Bitcoin miner reserve drops to 1.81M BTC: What’s happening?

- Bitcoin Miner Reserve drops to year-to-date low.

- This suggests an uptick in miner coin sell-offs.

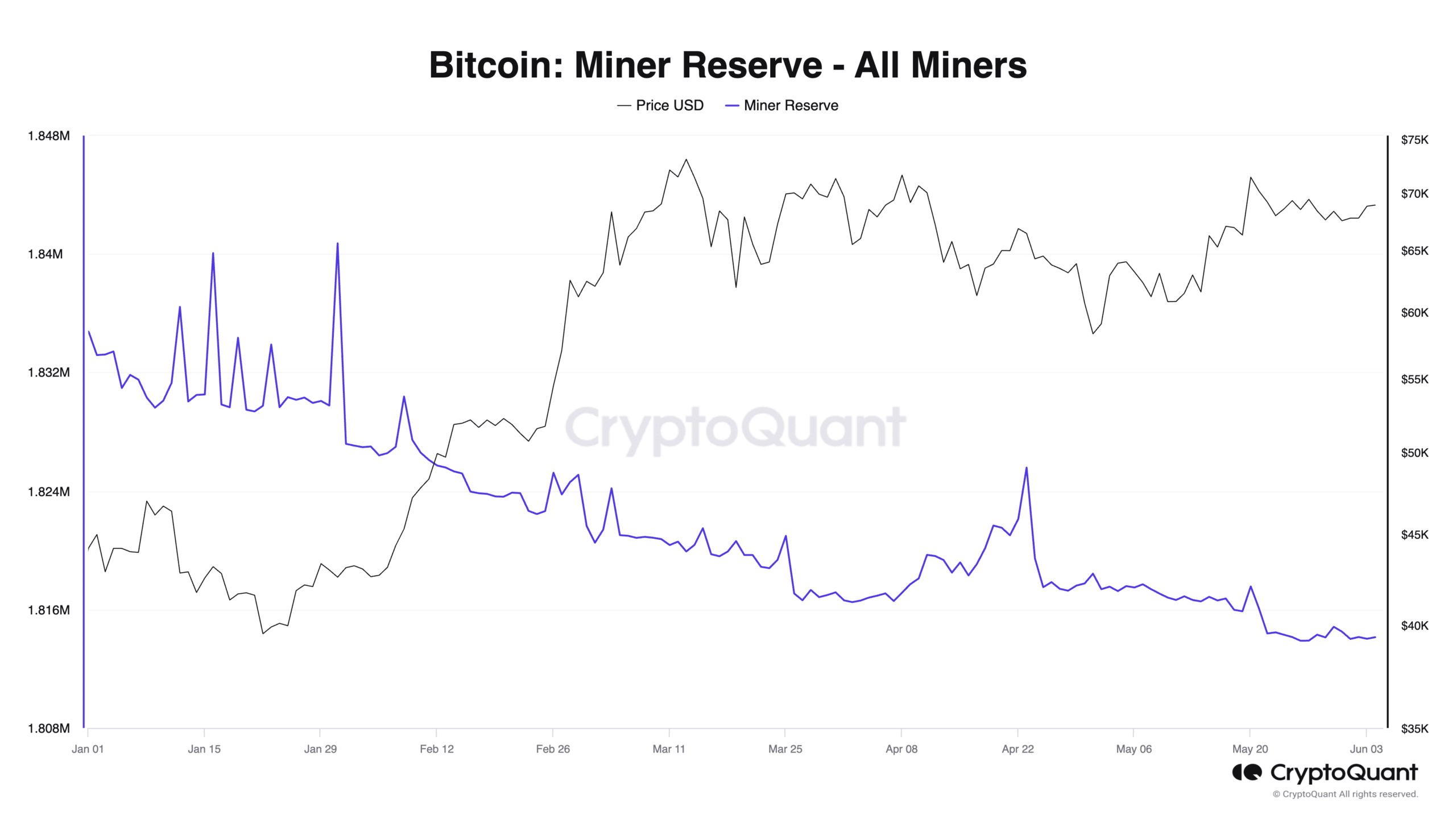

Bitcoin [BTC] Miner Reserve has fallen to its lowest level since the beginning of the year, data from CryptoQuant has shown.

This metric measures the amount of coins held in affiliated miners’ wallets. Its value indicates the reserve that miners have yet to sell. At press time, 1.81 million BTC valued at $125 billion at current market prices were held across miner wallets.

When BTC Miner Reserve declines, it suggests that miners on the Bitcoin network are distributing their coins for profit or to sort mining costs.

