Bitcoin miners’ $69 million payout: Boom before April halving?

- The jump in hash rate came in response to mining difficulty hitting an ATH.

- Revenue raked in by miners on the 11th of April was close to $69 million, up 70% YOY.

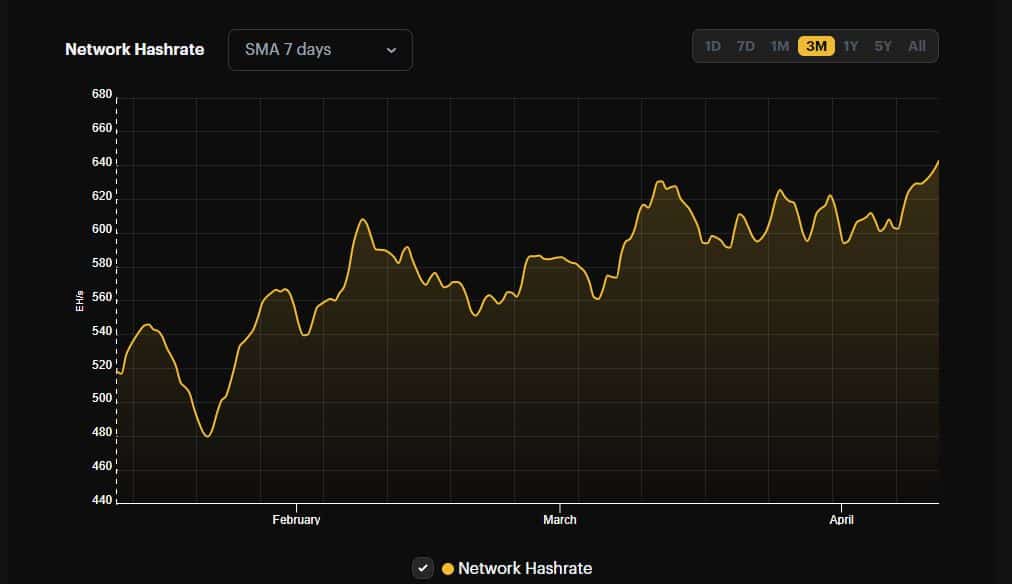

Bitcoin’s [BTC] hashrate bumped to a new all-time high (ATH) on 11th April as miners pressed their machines into full strength to boost revenues ahead of the halving.

The 7-day moving average of hash rate, used for measuring the total computational power invested by miners, hit 642 exahashes per second (EH/s) on 11th April, according to Hashrate Index, representing a 5% increase over the week.

Miners finding it tough to mine blocks

The increase in hash rate came as a likely response to the latest adjustment which pushed Bitcoin’s mining difficulty to its ATH of 86.39 trillion.

Bitcoin’s mining difficulty reflects how tough it is for miners to find the next Bitcoin block in the chain. It is adjusted every 2.016 blocks, or roughly two weeks, to ensure block production time remains at 10 minutes. The higher the difficulty, the harder it is to find a block, and hence, more hash rate need to be dedicated.

This was the last adjustment before the pivotal halving event, scheduled tentatively for 2oth April, which would slash mining rewards by half. In an industry with thinning profit margins, such occurrences end up exerting considerable financial stress to the participants.

What to expect post halving?

Hashrate Index had earlier estimated that halving would result in a 3.7% drop in hash rate, conservative when compared to Galaxy Digital’s estimate of a 15-20% decline.

Typically, smaller players with less capital to afford efficient mining equipment could be the first to capitulate.

