Bitcoin mining in May: Assessing the state of miners post-halving

- Bitcoin’s hash rate showed resilience, while BTC struggled to cross the $70k mark.

- European regulatory response targets potential market abuse risks associated with MEV.

Unlike previous years, the fourth Bitcoin [BTC] halving was quite different. While miners’ block subsidy rewards have now been reduced from 6.25 BTC to 3.125 BTC, they continue to earn additional transaction fee rewards for each block mined.

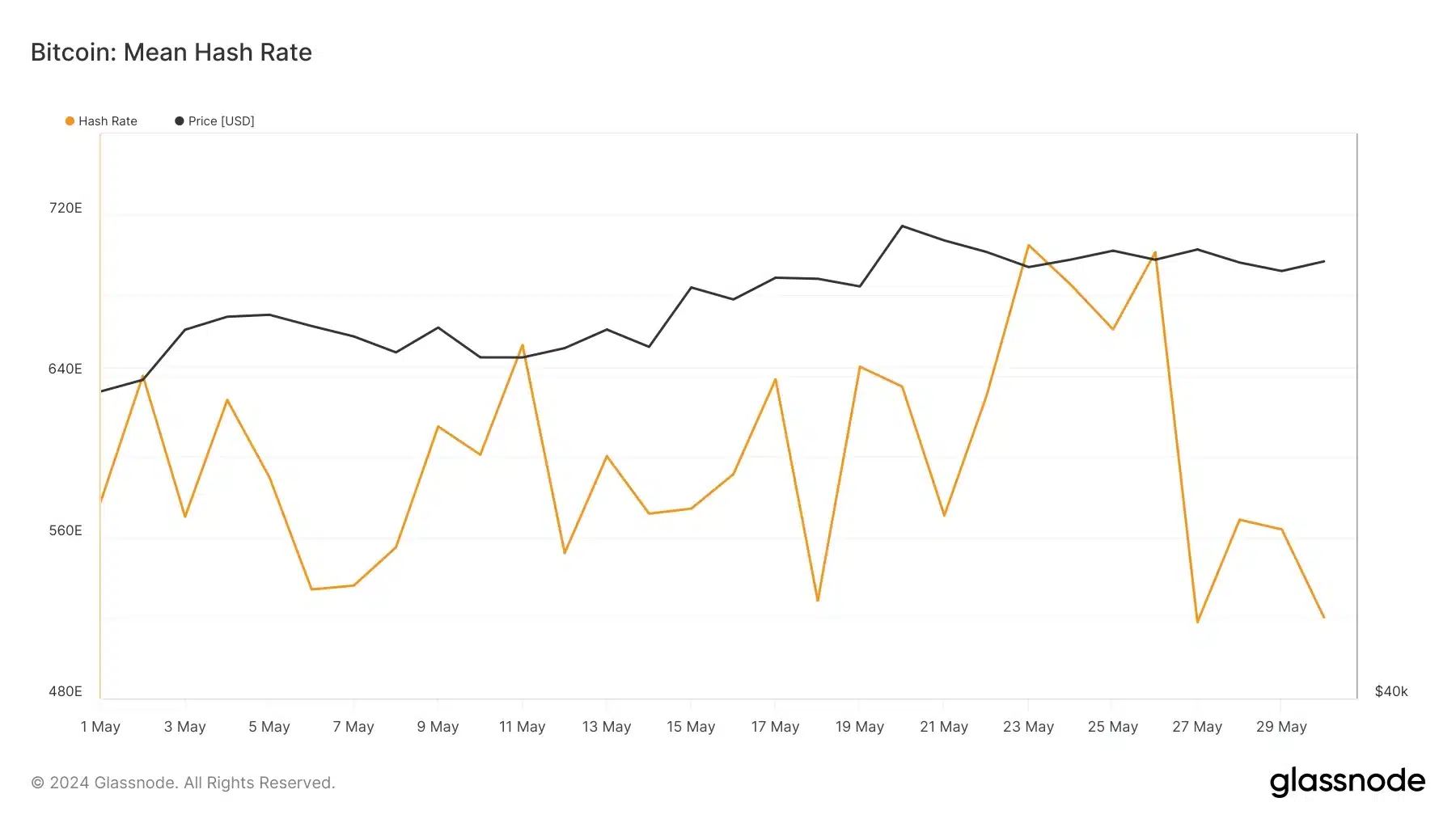

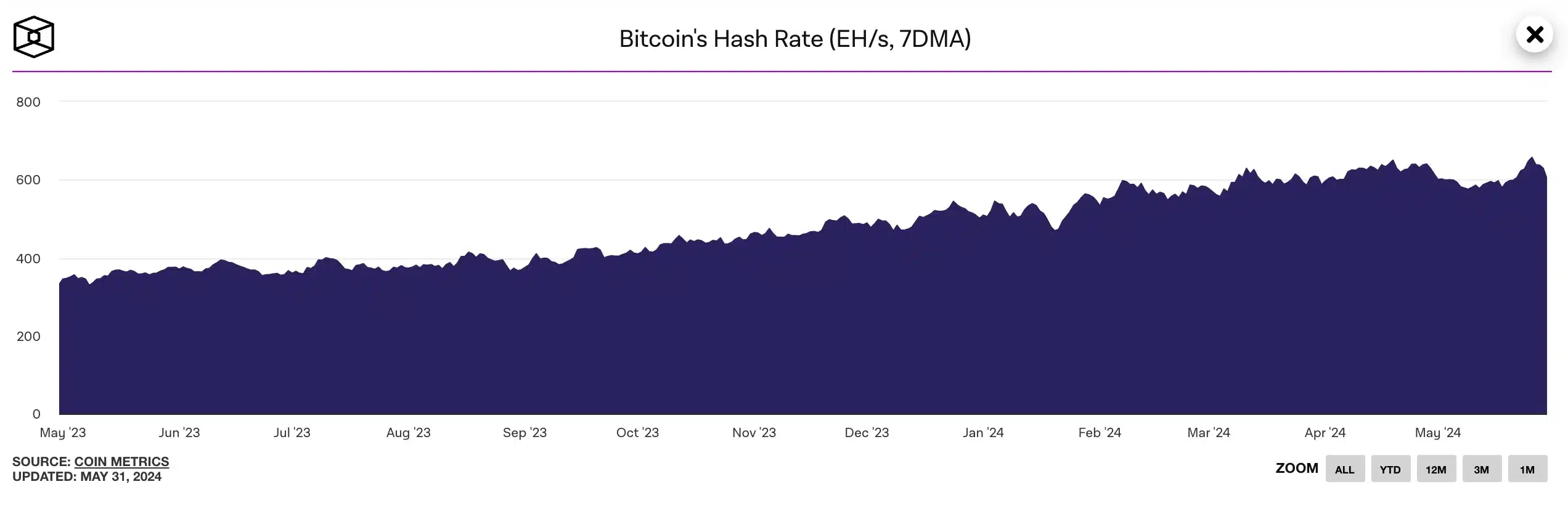

In past halvings, Bitcoin’s hash rate dropped due to insufficient transaction fee rewards. This time, the hash rate stayed near all-time highs, rising from 630 EH/s to 640 EH/s post-halving, driven by increased transaction fee rewards.

However, at the time of writing, it dropped back to 602 EH/s.

Additionally, while Bitcoin’s hash rate showed resilience, on the other hand, its price seems to be struggling to cross the $70k mark.

What metrics suggest about Bitcoin mining

According to on-chain data from The Block, Bitcoin’s hash rate has been declining since 26th May, indicating potential risks to the network. In such situations, miners might struggle to generate profits from their operations.

