Bitcoin miners in crisis? Profits hit 2021 lows after halving!

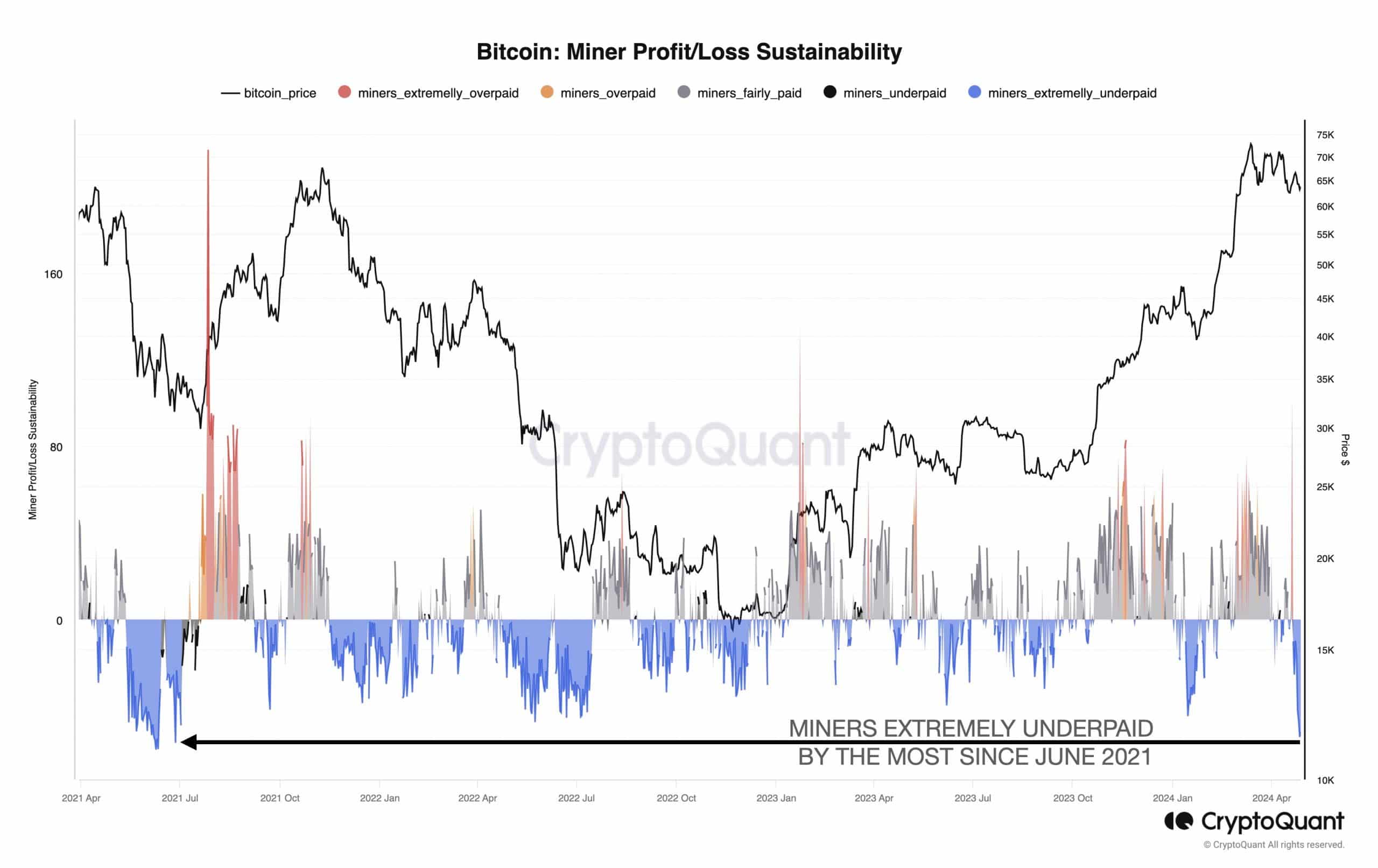

- Miner profit/loss sustainability sank to lows not seen since June 2021.

- Due to the dip in profitability, selling pressure from miners dipped further.

Bitcoin [BTC] miners’ earnings have been dealt a big blow since the halving earlier this month, creating pain for the industry critical for the smooth functioning of the world’s largest digital asset.

Miners face losses

In an X post dated 29th April, Julio Moreno, Head of Research at on-chain analytics firm CryptoQuant revealed that miner profit/loss sustainability has sunk to lows not seen since June 2021.

