Bitcoin

Bitcoin miners rejoice as transaction fees rise

The portion of Bitcoin mining earnings derived from transaction fees has touched a new monthly peak, providing some relief for miners.

- Bitcoin’s transaction count rose dramatically in the last week.

- Rising congestion promoted users to bid up fees and jump the queue.

Amidst gloom in the broader market, Bitcoin [BTC] miners had something to cheer. As per an update by on-chain analytics firm Glassnode dated 7 September, the portion of miners’ earnings derived from transaction fees touched a new monthly peak of 2.842%.

? #Bitcoin $BTC Percent Miner Revenue from Fees (7d MA) just reached a 1-month high of 2.842%

Previous 1-month high of 2.837% was observed on 11 August 2023

View metric:https://t.co/NphJIZNcsL pic.twitter.com/AgerAmf5ar

— glassnode alerts (@glassnodealerts) September 7, 2023

Is your portfolio green? Check out the BTC Profit Calculator

Jump in transactions

As is well known, miners earn their revenue from two sources – a fixed number of newly minted BTC coins for each block mined, and the fees paid by users to get their transactions included in the block.

Clearly, there exists a direct correlation between miners’ earnings and Bitcoin network’s traffic.

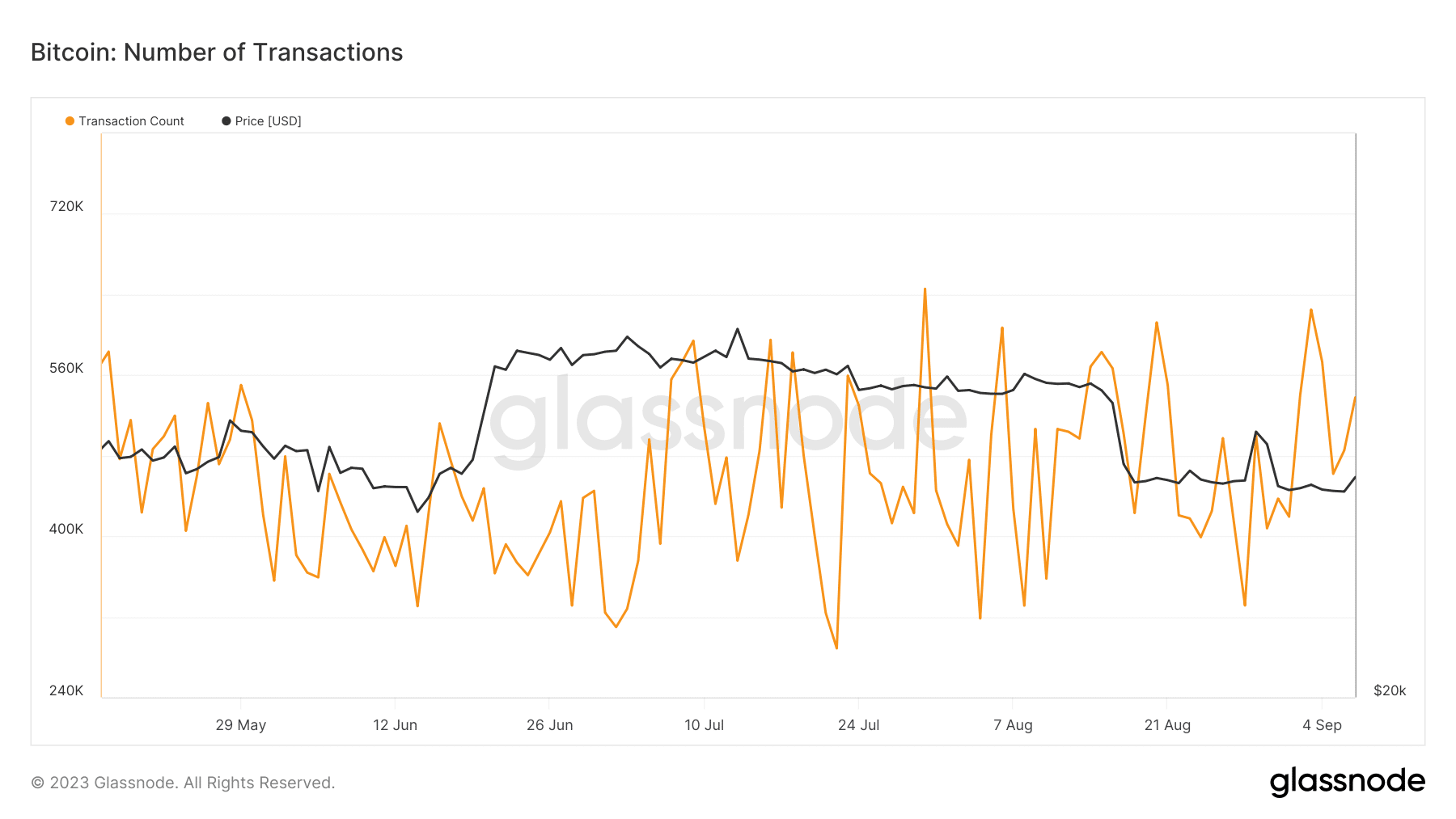

According to Glassnode, the transaction count rose dramatically in the last week, explaining the spike in miners’ revenue. In fact, 3 September witnessed a value of 625,009, the highest in more than a month.

Network congestion on the rise?

Another factor that could explain the rise in transaction fees was the dynamics surrounding hash rate and block intervals. As shown below, the network’s hash rate declined since the start of the week.

A dip in hash rate basically meant that miners’ efficiency in finding the accurate block declined, leading to high block intervals.

The delay in mining blocks made the network congested. According to Mempool data, the number of unconfirmed transactions in the queue shot up to 560,810 at the time of writing, promoting users to bid up fees to jump the queue.

Varying levels were set in prioritizing transactions. Users willing to shell out $0.9 were given the highest priority.

Read Bitcoin’s [BTC] Price Prediction 2023-24

What next for Bitcoin mining?

High fees augured well for the existing breed of miners as well as the ones seeking to explore it as a viable business model. As the Bitcoin blockchain expands, a continual influx of miners would be required to keep the network secure and decentralized.

Bitcoin miners fought the punishing bear market of 2022 with tenacity, intending to recoup their losses in 2023. However, after achieving yearly peaks in May, the overall earnings have significantly dried up.