Bitcoin miners jolted by U.S electricity prices: Here’s what’s going down

– Bitcoin miners could see some relief in 2023 as energy prices are expected to go down.

– Revenues continue to decline as miners are impacted by increasing difficulty and price corrections.

Over the last few days, Bitcoin [BTC] miners have been facing a lot of issues in terms of generating revenue, despite the growing prices of the king coin. With increasing difficulty and growing costs attached to mining, the amount of revenue generated by miners has dwindled significantly.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

However, things could work out positively for miners in the future. According to data provided by Hashrate Index, the U.S. Energy Information Association (EIA) is anticipating that electricity prices will decrease in 2023.

According to EIA’s short-term energy outlook, there will be a 1% reduction in electricity demand. This decrease in demand, along with an increase in power generation from renewable sources and lower prices for natural gas, may lead to a decline in electricity prices during the second and third quarters of this year as compared to the levels in 2022.

Coupled with the declining energy, the rising price of Bitcoin will affect miners too.

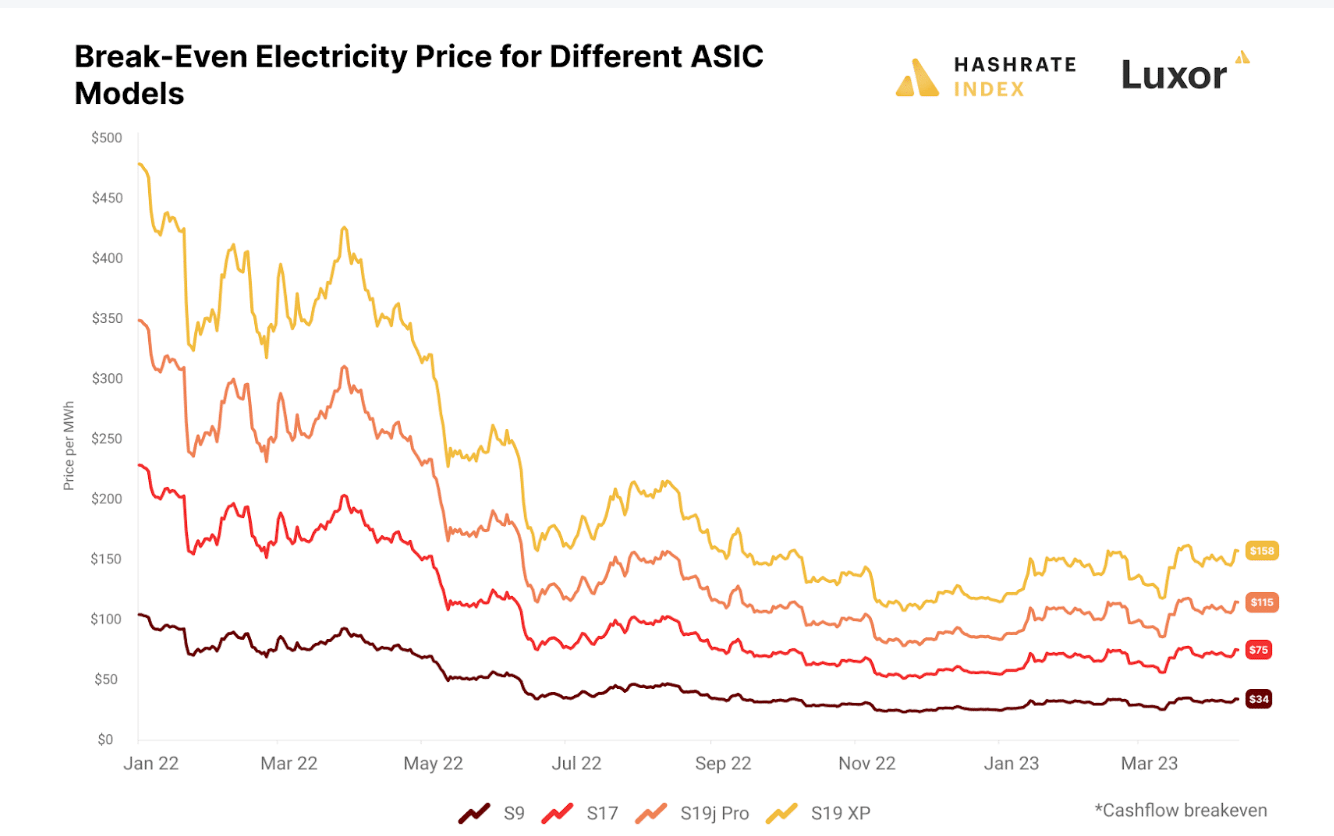

The year-to-date rise of over 80% in Bitcoin’s value has led to a 38% increase in the hash price, the cost of producing Bitcoin. This has resulted in an increase in the breakeven costs, referring to the expense of mining Bitcoin without suffering any financial losses.