For the curious, the aforementioned metric measures the growth of block rewards – a critical revenue stream for miners – against the growth in mining difficulty, which is an indicator of their costs. The sharp dip indicated that miners were “extremely underpaid” at the time of writing.

Moreover, relative to the price of Bitcoin, daily miner revenues were significantly low, additional data showed.

The recent halving slashed the block rewards from 6.25 BTC to 3.125 BTC per block, leading to a situation where miners would have to double their mining investments just to break-even.

While large miners with deep pockets might find it easier to weather the storm, the small miners would eventually bow out.

Selling pressure dips

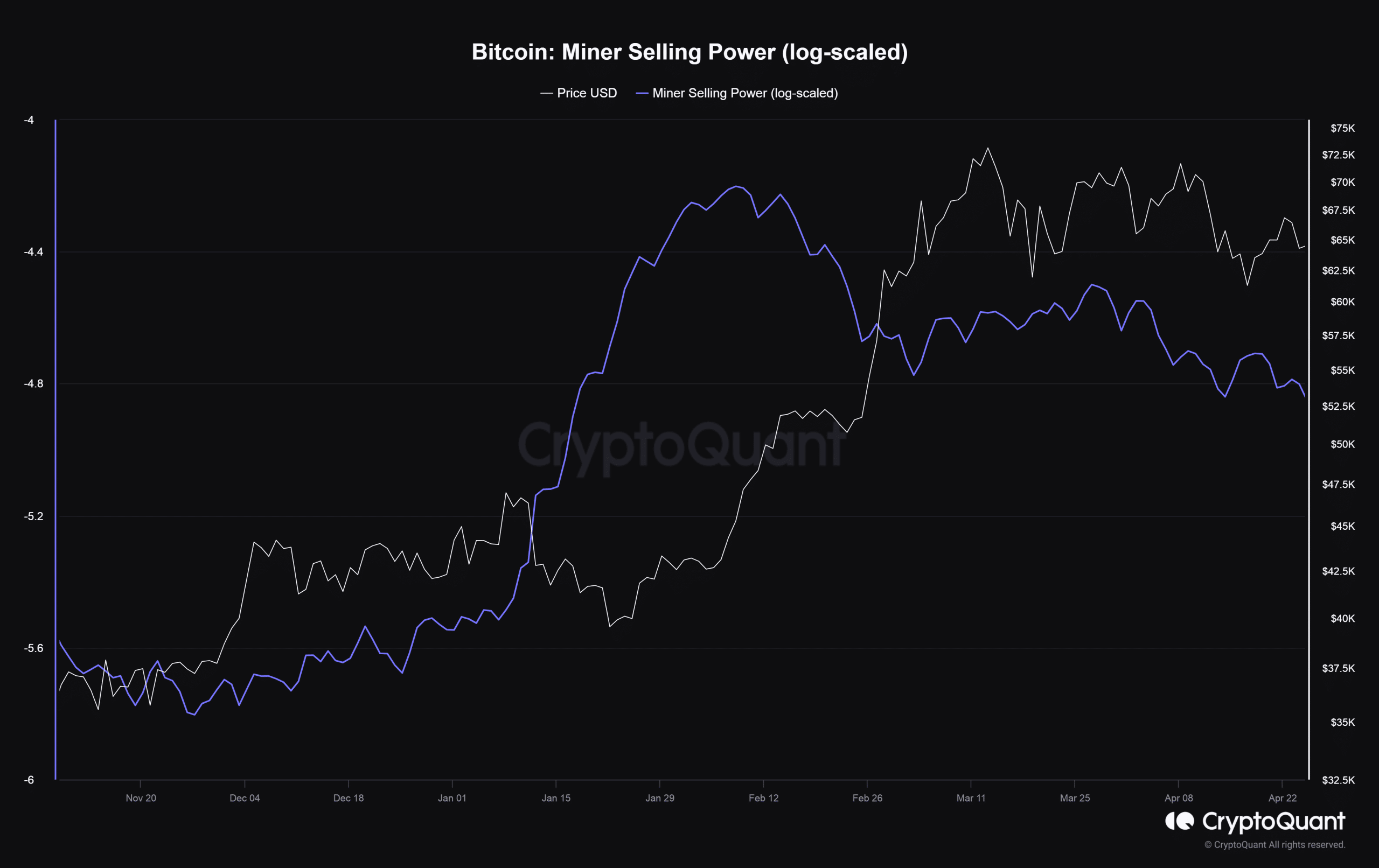

Due to the dip in profitability, most miners have resisted the urge to sell their Bitcoins and generate cash. As per AMBCrypto’s analysis of CryptoQuant data, the selling pressure from miners has dropped further since halving.