Data from CryptoQuant showed that after an extended period of decline, BTC Miner Reserve initiated an uptrend on 8th April, as the market awaited the fourth Bitcoin halving scheduled for 19th April.

After the halving event, the metric rose briefly to peak at 1.82 million BTC on 23rd April, after which it re-commenced its downtrend. Since then, the amount of BTC miners held has declined by 1%.

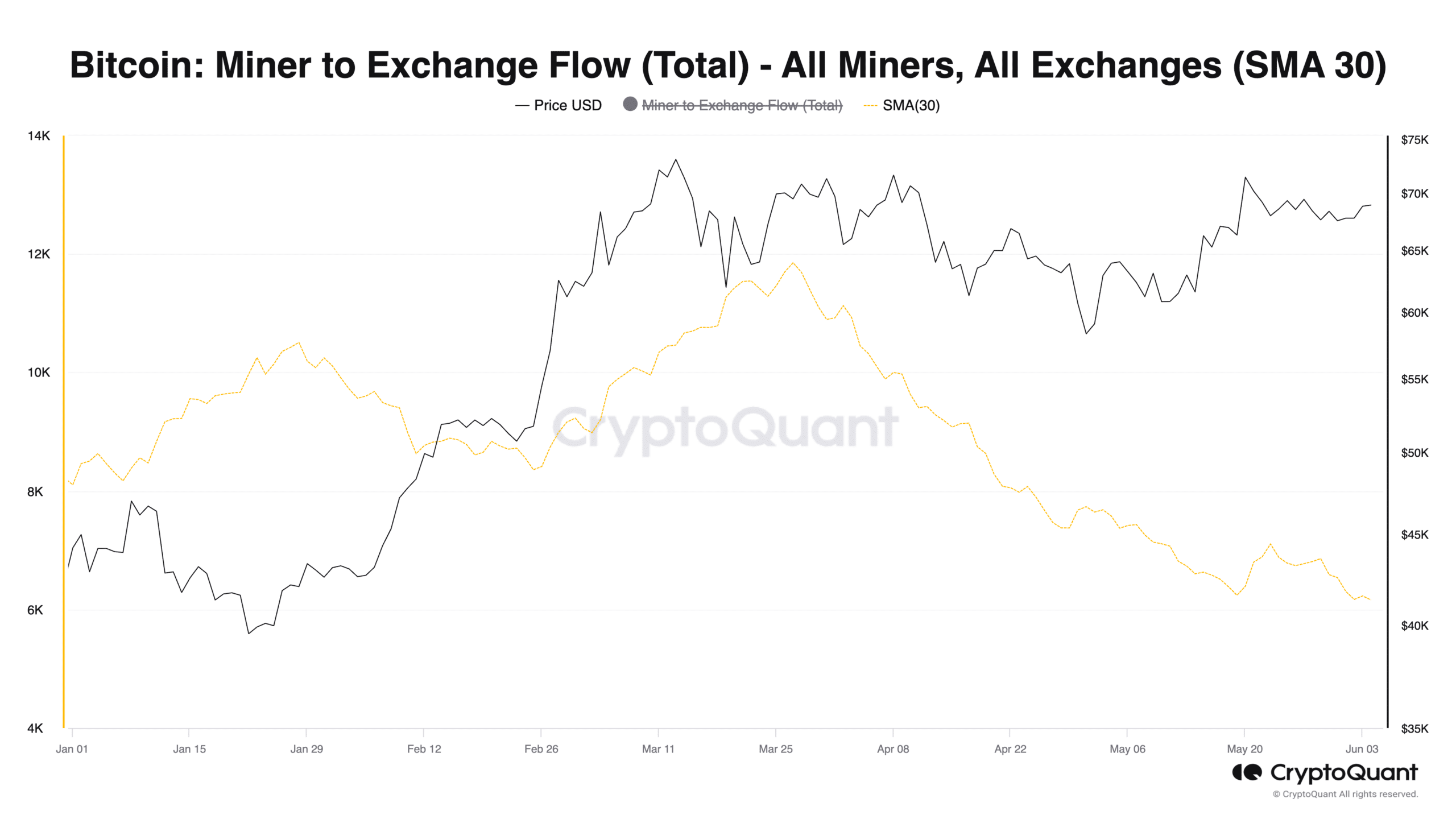

Interestingly, there has been a decline in miner-to-exchange activity in the past three months.

Per CryptoQuant’s data, the flow of BTC from miners’ wallets to exchanges assessed (using a 30-day moving average )has declined by 48% since its year-to-date (YTD) high of 11,853 BTC recorded on 27th March.

This, however, does not mean that miners have not been selling their coins. They may have been selling their BTCs through Over-the-Counter (OTC) markets instead of directly to exchanges.