Specifically, at the beginning of the year, the breakeven cost for an S19j Pro, a specific type of Bitcoin mining machine, was $80/MWh. However, by the end of March, the breakeven power costs had risen to $115/MWh, due to the surge in hash price.

Current state of Bitcoin miners

Despite the potential for improved conditions for miners in the future, their current situation appeared bleak at press time.

Is your portfolio green? Check out the Bitcoin Profit Calculator

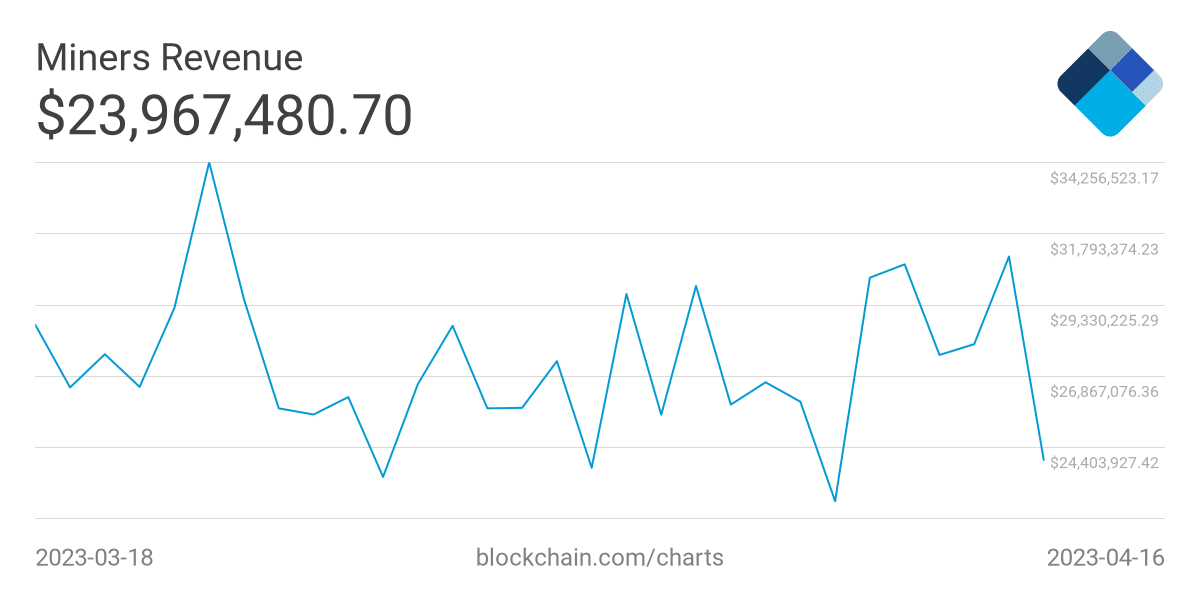

According to blockhain.com’s data, the revenue generated by miners declined severely over the past few days. One reason for the decline could be the increasing difficulty of Bitcoin and the recent fall in BTC’s prices.

Even though the miners were struggling, the Bitcoin network witnessed a surge in interest. Glassnode’s data indicated that the organic transaction activity on the network is approaching cycle highs. This suggests that despite the decline in prices, there is still a strong demand for Bitcoin and a significant level of activity on its network.

Organic #Bitcoin transaction activity is approaching cycle highs, with strong momentum, and over 270k Tx per day.

The #Bitcoin network is growing.

This chart uses Entity-Adjustment to filter out non-economical transactions such as internal shuffling, and exchange wallet… pic.twitter.com/aPXJlLlEbe

— glassnode (@glassnode) April 16, 2023