Bitcoin

Bitcoin mining data points to new rally: Will BTC bulls follow through?

Can Bitcoin miner-related data indicate a bullish or bearish outcome?

- Bitcoin mining may help bulls start another major rally, according to this analysis.

- Miner reserves soared to 6-week highs despite recent market FUD.

Now that Bitcoin [BTC] is trading below $60,000 once more, many might be wondering whether it is an ideal time to buy, especially now that it has demonstrated some weakness above that key price point.

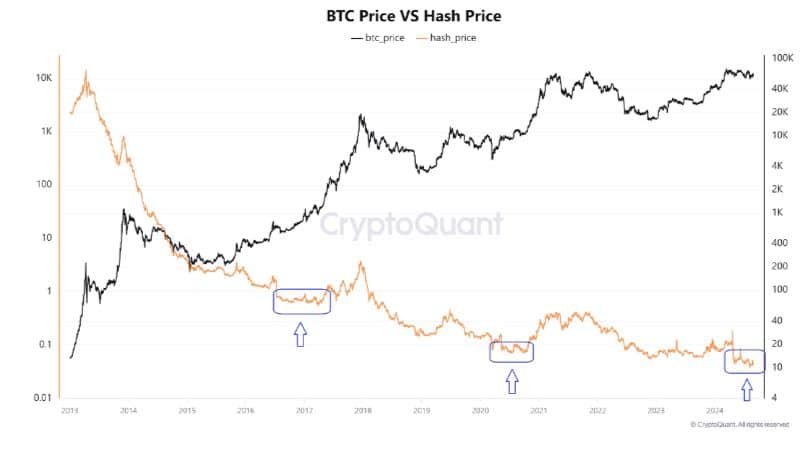

Bitcoin is currently in a buy opportunity, according to CryptoQuant analyst Woominkyu. The analyst made a bullish case for the cryptocurrency using the Bitcoin hash price, which showcased miner profitability.

Woominkyu’s analysis suggested that the hash price can be used as a bullish signal. A comparison with Bitcoin lows suggested that the hash price, at the bottom of its trend, could signal bullish opportunities ahead.

The Bitcoin hash price recently dropped to its lowest historic levels. This coincided with BTC’s recent downside, especially at the start of August.

If this analysis holds true, then it suggests that Bitcoin may already be in the beginning stages of its next major rally. It also suggests that the recent pullbacks might be the best accumulation opportunities at discounted levels.

Meanwhile, decentralized mining pool operator Loka Mining plans to introduce new measures that could prevent or ease miner capitulation.

According to its CEO Andy Fajar Handika, the company will finance growth and short-term needs using forward mining contracts.

The goal is reportedly to offset some of the pressures that miners face due to declining block rewards and high operating costs.

How Bitcoin mining affects demand

Bitcoin has so far demonstrated healthy demand below the $60,000 price level. Other miner related stats also point to a favorable sentiment for a potentially bullish outcome.

For example, miner reserves were at their highest levels in the last six weeks.

The surging miner reserves suggests that miners have been HODLing their coins in anticipation of higher prices. We also observed the highest spike in coin days destroyed in August.

The second-highest spike during the month was at the peak of the dip that occurred at the start of the month.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Previous spikes in the coin days destroyed indicator were observed before a major price move. This suggests that Bitcoin could be on the verge of another highly volatile move, either to the upside or downside.

However, the above observations suggest that a higher probability of a bullish outcome. Nevertheless, traders should move cautiously considering that there is still a decent level of uncertainty in the market.