Bitcoin miner capitulation & outflows – What they mean for BTC’s price

- The Bitcoin miner capitulation could ease the selling pressure on Bitcoin from miners.

- Metrics supported the idea that Bitcoin prices would have a bullish trajectory in the coming weeks.

Bitcoin [BTC] miner capitulation was gathering strength and was comparable to 2022 December.

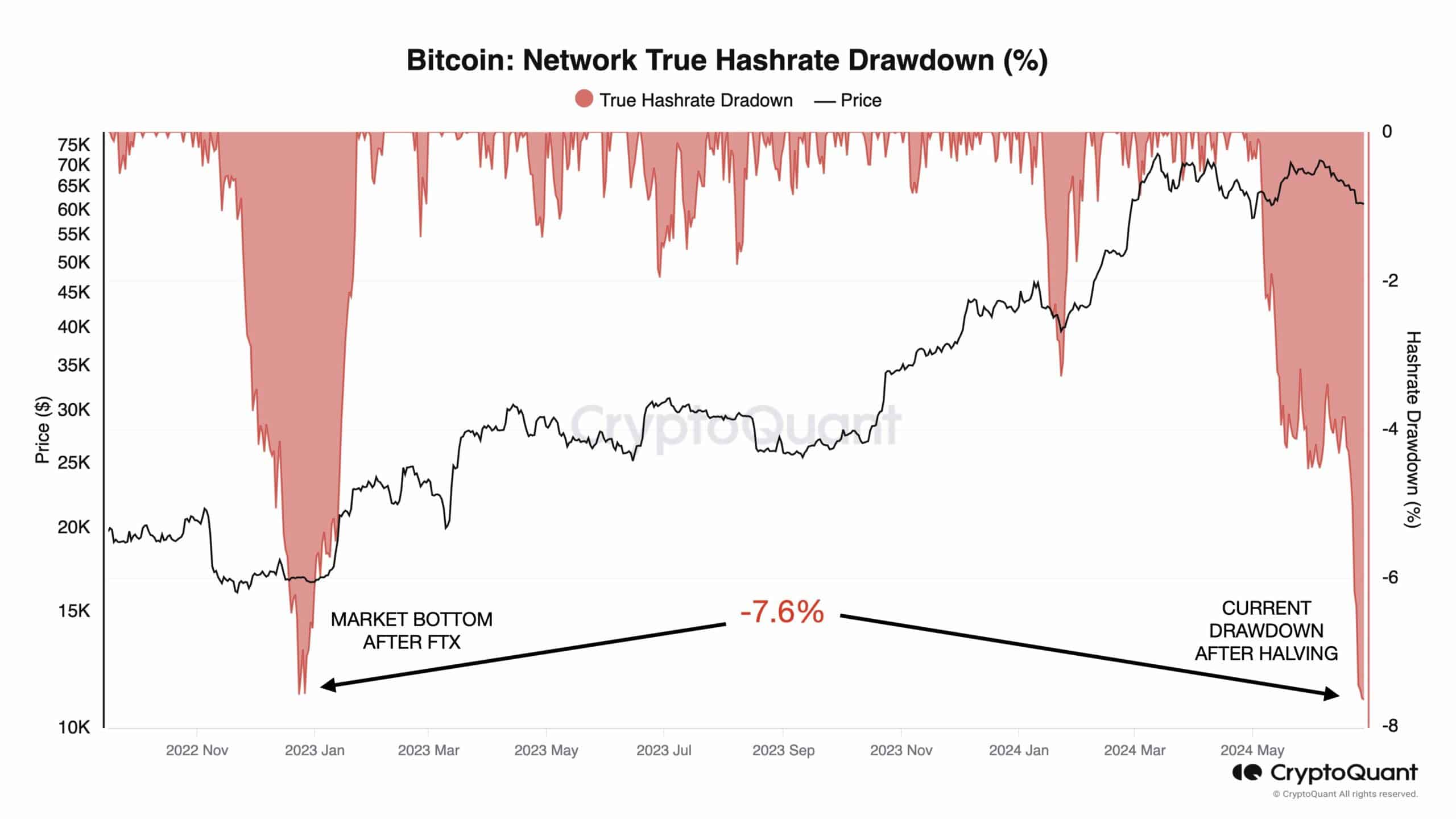

Julio Moreno, head of research at CryptoQuant, noted in a post on X (formerly Twitter) that the hash rate drawdown was at 7.6%.