They might also be engaging in Peer-to-Peer sales, where they sell directly to buyers without using exchanges.

Bitcoin bulls and bears slug it out

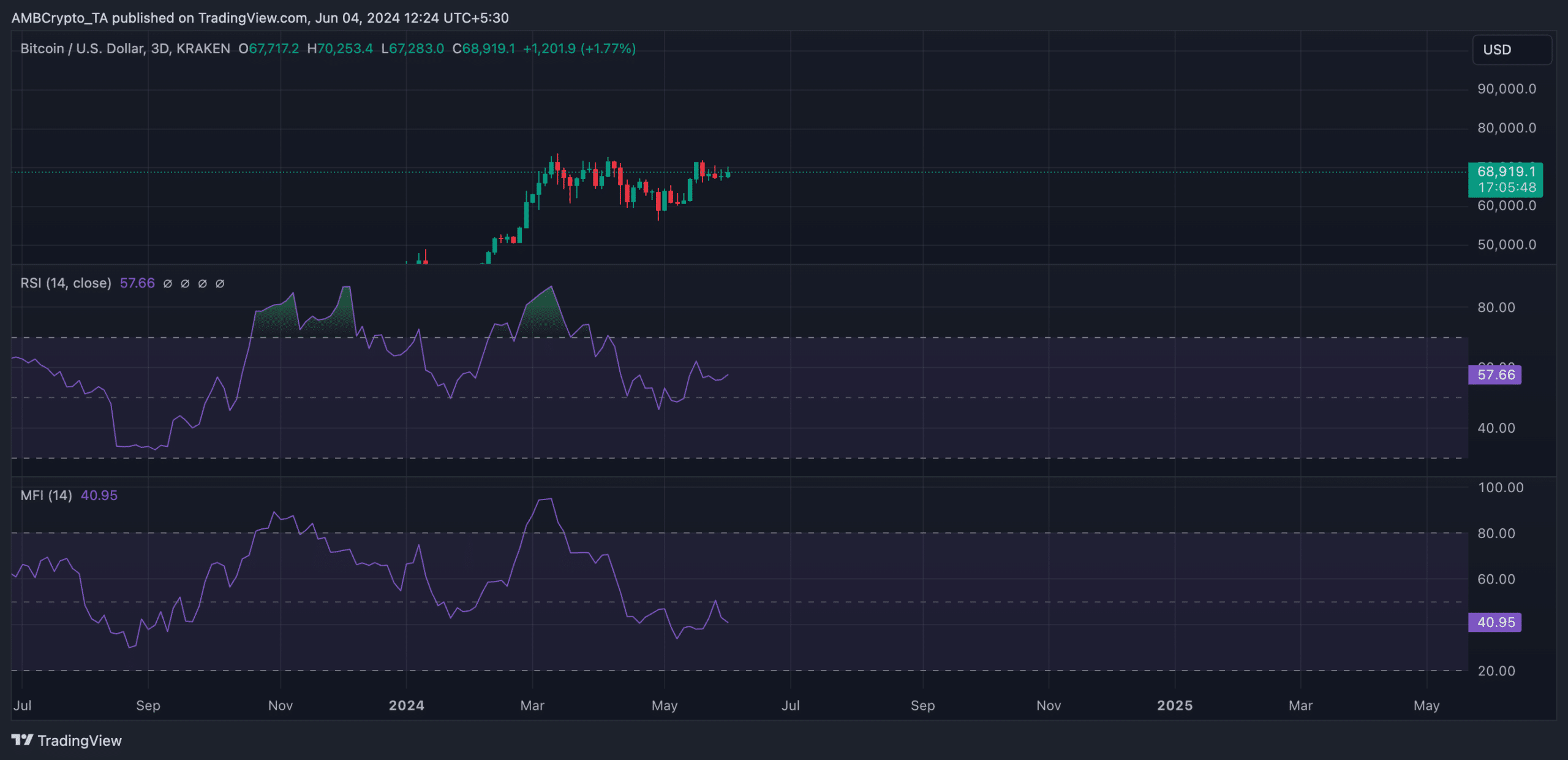

According to CoinMarketCap data, BTC exchanged hands at $68,988 at press time. The leading crypto asset has continued to face significant resistance at the $70,000 price level.

Assessed on a three-day chart, the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) were 57.72 and 40.95, respectively.

Is your portfolio green? Check the Bitcoin Profit Calculator

A combined reading of the values of these key momentum indicators suggested that while the market witnessed a rise in buying momentum, there was also notable selling activity in the market.

For BTC’s price to rally past $70,000, buying pressure has to increase and surpass profit-taking activity.