Bitcoin miners hold 9.1% of BTC supply – Will it trigger a supply shock?

- BTC miners have shown resilience, intensifying the chances at an incoming supply shock.

- However, the market bottom remained elusive, reducing the impact of their efforts.

Bitcoin [BTC] bulls showed strength over the weekend, recovering from a dip at $52K. With ongoing volatility in leveraged positions, the backing of large holders is becoming increasingly crucial.

Among these large holders are miners, who tend to either capitulate or HODL during extended periods of bearish sentiment.

Therefore, for a supply shock to take hold, AMBCrypto found that a few key factors must align. If these conditions are met, a potential price surge could follow as supply tightens in the market.

BTC miners support the crunch, while whales retreat

From an economic standpoint, a significant crunch in BTC supply could be a crucial catalyst for a price correction. For a supply crunch to materialize, miners must transition past the distribution phase.

In short, miners offloading less BTC means the supply shock could become more pronounced.

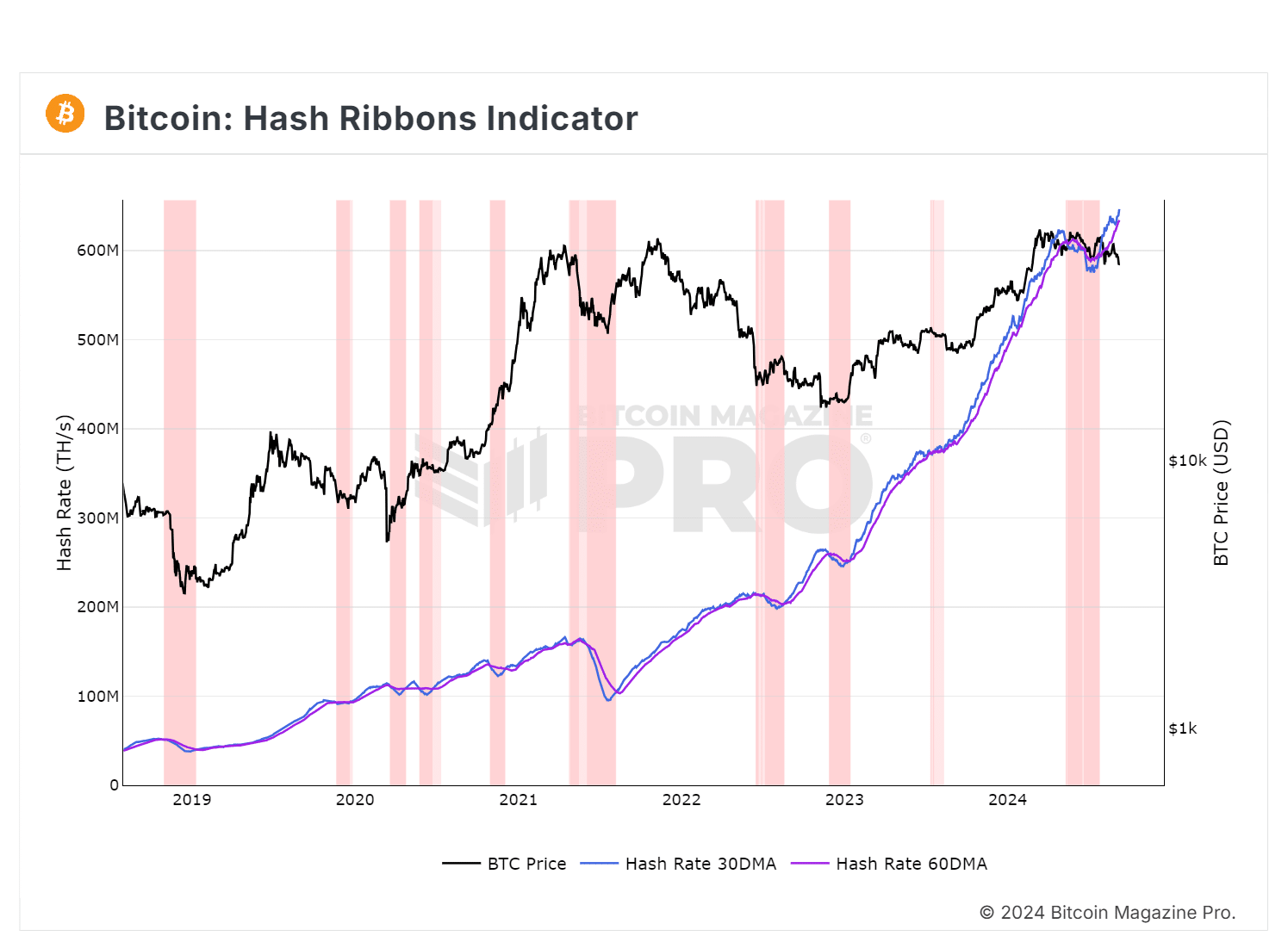

Interestingly, the chart below revealed that the 30-DMA has recently moved back above the 60-DMA, generating a hash ribbon buy signal.

