Bitcoin

Bitcoin: Japan’s Metaplanet mirrors MicroStrategy as BTC hits $65K

Has Metaplanet’s bold Bitcoin strategy positioned it as a leader in institutional cryptocurrency adoption?

- Metaplanet boosts BTC holdings amid price recovery, reinforcing its “Asia’s MicroStrategy” reputation.

- Post-announcement surge lifts Metaplanet’s stock by 25.81%, marking a bold Bitcoin investment strategy.

Metaplanet, a prominent publicly-listed investment and consulting firm headquartered in Japan, has significantly boosted its Bitcoin [BTC] holdings.

Metaplanet’s BTC holdings

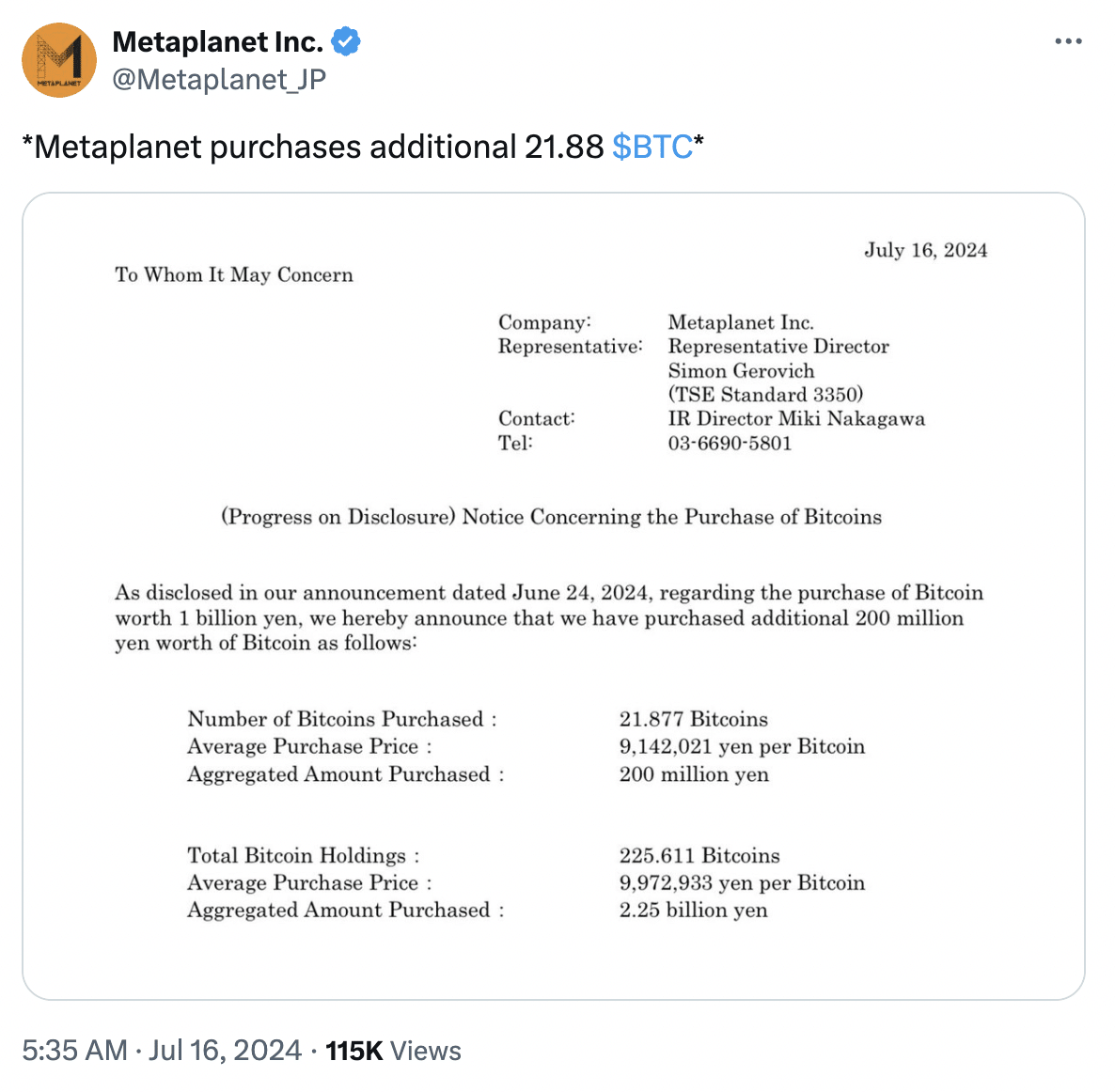

Recently, the company acquired an additional 21.88 BTC, valued at over $1.2 million (approximately 200 million Japanese yen).

This move aligns with Bitcoin’s recent surge to around $65,000, marking a notable 4.5% increase following weeks of continuous decline.

In fact, at the time of writing, BTC showed bullish signs on the daily chart, marking a 1.94% increase in the past 24 hours.

Metaplanet takes cues from MicroStrategy

Interestingly, Metaplanet is often dubbed “Asia’s MicroStrategy” due to its tendency to follow MicroStrategy’s investment strategies.

For context, Metaplanet is financing its Bitcoin purchases through bond sales, similar to MicroStrategy’s approach. This highlights the growing institutional adoption of BTC.

That being said, on 16th July, Metaplanet boosted its Bitcoin holdings to over 225 BTC, valued at about $14.55 million at current prices.

Additionally, Metaplanet’s recent announcement of expanding its BTC holdings has triggered a remarkable surge in its share price, soaring by an impressive 25.81% to reach 117 JPY.

This surge reflects investor confidence in the firm’s strategic adoption of Bitcoin, which has pushed its stock by an astounding 631% since the year began.

What’s more to it?

As of the latest update, Metaplanet’s current market capitalization stands at 17.5 billion JPY, with its BTC holdings valued at 2.25 billion JPY on its balance sheet.

As BTC’s proportion in its total assets continues to rise steadily, analysts speculate it could surpass 100% in the near future. This shows Metaplanet’s bold stance in embracing cryptocurrency as a core part of its investment strategy.

This was further confirmed by CoinGecko’s data, showing that Metaplanet currently ranks as the world’s 21st-largest corporate holder of Bitcoin.

This underscores Metaplanet’s proactive stance in hedging against Japan’s escalating debt crisis and the depreciating Japanese yen.

With the yen plummeting nearly 54% against the US dollar since January 2021, BTC has emerged as a robust alternative, appreciating by over 145% against the yen in the past year alone.

In conclusion, Metaplanet’s strategy reflects a growing trend where institutions are using Bitcoin alongside traditional assets for hedging and diversification.