Bitcoin mining difficulty hits record high: How will it impact BTC?

- Bitcoin mining difficulty reaches ATH.

- Bitcoin whales bought over 84,000 BTC in July.

Bitcoin [BTC] has been failing to make new highs but crypto investors are still bullish on BTC long-term.

VanEck CEO has predicted Bitcoin will reach half the market cap of gold, exceeding the $350,000 price point. Separately, Morgan Stanley advisors will pitch BTC ETFs by BlackRock and Fidelity starting 7th August.

These, combined with Trump’s Bitcoin debt idea, signals a powerful future for crypto. However, the asset could be about to face a potential downtrend.

Bitcoin mining difficulty hits new high

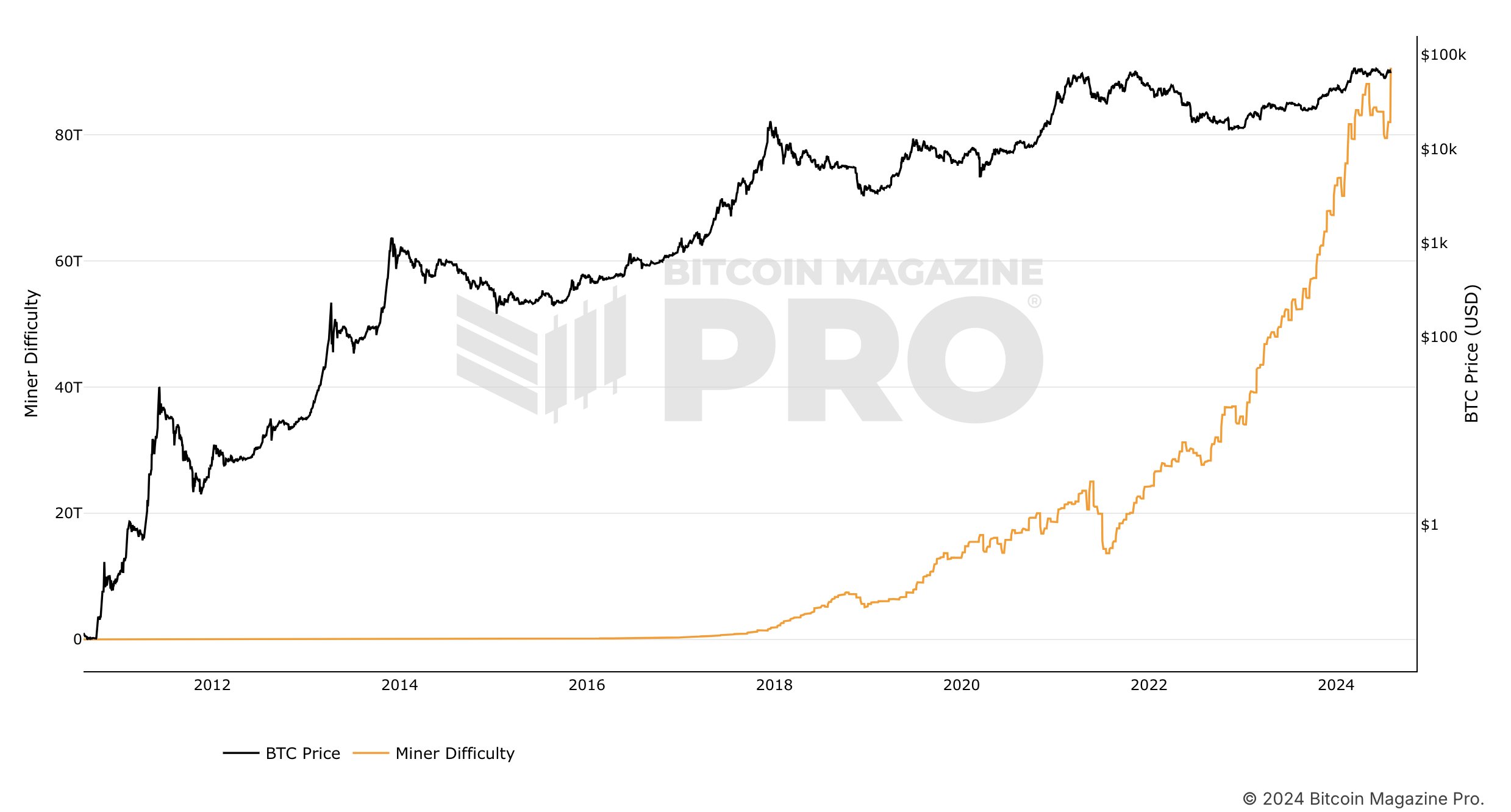

It was reported that Bitcoin mining difficulty and US money supply have hit new all-time highs necessitating more computational power, potentially affecting profitability.