This suggested a potential bullish trend, reinforcing the possibility of a price correction driven by miner accumulation.

As of now, the total circulating supply of BTC is 19.7 million. Miners hold 1.8 million BTC, representing approximately 9.1% of the total supply.

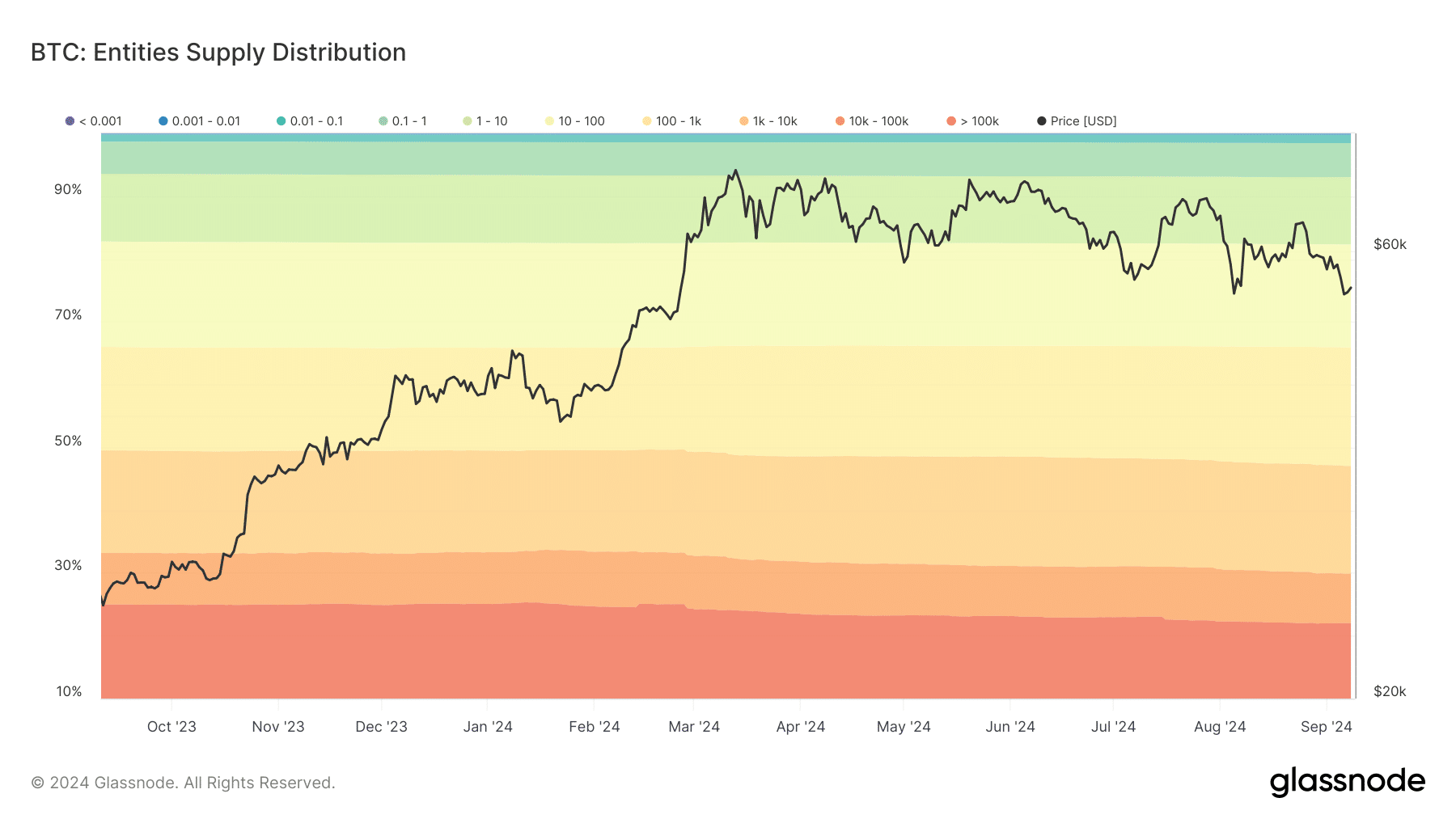

Meanwhile, the share of BTC held by whale cohort wallets has decreased from 24% when BTC tested the $73K ceiling, to 21.9% at press time.

According to AMBCrypto, this decline indicated a reduction in the concentration of large BTC holdings.

While miner reserves have remained resilient , these routine deposits by whales have lessened the likelihood of a supply shock. That being said, a turnaround is still possible if demand outweighs the selling pressure.

As BTC bulls maintain the price above the $51K support level, there remains potential for an outright reversal if buying pressure increases.