Is your portfolio green? Check out the BTC Profit Calculator

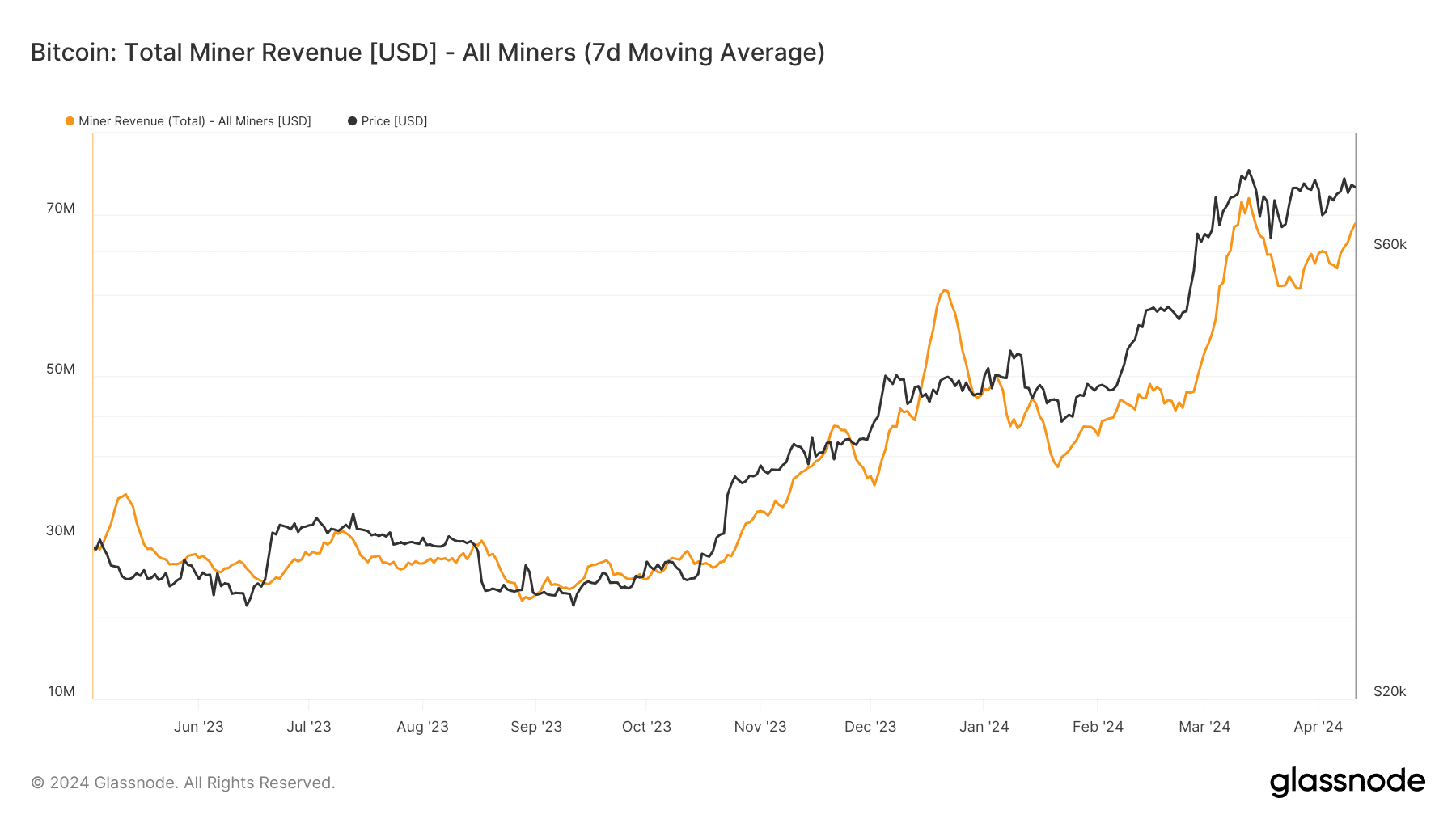

After struggling during the bear market, miners’ earnings rose considerably since BTC started rising in value in October 2023.

The total revenue raked in by miners on the 11th of April was close to $69 million, as per AMBCrypto’s analysis of Glassnode’s data, 70% higher than same time last year.