This is potentially because of the increased activities on the Bitcoin blockchain. With $900 trillion of global wealth and BTC’s market cap at $1.25 trillion, this is a significant allocation.

A recent $3 trillion loss in stocks due to recession fears highlights Bitcoin’s resilience. While traditional assets plummet, BTC remains a focal point.

Many investors underestimate cryptocurrency’s potential, making now an opportune time to consider BTC in a diversified portfolio for the long-term gains.

Bitcoin whales anticipate rally as BTC investment increases

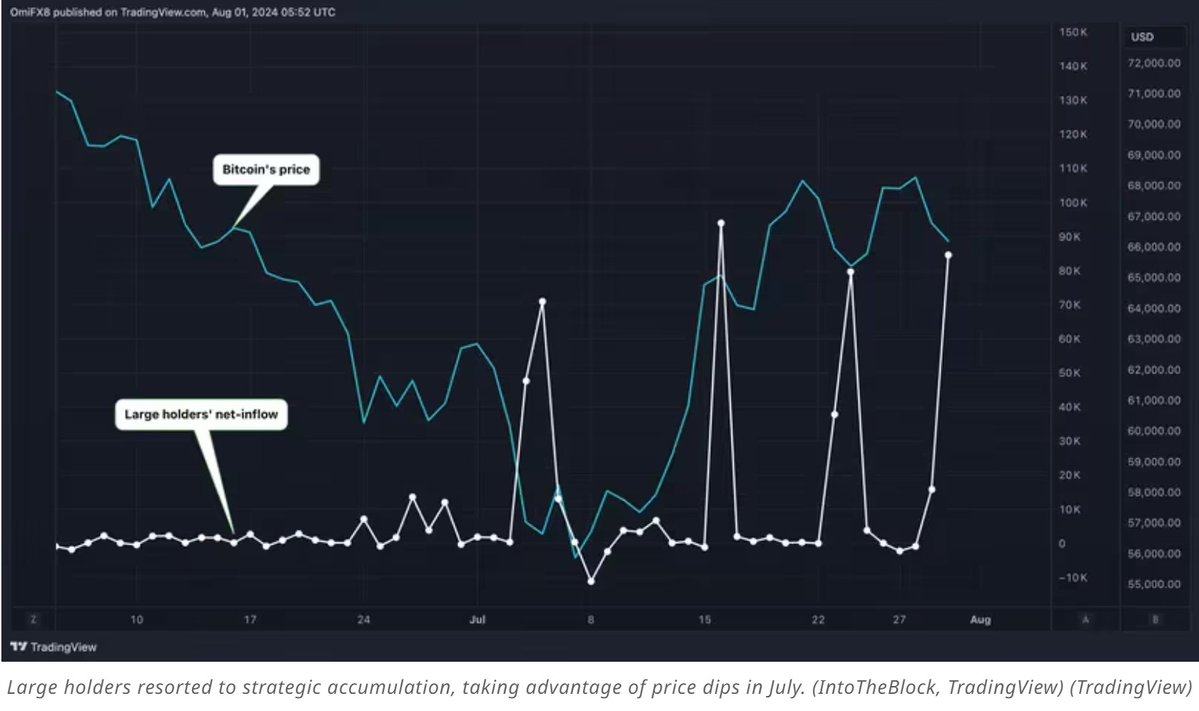

In July, Bitcoin whales bought over 84,000 BTC, the largest purchase since October 2014, amounting to $5.4 billion.

While many investors were offloading their holdings, these large holders, owning at least 0.1% of total Bitcoin’s supply, were accumulating according to IntoTheBlock.

This significant increase highlights the strategic moves of whales during market fluctuations, reinforcing their influence and confidence in Bitcoin’s long-term potential.

BTC potential downtrend

A look at Bitcoin’s MACD shows a lower high in 2024 compared to 2021, trending lower and pushing down swiftly while price is trading higher but in a potential reversal zone.

This divergence suggests a potential bearish trend is about to begin with a confirmation from price action that is making successive equal highs.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s new ATH in 2024 may have resulted from monetary inflation rather than true value growth.

The MACD’s bearish trend is a signal for the short-term traders that BTC may soon change direction targeting the critical support range of $28k – $37k.