Bitcoin nears record highs as U.S. elections loom: What’s next?

- Bitcoin bulls have been showing up strong recently, pushing price closest to its ATH.

- Bullish optimism remains especially as the U.S elections draw near.

October has arguably been a good month for Bitcoin [BTC] and for more reasons than one. Accumulation has been gaining traction during the month and this has contributed to a major pattern breakout.

An outcome that could set the pace for some interesting price action and new highs in the next few months.

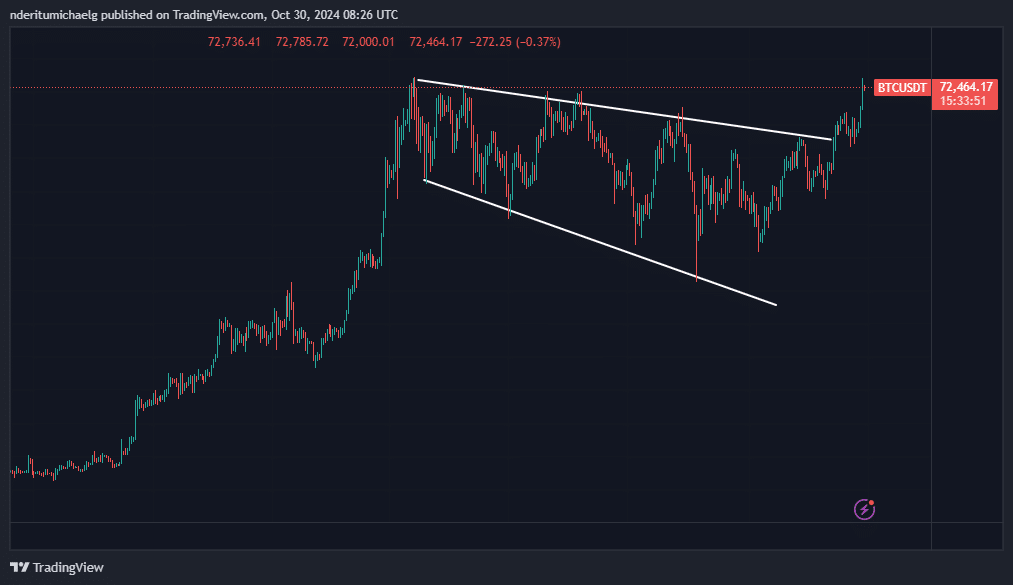

Bitcoin formed a lengthy bullish flag after its impressive rally in the first 3 months of 2024. This pattern has been playing out since March, characterized by descending support and resistance bands.

BTC’s latest push above the resistance line yielded success at $66,000 and continued to demonstrate strength above that level.

Bullish momentum in the last five days confirmed the breakout and allowed Bitcoin to soar close to its historic ATH of $73,777. The recent upside peaked at 73,620.

The bullish flag pattern breakout has finally occurred for the first time in almost 7 months. This also suggests that the price could be on the verge of another major move in favor of the bulls. In other words, Bitcoin is on the verge of price discovery and new all-time highs.

The next major Bitcoin catalyst

The U.S. elections are just around the corner and the outcome is expected to have significant outcome on Bitcoin price action. This became apparent in July when BTC sentiment around presidential candidates was quite high based on whether they support crypto.

Trump is currently considered the most pro-crypto candidate, which means a win for him would likely have a positive outcome on Bitcoin price action. On the other hand, a win for Harris may not yield a similar outcome for BTC.

Uncertainty has also made a comeback after the latest rally. Price has demonstrated resistance within the previous high range. More noteworthy is that on-chain data suggests that large holders have been taking profits.

There was a large spike in the amount of Bitcoin flowing out of large holder accounts recently. Outflows grew from 0 BTC to 3,990 BTC between 26 October and 30 October. Meanwhile, large holder inflows peaked at 2,020 BTC in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Despite this observation, the current sentiment suggests that there are more bullish expectations moving forward. This was evident by the fact that the latest uptick was not immediately followed by a surge in sell pressure.

However, higher levels of volatility are likely to manifest moving forward.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)