Bitcoin mining firm Marathon Digital misses Q2 projections, shares drop 8%

- Marathon’s hash rate surged 78%, but Bitcoin production fell by 30%.

- Despite higher revenue, earnings missed forecasts due to rising costs and technical issues.

Following its recent acquisition of $100 million in Bitcoin [BTC], Marathon Digital Holdings [MARA], the largest BTC mining firm, reported its second-quarter earnings, which fell short of Wall Street projections.

This led to an 8% drop in its share price.

Marathon Digital Q2 results

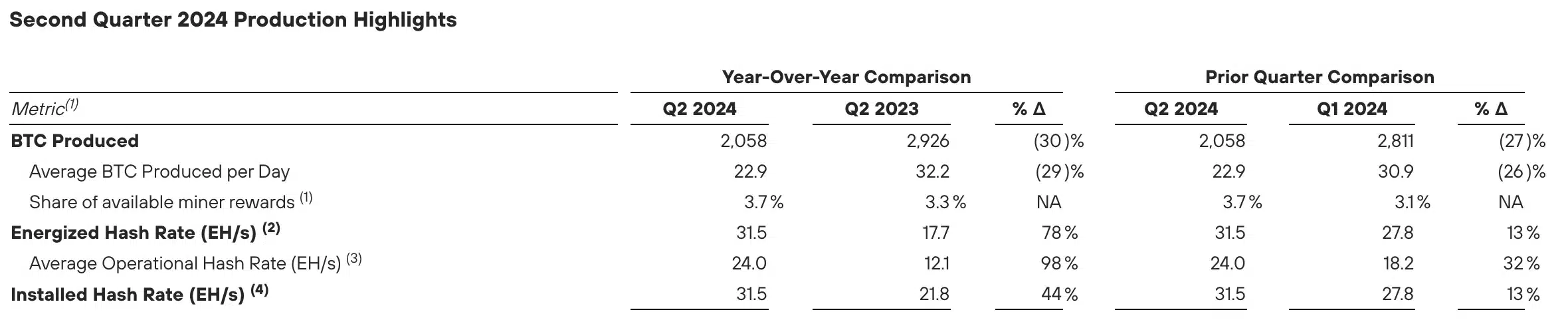

The company’s press release highlighted a notable 78% increase in hash rate, reaching 31.5 EH/s in Q2 2024 compared to 17.7 EH/s in Q2 2023.

Despite this growth in computing power, Marathon Digital’s Bitcoin production decreased by 30%, with 2,058 BTC mined in Q2 2024, down from 2,941 BTC the previous year.

However, in terms of revenue, the firm noted,

“Revenues increased 78% to $145.1 million in Q2 2024 from $81.8 million in Q2 2023.”

Surprisingly, Yahoo Finance data revealed that this figure was approximately 9% below the anticipated $157.9 million forecast by analysts.

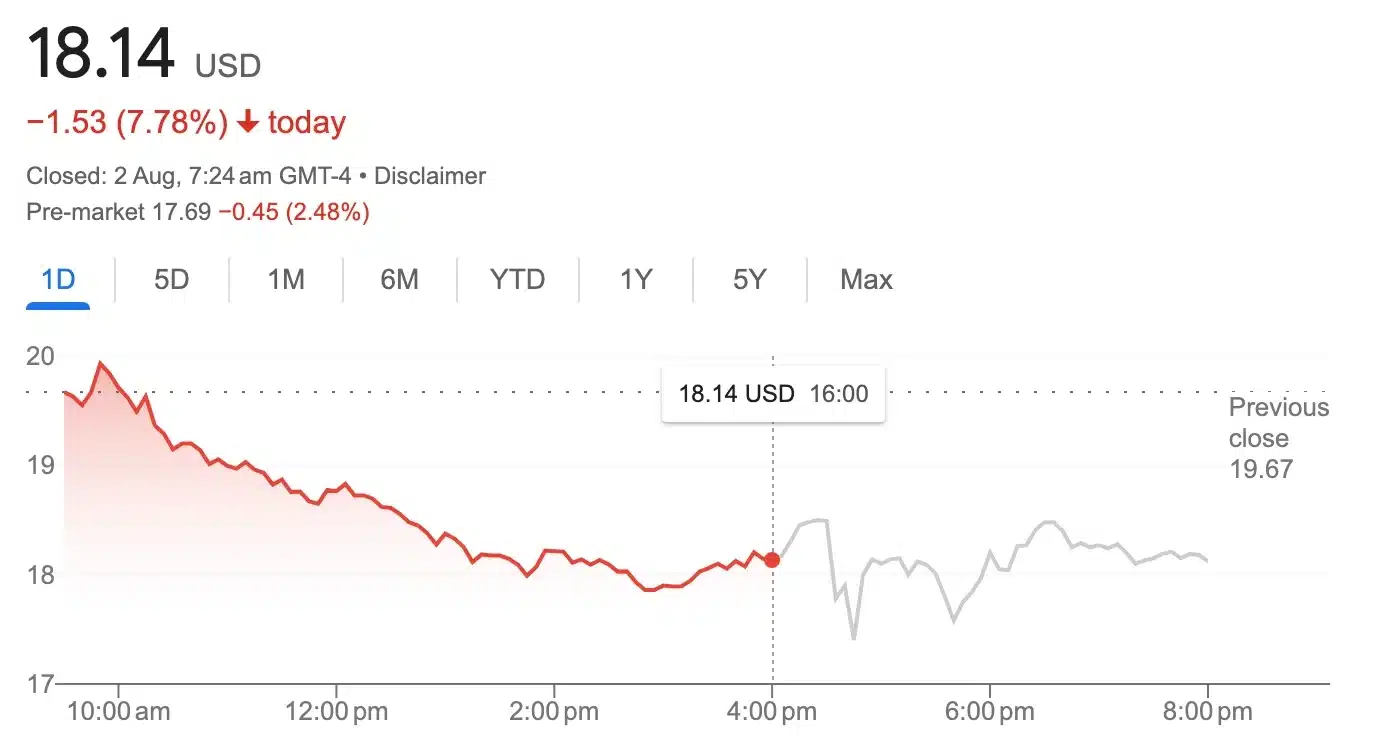

As of the latest update, the company’s stock had dropped 7.78%, trading at $18.14.

What happened so far?

That being said, during the quarter, Marathon Digital faced financial pressures due to increased operational costs following the Bitcoin halving event in April.

To manage these costs, the company sold over half of its mined BTC.

Despite a significant increase in the average price of Bitcoin mining compared to the previous year, Marathon’s daily BTC production decreased by 9.3 BTC.

This suggests that, although the value of Bitcoin was higher, operational challenges and rising costs impacted their overall mining output and financial strategy.

Execs weighing in

Remarking on the same, Fred Thiel, MARA’s chairman and chief executive officer, said,

“During the second quarter of 2024, our BTC production was impacted by unexpected equipment failures and transmission line maintenance at the Ellendale site operated by Applied Digital, increased global hash rate, and the April halving event.”

He further added,

“However, I’m pleased to report that transformer issues at the Ellendale site were mitigated and remediated post-quarter end, and our hash rate recovery effort is complete.”

According to Thiel, the company has reached an all-time high installed hash rate of 31.5 exahash in the second quarter and continues to target 50 exahash of energized hash rate by the end of 2024 with additional growth in 2025.

What lies ahead?

As Marathon Digital adjusts to higher costs and technical issues, its ability to innovate while managing these challenges will be crucial.

Henceforth, the company’s future success will depend on how well it balances these factors in the evolving crypto market.