If this increased buying pressure sustains the supply crunch, a supply shock could indeed be achieved. The key will be whether demand continues to outpace the available supply.

The MVRV chart tells you..

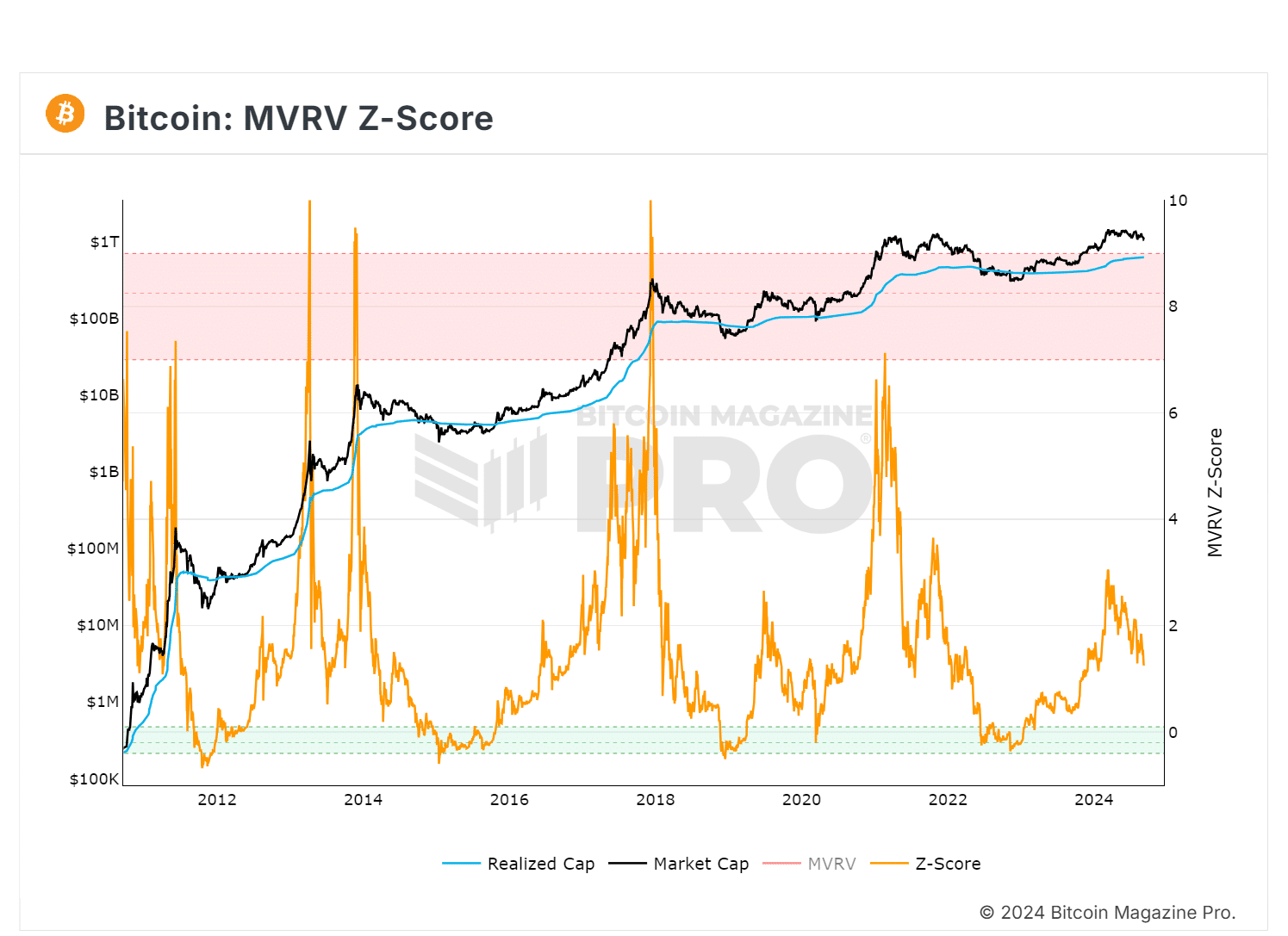

The MVRV Z-score has historically been very effective in identifying periods where market value is moving unusually high above realized value.

Interestingly, when the Z-Score (orange line) enters the pink box, it often signals the peak of a market cycle. Historically, this indicator has been able to pinpoint the market highs within about two weeks.

Conversely, when the Z-Score enters the green box, it indicates that BTC may be undervalued. Buying Bitcoin during these periods has historically produced outsized returns.

Therefore, an advanced trader will monitor for the market bottom to identify the optimal “buy the dip” opportunity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This is evidenced by the bull rally that typically follows each time the market reaches a price bottom.

Put simply, demand is unlikely to surpass supply unless the bottom zone is tested. In short, AMBCrypto notes that a reversal remains unlikely. Without sufficient holding evidence, the chances of a rebound diminish.