Bitcoin

Bitcoin miners face uncertain future as block space declines

Bitcoin miners grapple with block space demand’s twist amid thrilling highs and unexpected lows. Fees slide, leaving miners on an adventurous revenue ride.

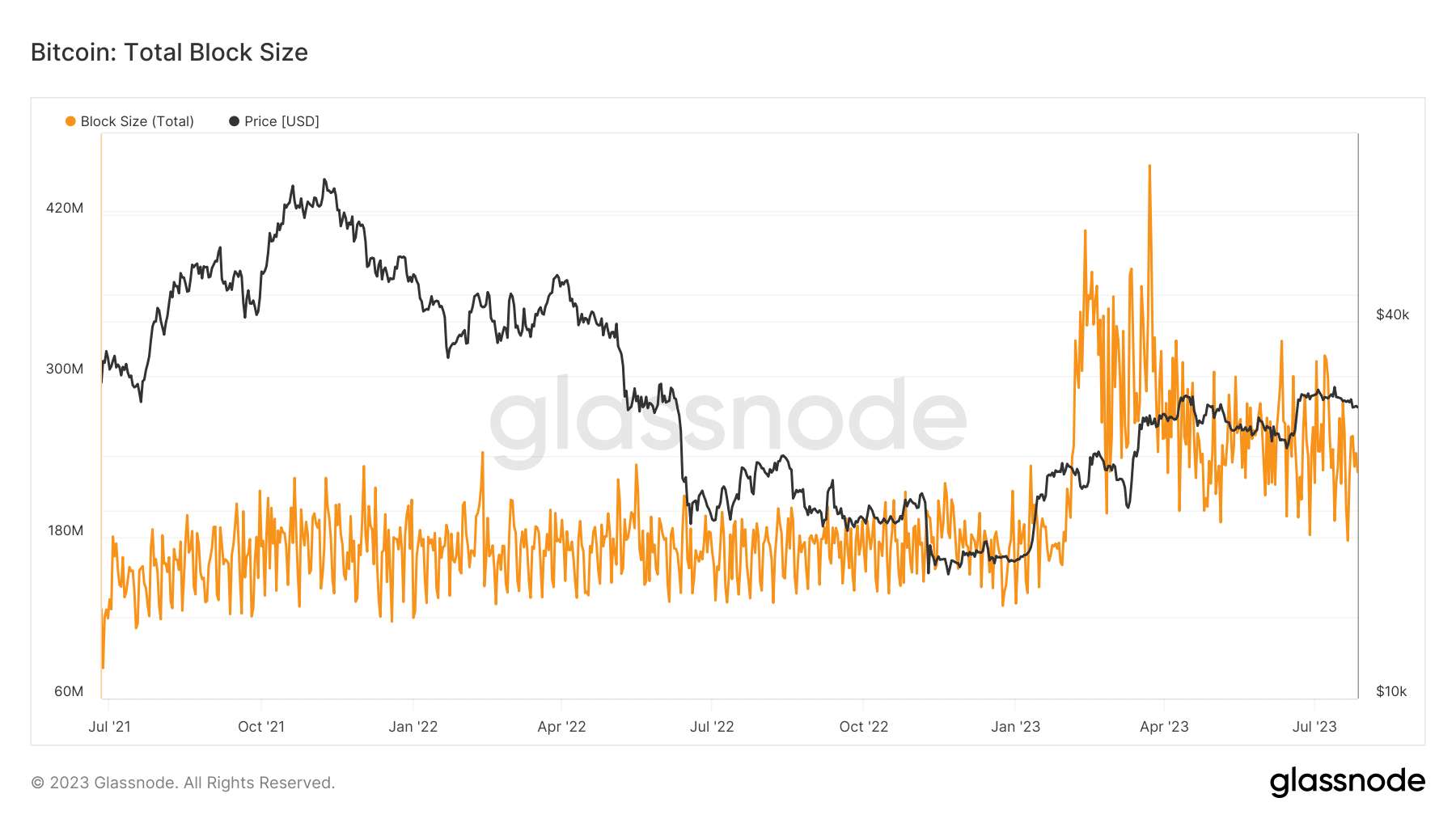

- Bitcoin block space recently dropped to around 200 million.

- Bitcoin miner revenue also declined to around 2%.

Bitcoin [BTC] miners have encountered a whirlwind of events that shaped their fees throughout the year. But amidst this turbulent journey, recent data revealed a fascinating twist: the demand for block space has dropped over the past few weeks, causing a significant impact on miners’ hard-earned revenue.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin blocks and miner revenue slides

Looking at the Bitcoin block size chart on Glassnode, a remarkable surge in size took place back in February. The block size surged from a modest 190 million to an impressive range of 300–400 million. However, this was short-lived as a decline soon followed, settling at an average of 250 million. Another downturn could still be observed, with the block size hovering around 220 million.

Coinciding with this ebb and flow, a crucial on-chain metric experienced a similar trajectory. While miner revenue initially didn’t respond dramatically to the increase in block size, it experienced a thrilling surge around May, shooting up to over 42%.

Yet, as the ride tends to go, a gradual decline set in afterward, and as of this writing, the fee had dwindled to approximately 2.3%.

These intriguing movements in metrics indicated that while they may not always synchronize perfectly, block space utilization undeniably impacted the revenue earned by Bitcoin miners. It’s a delicate dance of interplay between block size and miner income, where each twist and turn could lead to unexpected results.

A possible reason for block size reduction

Bitcoin Ordinals has emerged as a game-changer for NFTs on the Bitcoin network, leaving a lasting impact on NFT enthusiasts and miners alike. Introducing inscriptions brought about a significant shift, increasing the block size mined by miners.

As a direct consequence of this larger block size, fees experienced a noteworthy uptick.

According to the data from Dune Analytics, the total number of inscriptions to date has surpassed an impressive 19 million, bringing in substantial inscription fees that have reached an astounding $54 million.

However, the fees declined, with daily inscription fees dropping to less than 1 BTC. Nonetheless, there were moments of exuberance, like the thrilling ascent in May when daily fees surged to over 20 BTC and even spiked to an incredible 250 BTC

.As the buzz around inscriptions gradually subsided, it had a noticeable impact on block space and miner fees. It caused them to decrease in tandem.

While the initial excitement sparked impressive results, the subsequent reduction in inscription volume brought about a more subdued state for block space and miner earnings.

Is your portfolio green? Check out the Bitcoin Profit Calculator

State of fees on the network

According to data from Crypto Fees, Bitcoin fees have remained relatively stagnant in the past couple of months. After witnessing a sharp spike to over $17 million around May, fees have steadily declined.

As of this writing, Bitcoin fees have dipped significantly from the $1 million range and hovered around $550,000 at press time.