Bitcoin moves above short-term bull flag- Will $26k be the next target?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

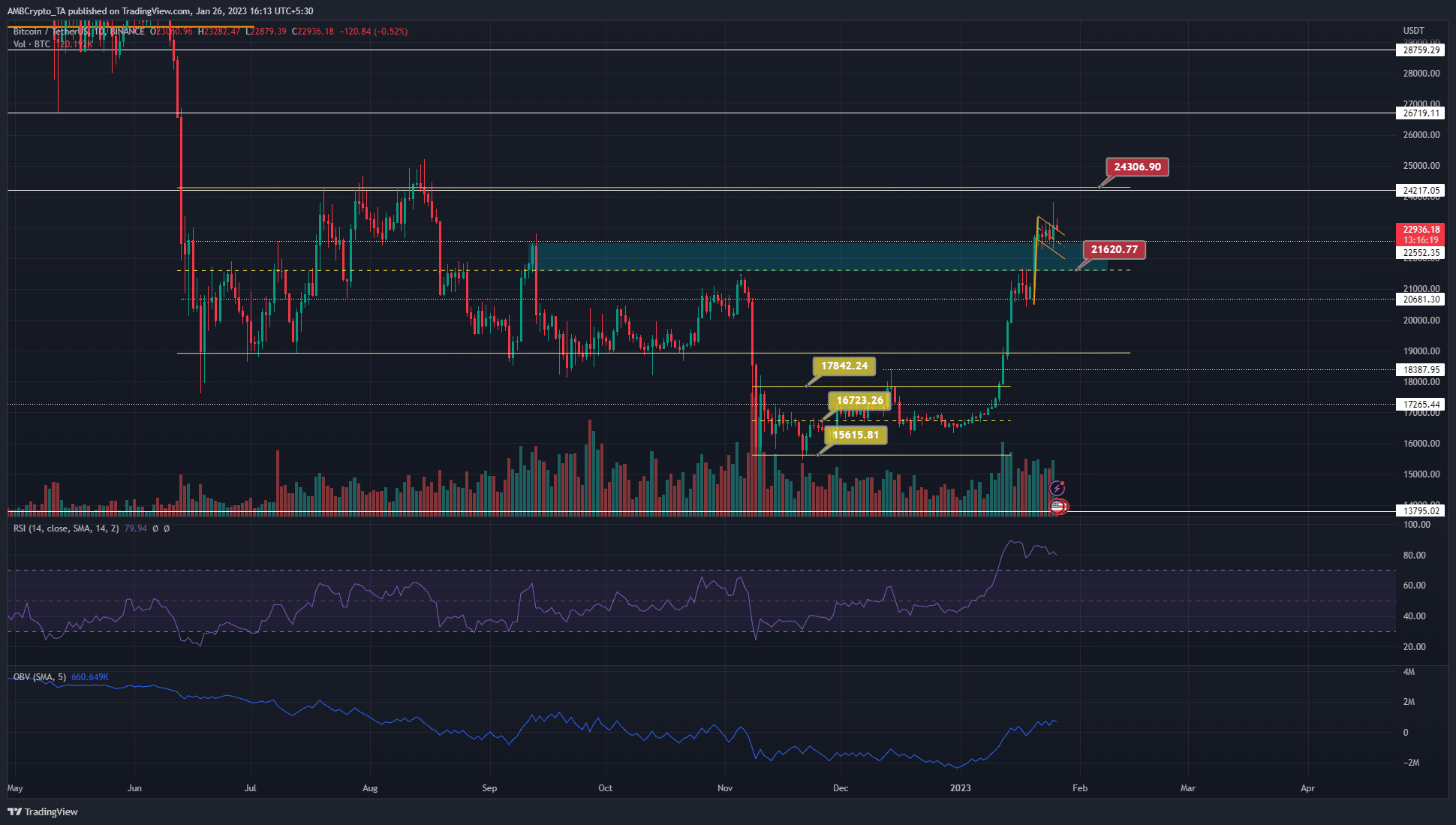

- The daily timeframe structure was strongly bullish.

- A dip below $22.2k will break the lower timeframe bias.

Bitcoin rallied hard throughout January and has posted gains of 44.3% from the swing low to the swing high of January. While this is an impressive feat by itself, it must also be remembered that Bitcoin knew nothing but selling pressure for the majority of 2022.

Read Bitcoin’s Price Prediction 2023-24

In January and February 2019, BTC embarked on a 300% rally that lasted nearly five months. Has BTC embarked on a similar path once again? In the face of all the bearish news in recent months, a revival in prices and demand was a pleasant surprise- and BTC bulls could have more in store.

The bullish breaker from September has been defended so far

Bitcoin formed a bull flag and climbed above it. The next level of resistance lies at the range highs of $24.3k. This area was last tested in mid-August. The length of the flag staff meant a bullish breakout will target the $25k mark.

Above the $24.3k level, the next important levels of resistance lie at $26k, $26.7k, and the $28k region. Due to the lack of price action from Bitcoin on its descent in June, it was uncertain where BTC will run into significant resistance between $24k and $28k.

Is your portfolio green? Check the Bitcoin Profit Calculator

Invalidation of the bullish idea would be a daily session close below $21.6k. This would make the price action of the past few days a deviation, and a reversal toward $19k could commence.

However, as things stand, this course was unlikely. The RSI showed strong bullish momentum and the OBV was in an uptrend as well to denote genuine demand.

The Open Interest has flattened alongside the price in recent days

Source: Coinalyze

Over the past four days, both the price and the OI were flat. The spot CVD has retreated to show selling pressure. Hence, despite the breakout from the bull flag, the veracity of the move above $23k could be in question if OI and CVD do not pick up. The predicted funding rate was positive to indicate bullish sentiment.

The higher timeframe market structure was bullish, and a session close back beneath $20.6k would break this structure. A revisit to the $21k-$21.6k area could occur due to the inefficiency left behind on the swift move upward.