Bitcoin & MicroStrategy’s concerning parallels: Peter Schiff issues warning

- Schiff warned that hedge funds selling Bitcoin to cover MSTR shorts could crash Bitcoin’s price.

- Bitcoin faced bearish trends, showing red candles in daily and weekly charts.

Bitcoin [BTC] bulls are struggling to turn the bearish sentiment as the cryptocurrency showed red candles on daily and weekly charts.

Trading at $65,177.67 at press time, the king coin’s volatility has drawn a lot of criticism lately, especially from Peter Schiff.

In an X (formerly Twitter) post dated the 17th of June, Schiff noted,

Schiff on Bitcoin and MicroStrategy

Here, Schiff underscored the interconnected risks between Bitcoin and Microstrategy [MSTR], highlighting potential cascading effects on both assets.

Moreover, when asked by an X user—Jim—”Why would Bitcoin crash?,” Schiff replied,

“Hedge funds selling as they buy MSTR. They would be unwinding both sides of the spread.”

Schiff’s statement suggests Bitcoin price could crash if hedge funds sell their Bitcoin holdings while buying MSTR to close their short positions.

However, there remains some confusion regarding the reasons why hedge funds will sell their Bitcoin holdings even when their MSTR short positions yield profits.

Schiff’s remarks lack substantial support

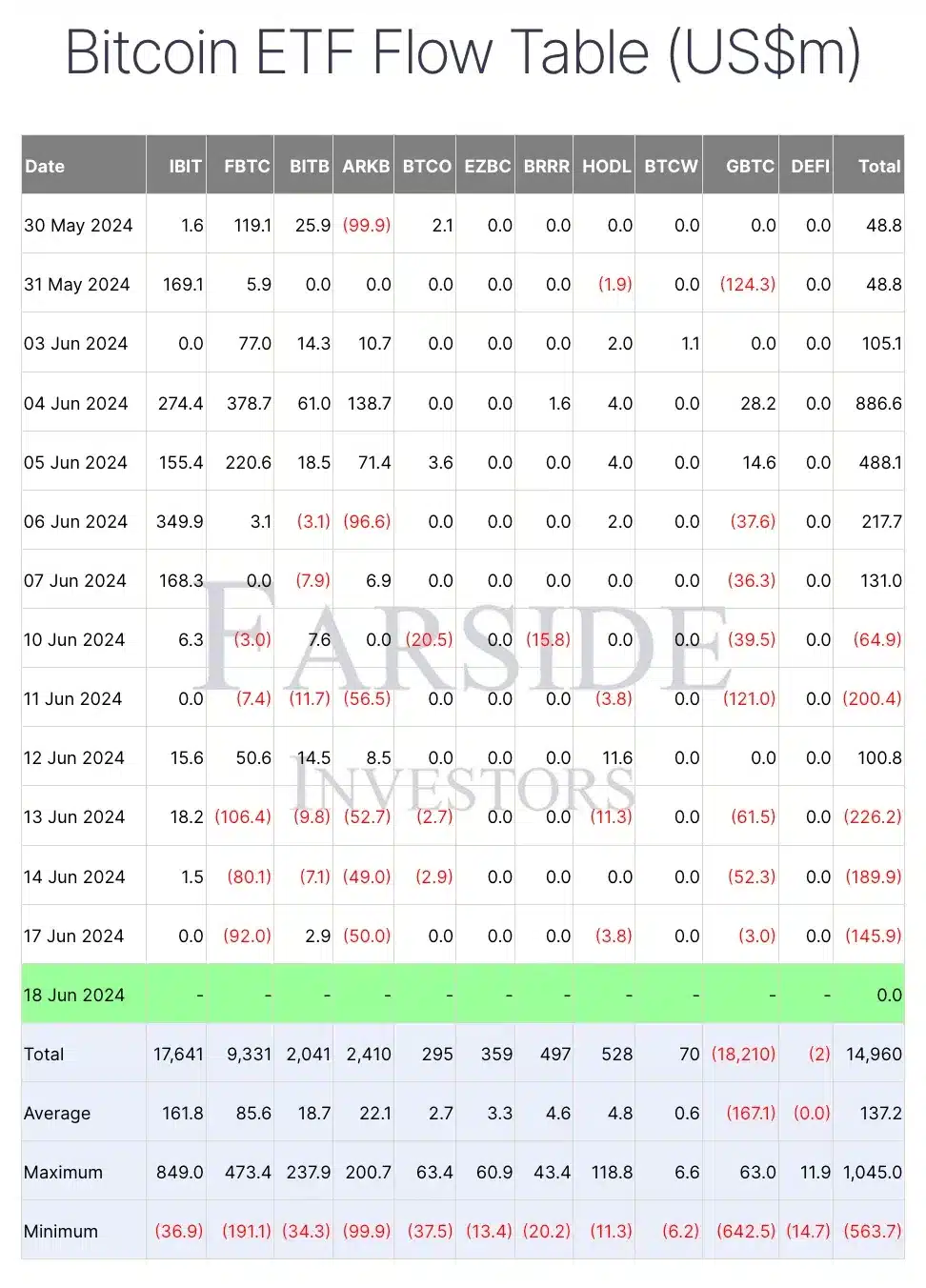

Amid Bitcoin’s ongoing price struggles, BTC ETFs too are facing similar challenges. From the 13th to the 17th of June (excluding weekends), BTC ETFs saw consecutive outflows.

Moreover, MicroStrategy’s stock,MSTR, also dropped by 3.13% in the past 24 hours.

However, with the Relative Strength Index (RSI) near the neutral zone, it’s uncertain where MSTR will go in the near future. If it manages to surpass the resistance level at $1607.8, bullish momentum could potentially follow.

This underscored the strong interconnection between the two markets, suggesting that MicroStrategy’s (MSTR) price action follows Bitcoin’s movement.

Bitcoin stands strong

AMBCrypto’s analysis of social volume and 24-hour active addresses revealed a significant increase, indicating that despite recent price declines, investor sentiment towards Bitcoin remains positive.

Echoing similar sentiment, YouTuber Crypto Rover, analyzed,

“Once this falling wedge on #Bitcoin breaks out, the price target is $72k.”