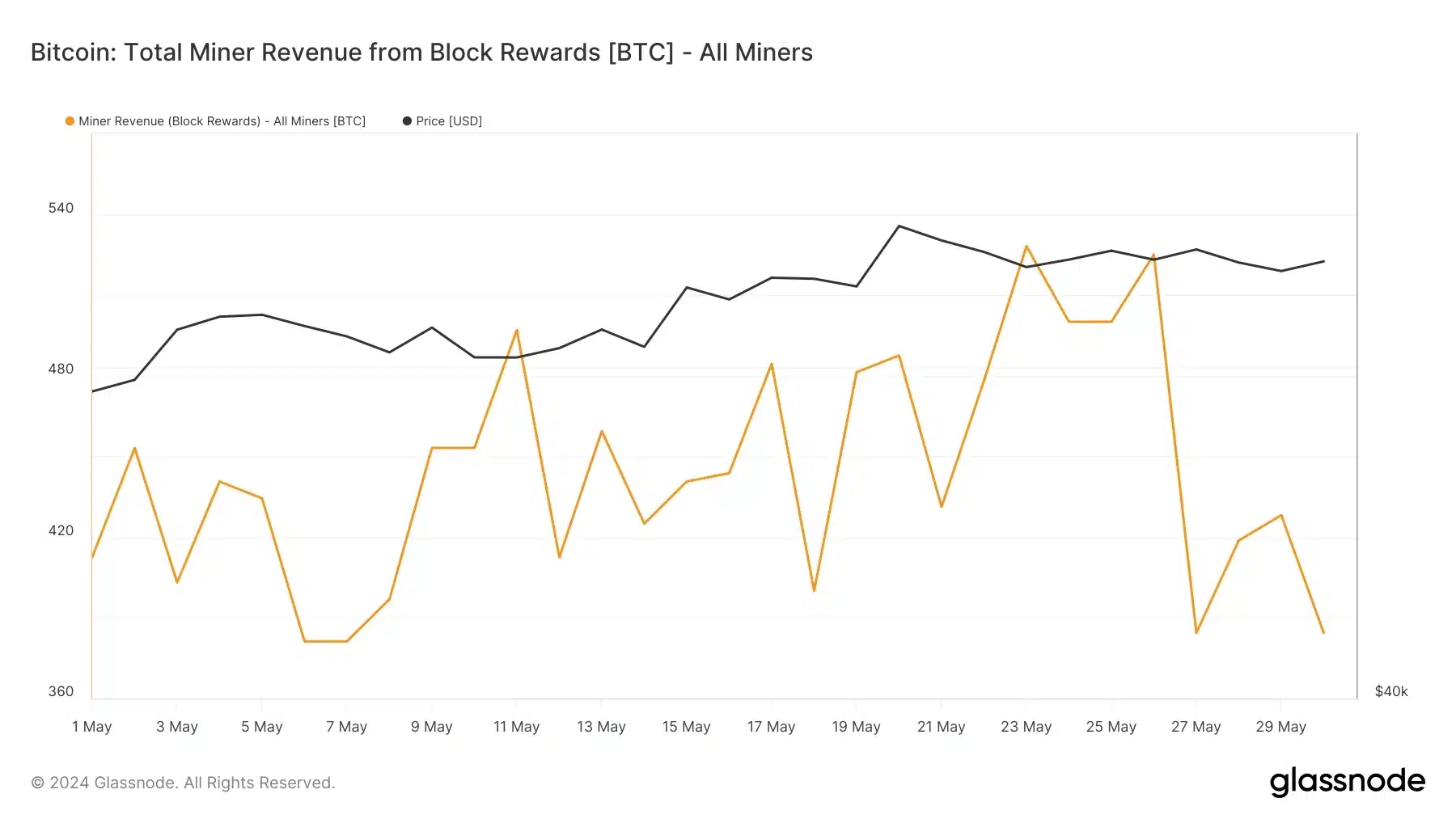

This was further confirmed by Glassnode’s, miners’ revenue block data. As of the latest update, on-chain data shows that miners’ revenue has dropped significantly to 384.375 BTC, down from 525 BTC on 26th May.

However, some still view this situation as a net positive for Bitcoin, as highlighted in a recent InvestAnswers stream.

“That is good because typically miners wouldn’t jump in to mine Bitcoin unless the price is going up and big enough to sustain a lot of this.”

Looking at the Bitcoin mining difficulty data, it can be seen how hard it is to find the right hash for each block. Please note that this difficulty doesn’t affect the price of the mined BTC. So, BTC’s prices play an important role in determining the profitability of miners.

What’s the matter around MEV?

But block rewards aren’t the only way for miners to earn. Maximum Extractable Value (MEV) refers to potential profits that miners can get by applying strategies like frontrunning, sandwich attacks, etc. that rely on their ability to reorder transactions in a block.

Recognizing the threat that MEV can pose to investors, the European Securities and Markets Authority (ESMA) recently shared its plan to restrict MEV utilized by miners and validators, considering it as potential market abuse.

While the proposal is still in the draft stage, stakeholders have until June’s end to comment. If it gets approved, it could have significant implications for validators and miners worldwide.