The reduced sell pressure was also apparent in the lower number of coins transferred to exchanges. Since the halving, 7-day moving average of miner to exchange flows tanked 70%.

Is your portfolio green? Check out the BTC Profit Calculator

Fees not coming to the rescue

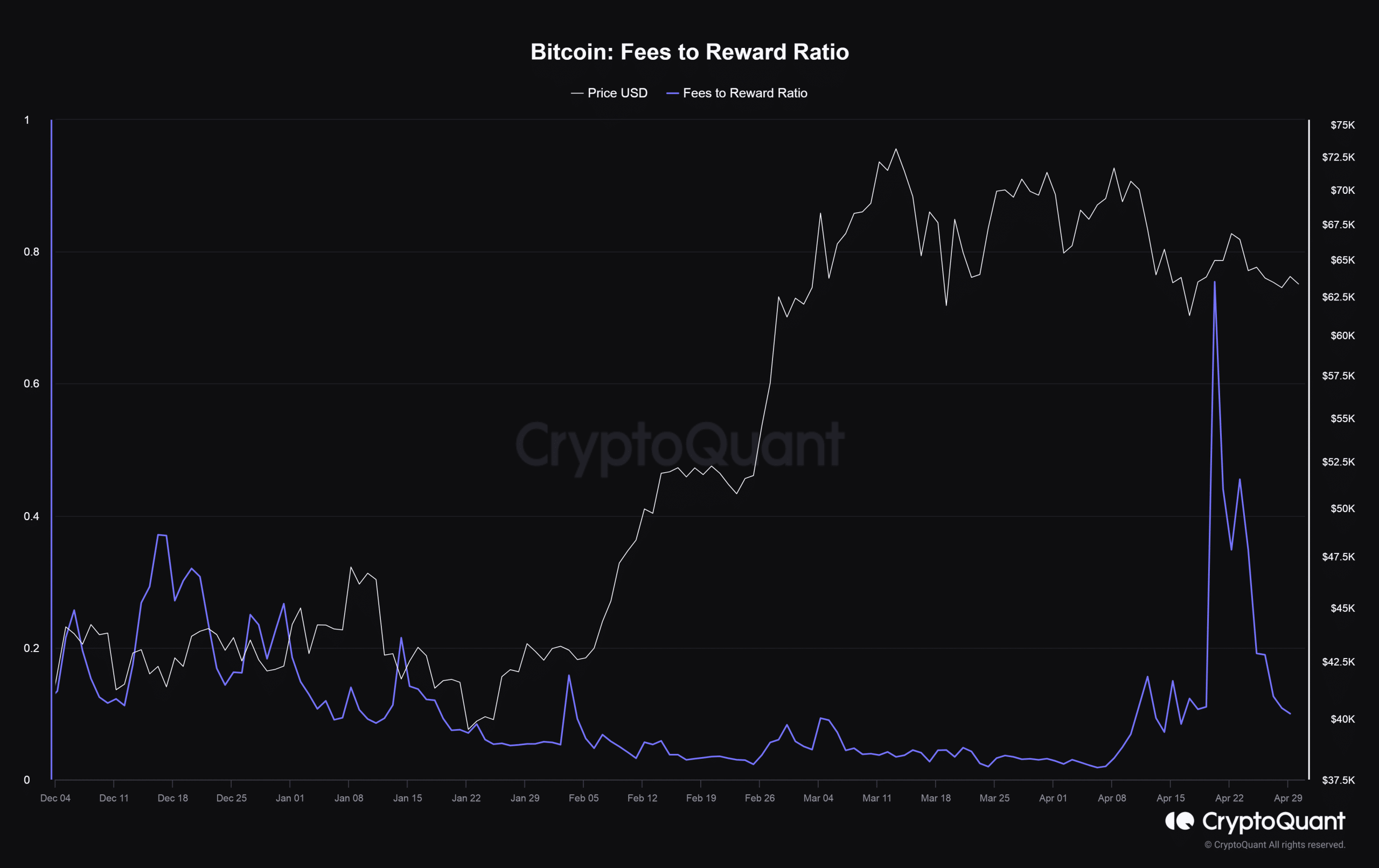

Miners were also hit by a sharp fall in transaction fees since the halving day frenzy.

The percentage of fee in total block rewards fell progressively from 75% on the 20th of April to 9% on the 29th of April.