Bitcoin: Key data reveals why you shouldn’t sell just yet

- Bitcoin traders might not want to sell right now, as an uptrend seems imminent.

- Miners, generally considered market-savvy participants, were unwilling to sell their holdings.

Bitcoin [BTC] noted a smaller range formation after breaking out past the $67k resistance last week.

This range reached from the $70.5k resistance to the $$66.8k support, and the 27th of May saw BTC rejected from the shorter-term range high.

However, unlike the previous time that Bitcoin tested the $70k area, things are quite different. The bulls have a much better chance of continuing the trend upward.

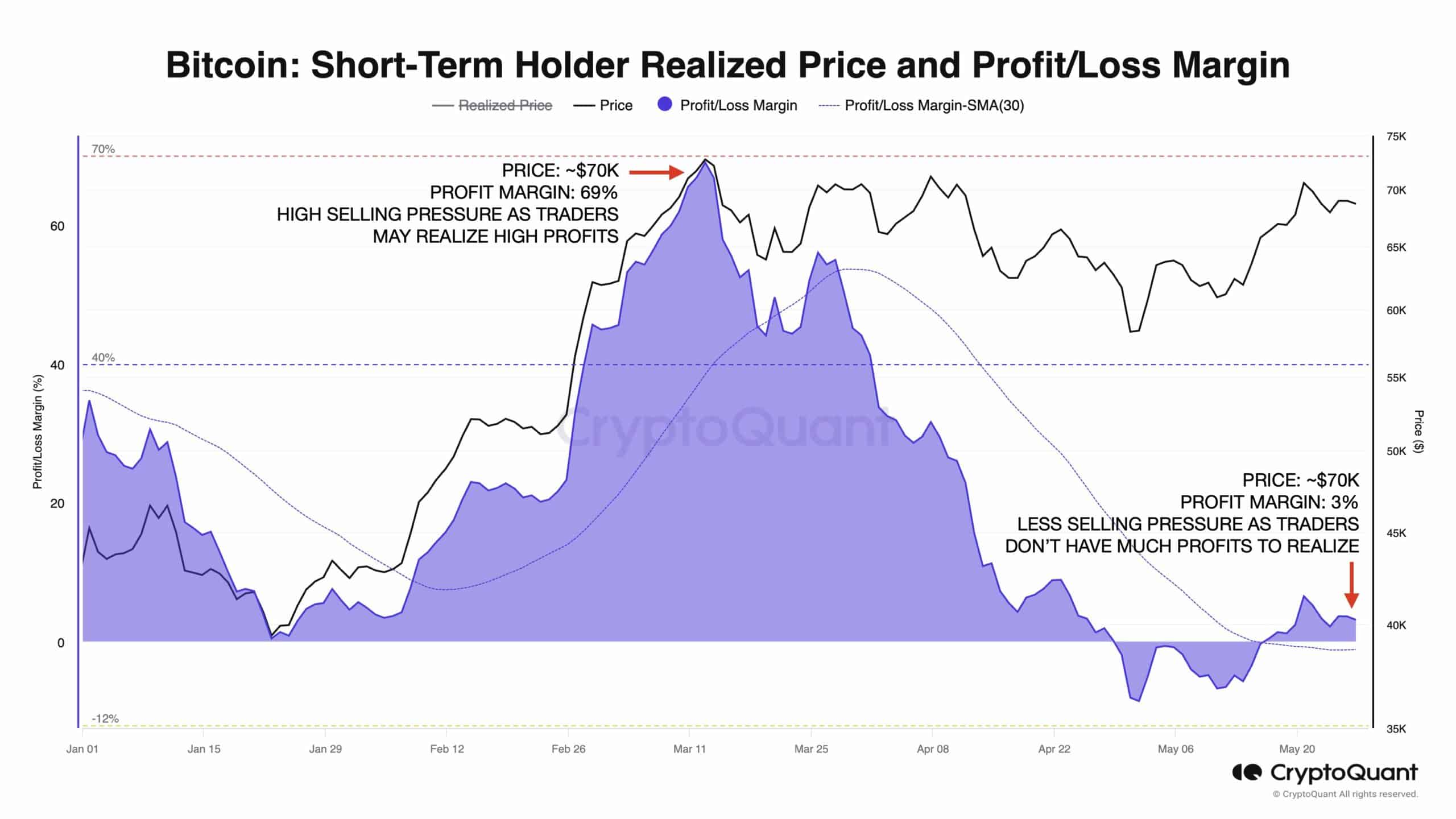

Selling pressure from profit-taking activity will be far less

Source: Julio Moreno on X

Crypto analyst and head of research at CryptoQuant Julio Moreno observed that the profit margin at current market prices is at 3% compared to the 69% it reached in mid-March when prices rallied that far north.

