enough to prevent another BTC crash?

- Over one million users bought BTC at $94K, making it a strong support for an upside move.

- But a sharp BTC pullback can’t be overruled, as key metrics flashed red flags.

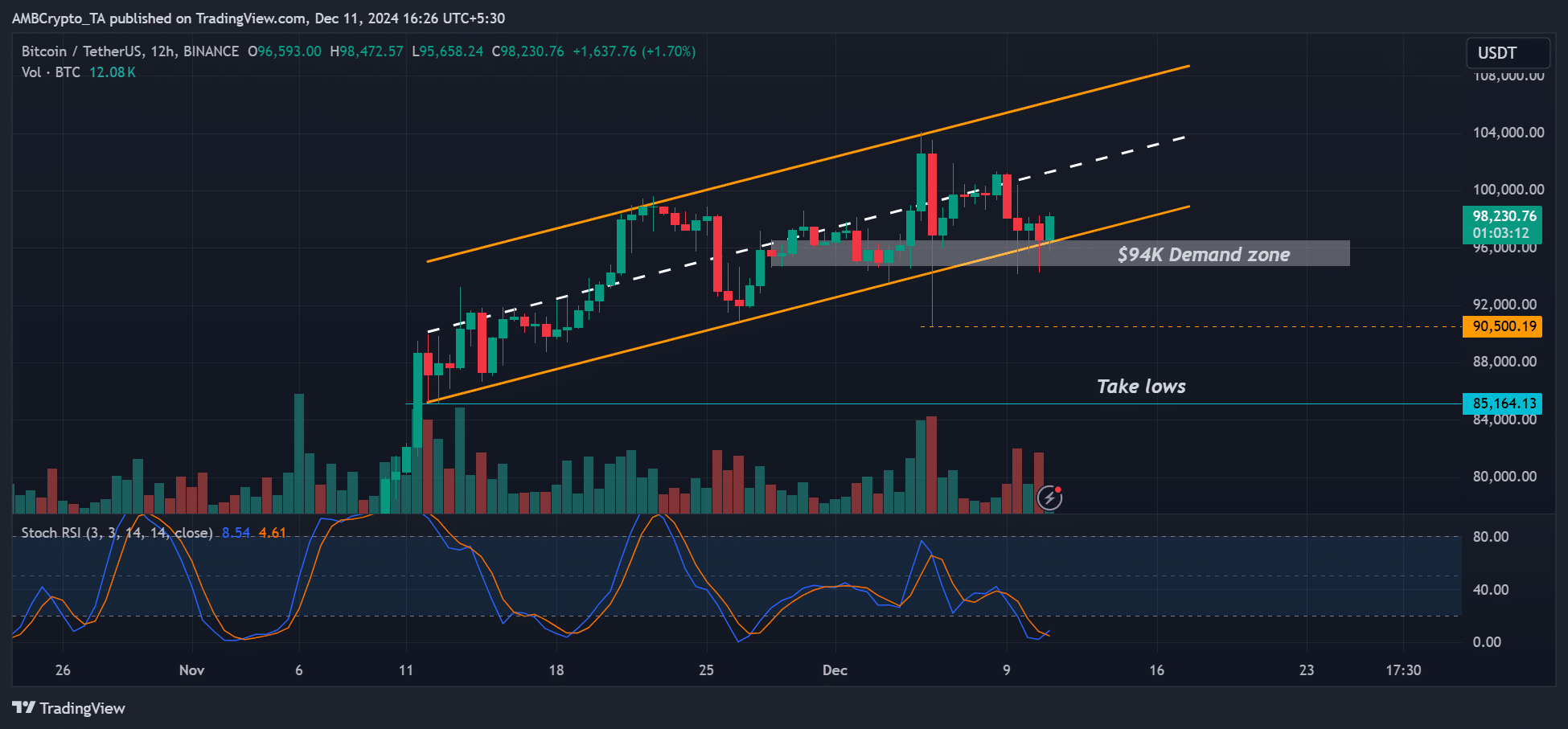

Despite recent sell-offs, Bitcoin [BTC] has marked $94K as key support and was valued at $98K ahead of key US inflation data (CPI).

This week’s key macro updates, from inflation to labor markets, could trigger wild price swings as the data points will determine the pace of Fed interest cuts from the 18th of December. The market was currently pricing a 25bps interest rate cut.

Another BTC crash?

Interestingly, BTC still held the short-term channel and the $94K aligned with the range lows. Will it hold or crack post-CPI data?

