Bitcoin

Bitcoin miners cash in as network fees surge by 38%

Bitcoin sell-offs amongst miners jumped briefly during the week. This was due to a surge in network transaction fees.

- The transaction fees paid to use the Bitcoin network increased by double digits.

- This has been due to a spike in daily inscriptions on the network.

Bitcoin’s [BTC] network fees climbed by 38% in the last week, reaching an average of $0.000086 per transaction, data tracked by IntoThe Block revealed.

Bitcoin network fees climbed by 38% this week as Ordinals inscriptions reached their second highest daily amount pic.twitter.com/rjQ7aYLNSU

— IntoTheBlock (@intotheblock) September 8, 2023

How much are 1,10,100 BTCs worth today?

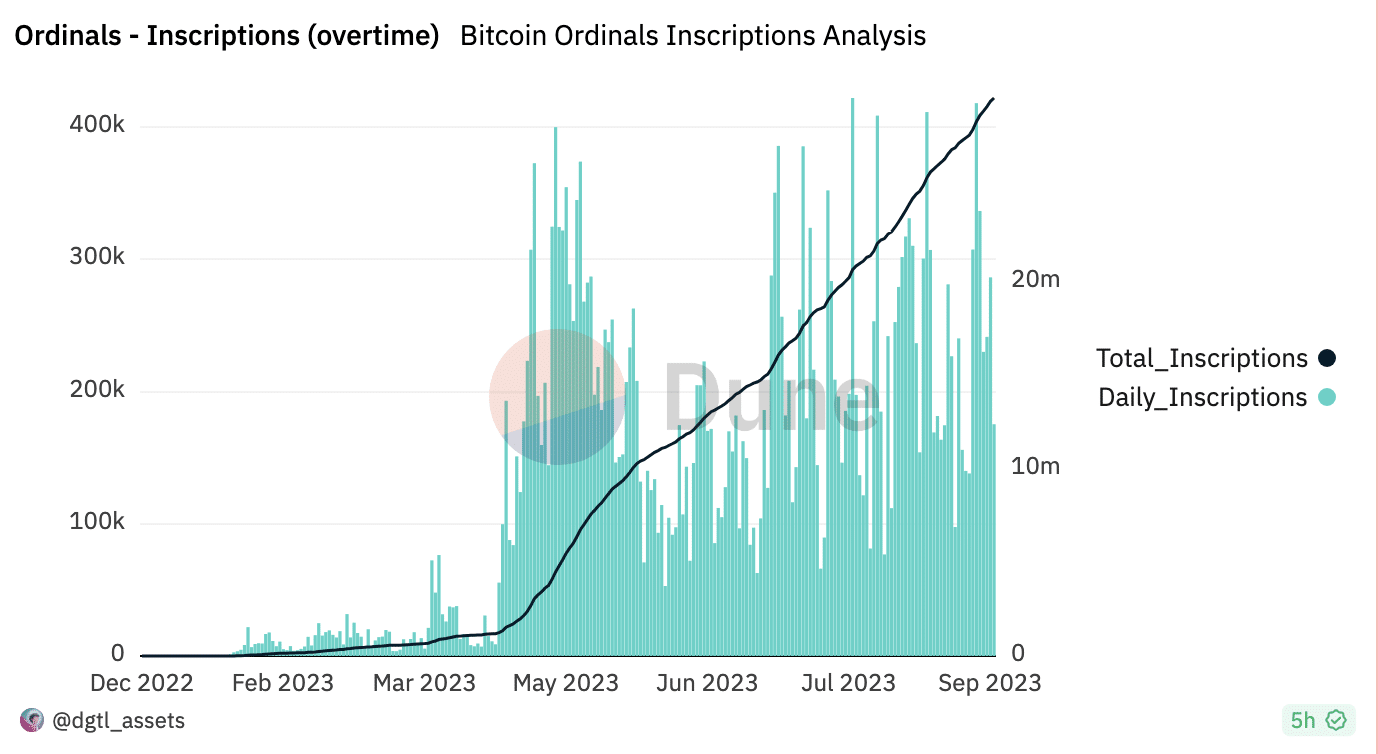

The jump in network fees has been attributed to a resurgence in the activity of Ordinals Inscriptions. Data from Dune Analytics revealed that the month so far has been marked by an uptick in inscriptions on the Bitcoin network.

On 3 September, these inscriptions recorded their second-highest daily amount of 418,000.

While text inscriptions tapered around 150,000 as of 8 September, daily inscriptions count was still pegged at highs last observed in August.

Bitcoin miners reacted briefly

As network fees rallied due to a surge in network activity on 3 September, miners increasingly let go of some of their BTC holdings between 4 and 5 September.

An assessment of BTC’s Miner to Exchange Flow revealed a 364% uptick in this metric between when daily inscriptions climbed to their second-highest amount and the two days that followed.

The Miner to Exchange Flow metric measures the amount of BTC that is flowing from miners to exchanges. When this metric rallies, miners sell more BTC than they are mining.

For context, as of 3 September, BTC’s Miner to Exchange Flow was 81.57 coins. By 5 September, this had jumped to 376.78 BTC, according to data from CryptoQuant.

Further, BTC’s Miner Reserve – which measures the amount of coins held in affiliated miners’ wallets, confirmed coin exits from miners’ wallets within the period under review.

Between 3 and 5 September, this metric trended downward, suggesting miners rallied to book profits when network fees spiked.

At press time, BTC’s Miner Reserve held 1.84 million BTC, data from CryptoQuant showed.

Daily demand is up, but price continues to say no

While BTC’s price lingers in a tight price range, new demand for the leading coin appears to have returned.

Assessed on a seven-day moving average, data from Glassnode revealed that the daily count of new addresses created to trade BTC has oscillated between 450,000 and 530,000. As of 8 September, BTC saw a total of 527,908 new addresses that completed transactions involving the king coin.

A surge in new demand for an asset suggests renewed interest in the asset and is often a precursor to a price jump. While BTC continued to face the $26,000 price mark at press time, its Chaikin Money Flow (CMF) embarked on an uptrend, as it was positioned above the center line.

An asset’s CMF measures the flow of money into and out of that asset. When this indicator rises, it suggests that money is flowing into the asset. Conversely, a falling CMF indicates that money is flowing out of the asset.

Read Bitcoin’s [BTC] Price Prediction 2023-24

When CMF spikes while the price oscillates in a narrow range, it suggests that although increased liquidity flows into an asset, the market sentiment is not positive enough to drive up the asset’s value.

It remains key to note that a spiking CMF in a narrow price range is a sign that there is a lot of volatility in the market, and it can be a good time to trade.