This means that the past 10 weeks of consolidation have absorbed the selling pressure from profit-takers.

It has also likely wiped out high-leverage longs and shorts in the futures market and paved the way for a more organic, spot-driven uptrend.

This is strongly bullish for the market and especially for investors with a high time horizon. The sellers are exhausted, and the buyers have had enough time to gather steam for the next upward charge.

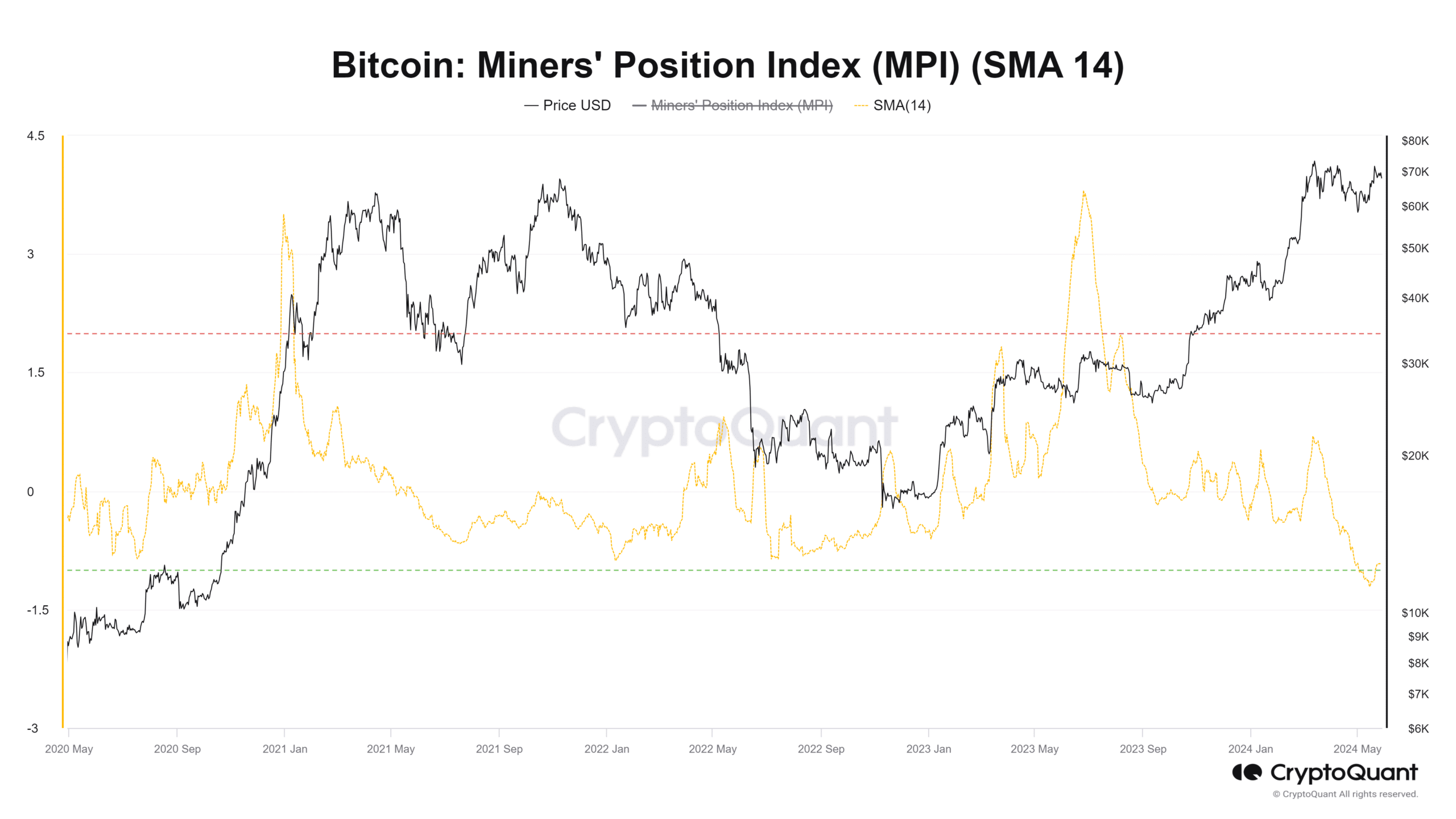

Miner’s position shows a bullish sign too

Source: CryptoQuant

The miner’s position index is the ratio of total outflow from miners to the one-year moving average of the total outflow from miners.

Is your portfolio green? Check out the BTC Profit Calculator

A downtrend in this metric is a bullish sign, as it shows miners are less willing and less involved in selling.

The 14-period simple moving average reached a low not seen in more than four years. This showed that miners are not willing to sell. An uptrend in this metric could inform traders of a potential top.