It must be noted that prices are not down directly as a result of this hash rate plunge.

Rather, the effects of the halving and the market sentiment, as well as the miner cash requirements to upgrade their equipment and remain competitive, are some factors that saw Bitcoin falter from $71k to $60k in June.

The Bitcoin miner capitulation might be good news

Source: Julio Moreno on X

The concept of Bitcoin miner capitulation is tied closely to the hash rate of the Bitcoin network. The hash rate refers to the computational power of BTC miners, and it stood at 537.15 EH/s at press time.

The hash rate drawdown chart reflected a 7.6% drop, which was comparable to the drop that came after the FTX exchange collapsed in November 2022 and market sentiment tanked further in December 2022.

Source: CryptoQuant

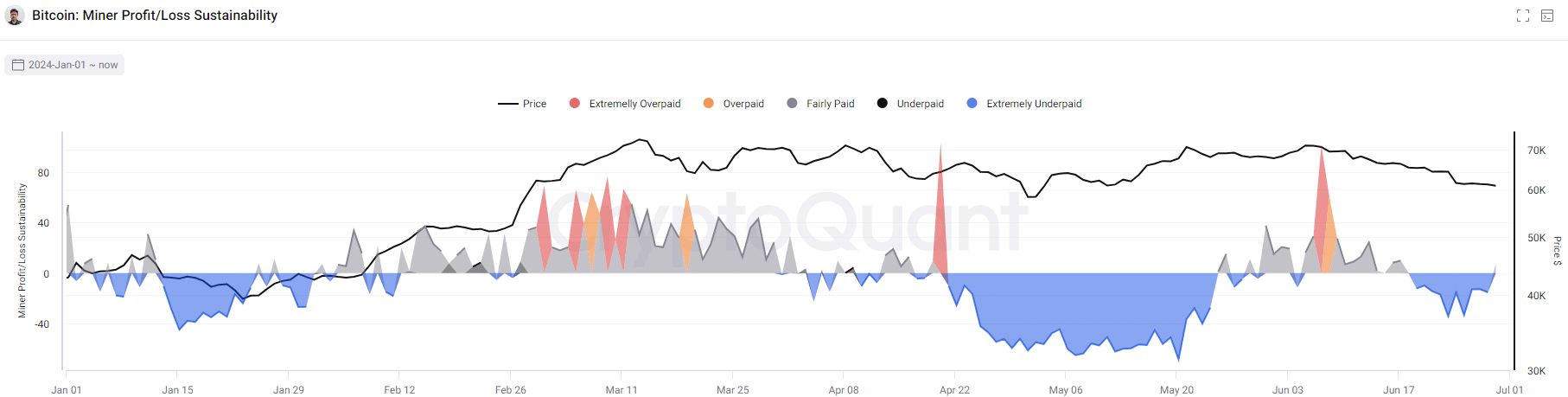

A look at the miner profit/loss sustainability chart showed that miners were extremely overpaid in early June.

Two weeks later, they were extremely underpaid, as Bitcoin prices had dropped by 16.2% in that window.

At press time, the sustainability metric was crossing over from extremely underpaid to fairly paid.

This metric’s movement into underpaid territory does not immediately imply a local bottom, but it outlines that miners might choose to wait for better prices before selling.

How heavy are the miner outflows in recent weeks?