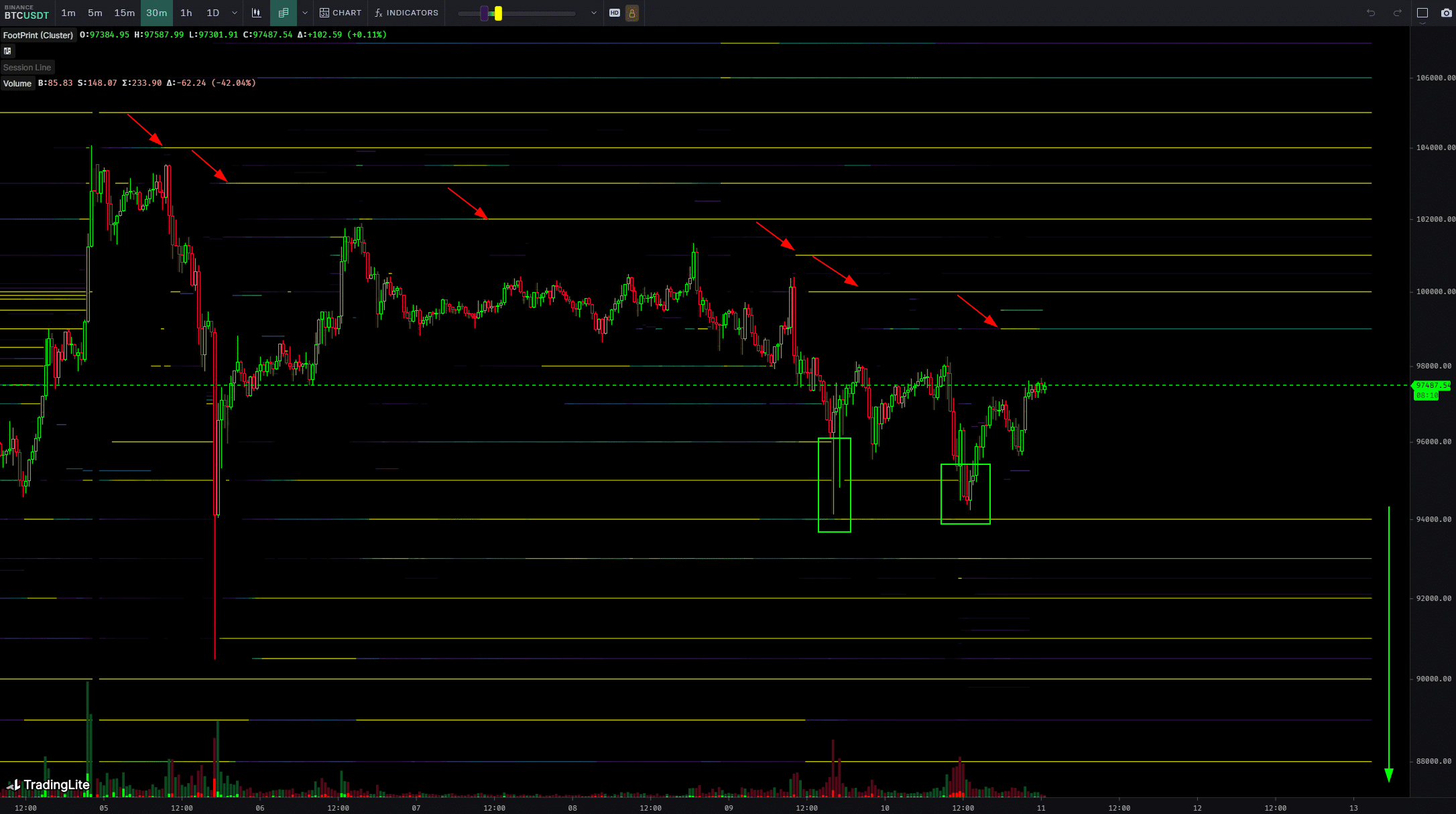

According to BTC trader Skew, there was strong demand between $90K and $95K, suggesting that BTC might have stabilized at these levels with $97K as an equilibrium point. Part of his analysis read,

“I think the market is or has found its equilibrium here…The market continues to add bid liquidity around current lows $95K – $90K as well passive buying is present in these two sweeps so far.”

Blockchain analytics firm, IntoTheBlock also confirmed strong bid levels above $90K. The firm noted that,

“The real demand zone emerges between $94,800 and $97,700, where over 1.3 million addresses have accumulated Bitcoin. This range represents a critical area for potential support.”

Put differently, $94K was a crucial demand zone and springboard for a potential move to the $105K target.

However, this also implied that a drop below $94K could put over 1 million addresses underwater. They could panic sell and drag BTC lower if they’re not diamond holders.

