Bitcoin moves past $28k, is BTC ready to go on a bullish spree?

- BTC breached the $ 27,900 mark, which led to the anticipation of big gains.

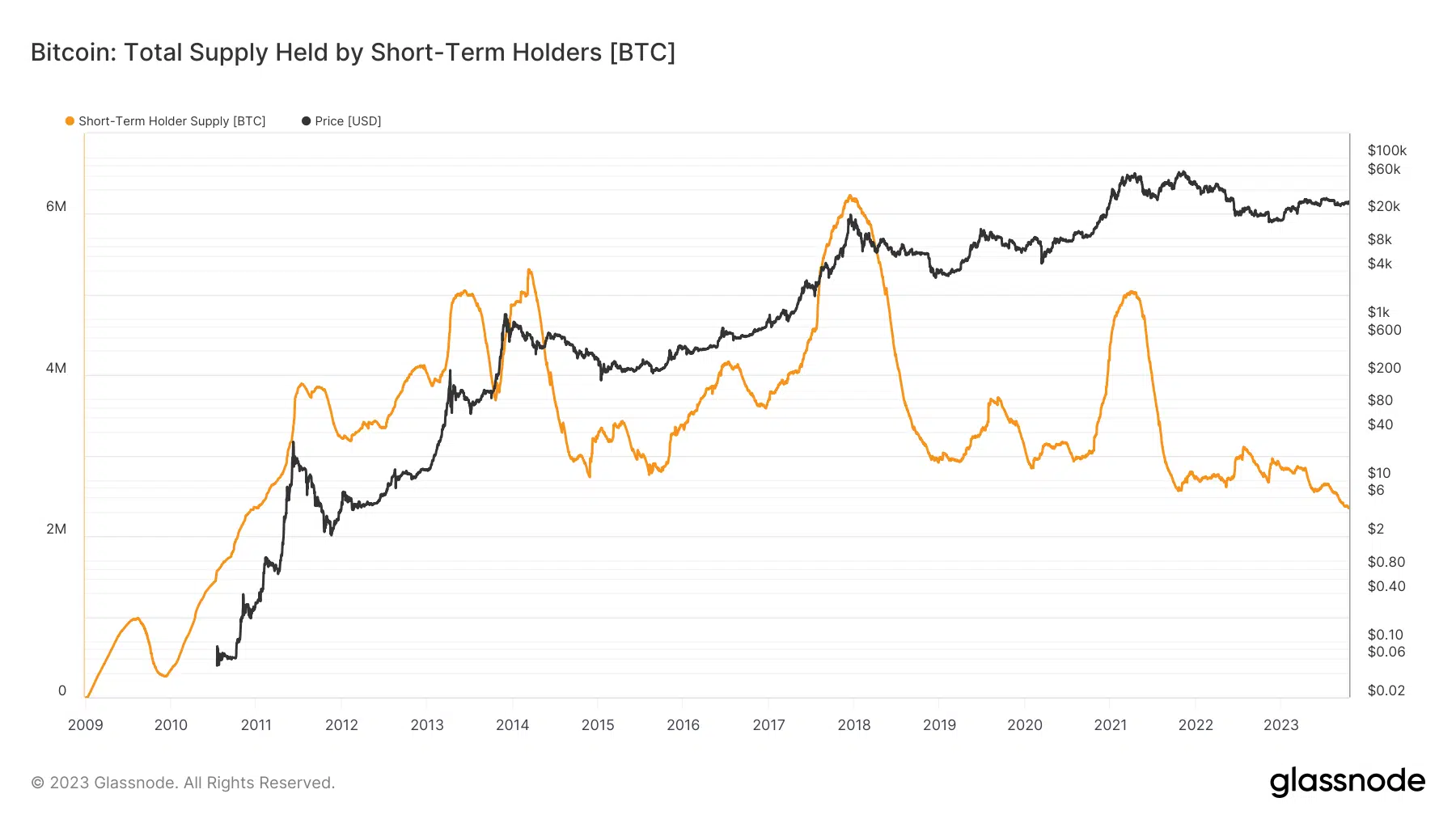

- Short-term holders may be back in profit.

Bitcoin [BTC] can be in for a bullish pivot in the near term if the predictions of well-known on-chain sleuth Ali Martinez were to be trusted.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Is Bitcoin ready for a bull market?

The king coin rose to nearly $30,000 earlier this week after an unverified claim by a popular news platform went viral. Although it retreated from the highs, Bitcoin consolidated in the $28,000 zone and hasn’t slipped below, per data from CoinMarketCap.

However, of particular interest were the levels that Bitcoin breached in the dramatic episode. As per an X post dated 18 October, Martinez highlighted that the world’s largest cryptocurrency broke through the “crucial psychological benchmark” of $27,900.

He went on to state that if BTC manages to stay above this level, bullish market forces would get emboldened.

Significance of the level

The critical price point highlighted was the short-term holder cost basis or the Short-term Holder Realized Price (STH RP). The STH RP calculates the average price at which Bitcoin was purchased by investors who held their holdings for less than 155 days.

It has historically served as a reliable support level during strong uptrends. This is because previous breaches of this level injected considerable bullish strength into Bitcoin.

The STH RP, therefore, has been a barometer of market sentiment. A possibility of previously underwater short-term holders tasting profit implied a decisive shift toward a bull market.

As of this writing, just about 12% of Bitcoin’s total circulating supply was in the hands of short-term holders. However, since these players are the first to respond to market volatility, their behavior exerts a bigger impact on Bitcoin’s price movements. Long-term holders (LTH) on the other hand stay unmoved during intermittent bouts of rallies and crashes.

Is your portfolio green? Check out the BTC Profit Calculator

The market sentiment was in the balance, as per the latest update from the Fear and Greed Index. With bears and bulls locked in a close tussle, key price points as discussed above could be the key to speculating on Bitcoin’s next moves.

Bitcoin Fear and Greed Index is 52. Neutral

Current price: $28,492 pic.twitter.com/EJdXHexJYg— Bitcoin Fear and Greed Index (@BitcoinFear) October 19, 2023