Bitcoin

Bitcoin miner Marathon Digital’s MARA hikes 17% after S&P 600 listing

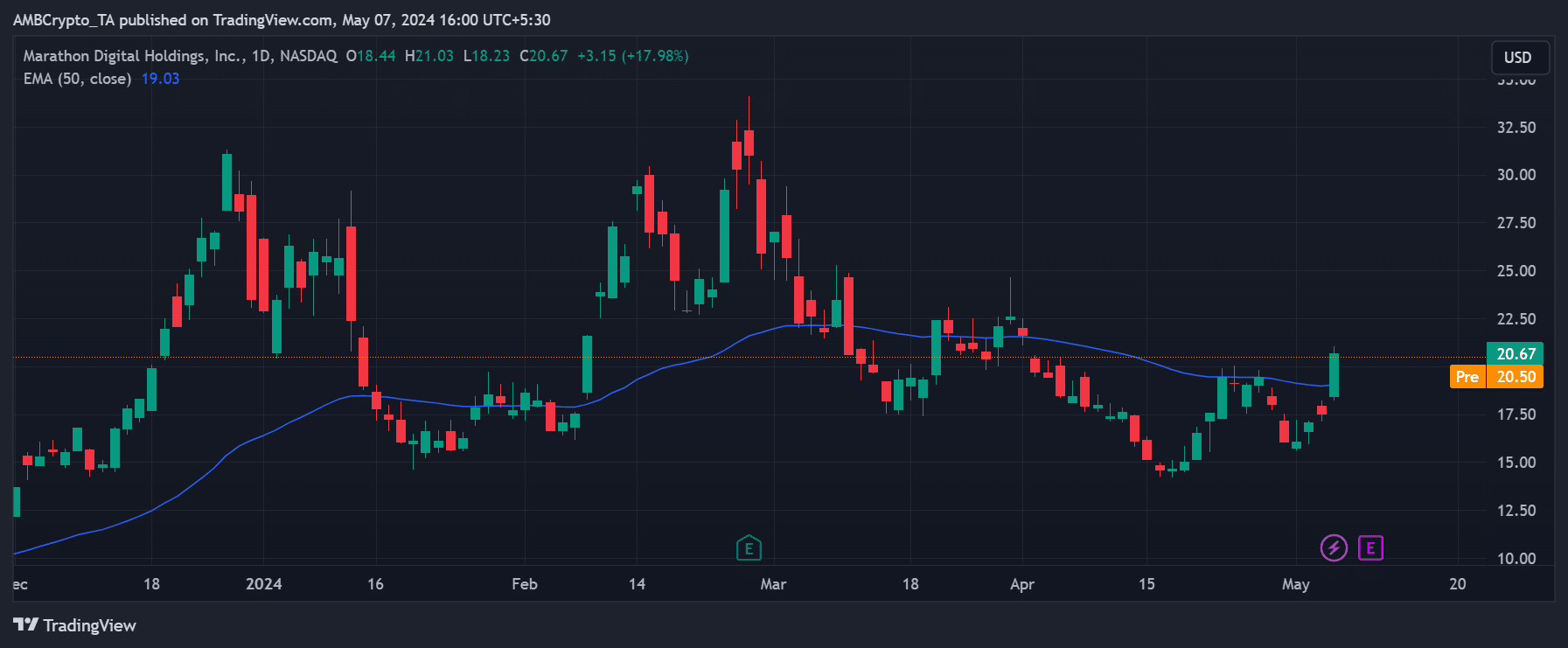

Marathon Digital’s stock (MARA) rallied and reversed its April losses after its latest listing.

- Marathon Digital’s MARA surged 17.98% on Monday after its listing on the S&P SmallCap 600 index

- Company set to release its quarterly earnings report on 9 May

Bitcoin’s [BTC] largest miner by market cap, Marathon Digital, saw its shares (MARA) hike by 17.98% during Monday’s trading session. By hiking as it did, MARA marked an extended recovery, pushing it closer to $20 as it effectively reversed over 90% of its losses in April.

Bitcoin miner joins S&P 600

The massive single-day jump followed the S&P Global listing last Friday. Marathon Digital was included in the S&P 600, an index that tracks the smallest traded public U.S companies based on market cap.

The development happened last Friday after market hours, but was only priced on Monday, as underlined by the aforementioned jump. The S&P 600, also known as the S&P SmallCap 600, requires a market cap of $1 billion—$6.7 billion for listing. Additionally, firms have to record positive profits for the last four quarters.

After Monday’s rally, MARA had a market cap of $5.64 billion. With a Q1 earnings report scheduled for 9 May, staying on the index will depend on future quarterly earnings.

Despite the Monday jump and overall recovery in May, however, MARA’s YTD (year-to-date) performance was down 9.86% at press time. In fact, the YTD performance across most miners’ stocks, like Riot Platforms and Hut 8, have fallen by double-digits.

Apart from mining rewards, which dropped by half after the halving, transaction fees have become a key revenue stream for Bitcoin miners.

However, the enlisting of MARA on the S&P 600 marks another relevant chapter for Bitcoin-linked publicly traded companies. It will increase the visibility of Marathon Digital and the potential to attract more investment in the mining ecosystem.

However, BTC closed in the red during MARA’s Monday rally. Ergo, it will be interesting to see how BTC reacts to Marathon Digital’s quarterly earnings report on 9 May.