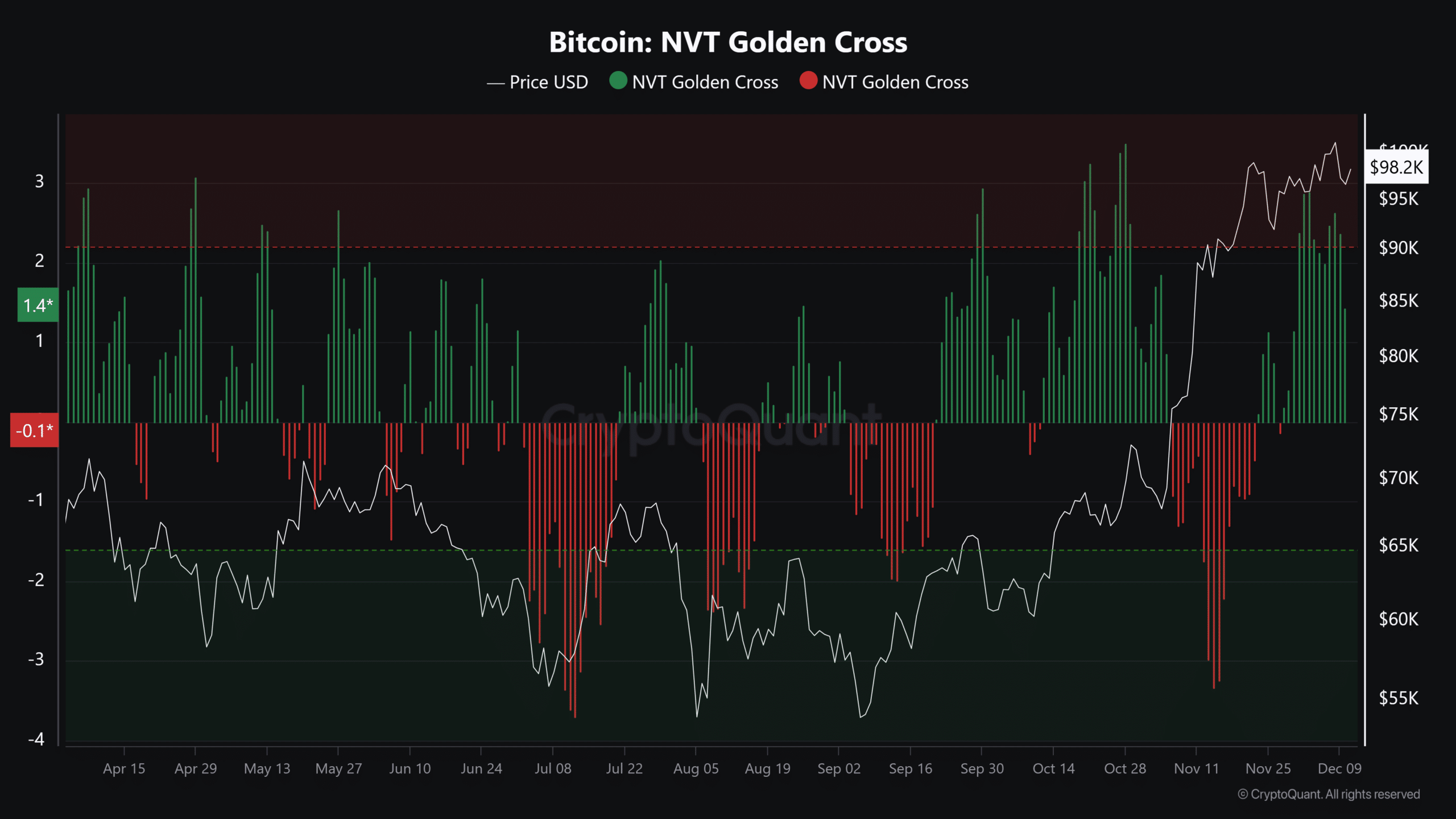

The sticky NVT Golden Cross metric supported this potential bearish scenario.

For context, the metric marked previous local tops and bottoms. It first flagged an imminent BTC local top in late November (green bars) and has remained sticky despite this week’s shake-outs.

This suggested that despite recent pullbacks, BTC might not be out of the woods yet, at least according to the NVT Golden Cross.

Read Bitcoin [BTC] Price Prediction 2024-2025

Besides, MVRV has recently soared towards an overheated territory, further signaling a likely pullback. This implied that BTC could still surge above $100K, but a sharp pullback couldn’t be ruled out.