Source: CryptoQuant

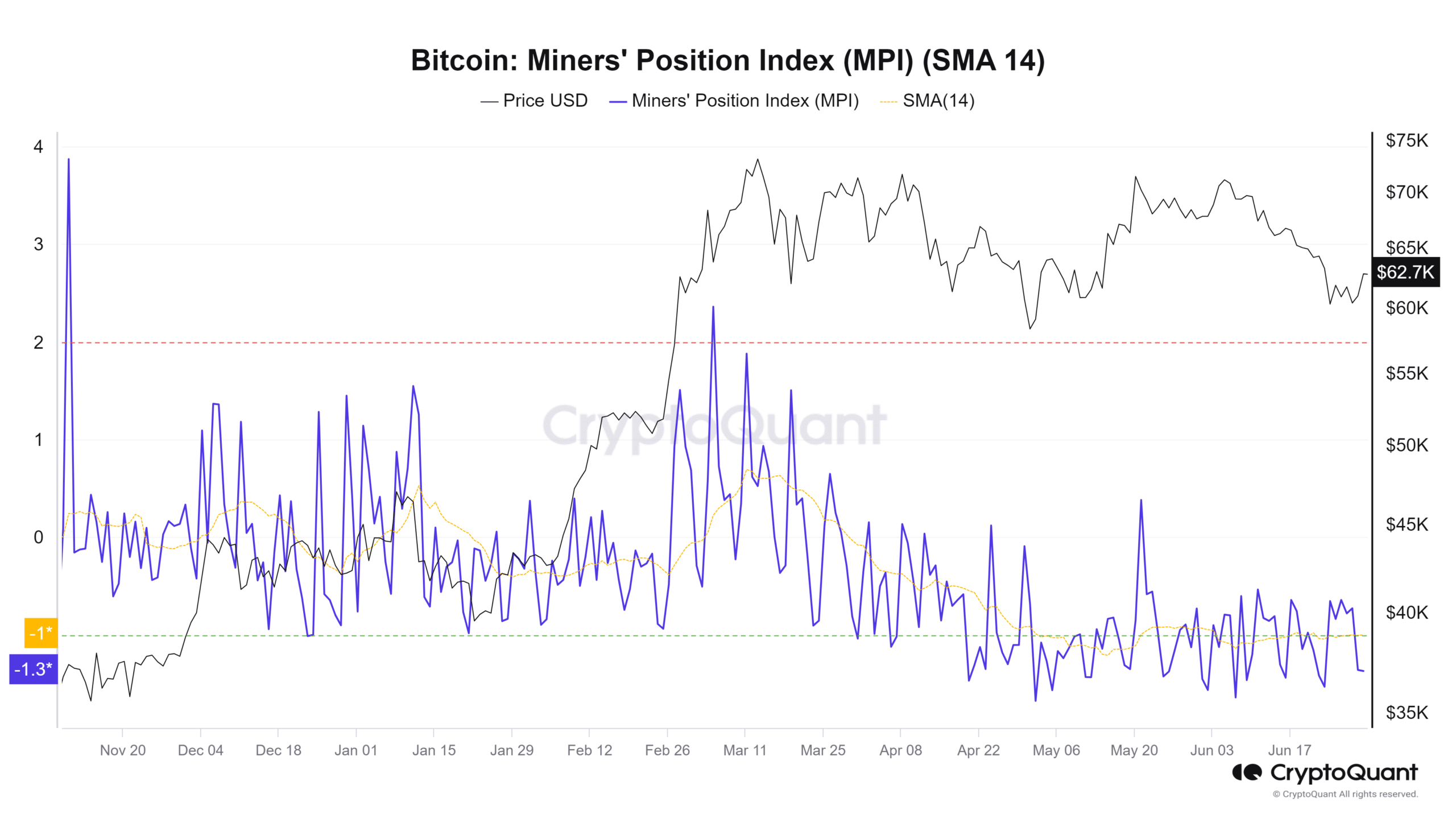

The Miners’ Position Index uses the 365-day moving average of the miners’ USD outflows alongside current outflows to compute a ratio.

The ratio’s trend reveals miner behavior, and whether they are sending more or less Bitcoin to exchanges.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The data showed that miner outflows were large in February and March, fell slightly in April and May, and were quite subdued in June. This means that miners are sending fewer coins than usual to exchanges.

Overall, the hash rate drop reinforces the idea of miner capitulation. The MPI findings show that miners have been liquidating fewer Bitcoin than usual, which was also a bullish sign in the long-term.