Bitcoin

Bitcoin network fees soar to three-month high

Although Bitcoin’s network activity dwindled during the week, total transaction fees on the network managed to climb to a three-month high.

- Transaction fees on the Bitcoin network climbed to a new high during the week.

- This happened despite the decline in network activity during that period.

Total fees paid to complete transactions on the Bitcoin [BTC] network rallied to a three-month high of $7 million this week, on-chain data provider IntoTheBlock noted in a recent post on X (formerly Twitter).

Total Bitcoin fees continue to climb and have reached a three-month high of $7M this week! pic.twitter.com/H46FjuriUE

— IntoTheBlock (@intotheblock) September 22, 2023

Is your portfolio green? Check out the BTC Profit Calculator

Miners took no chances

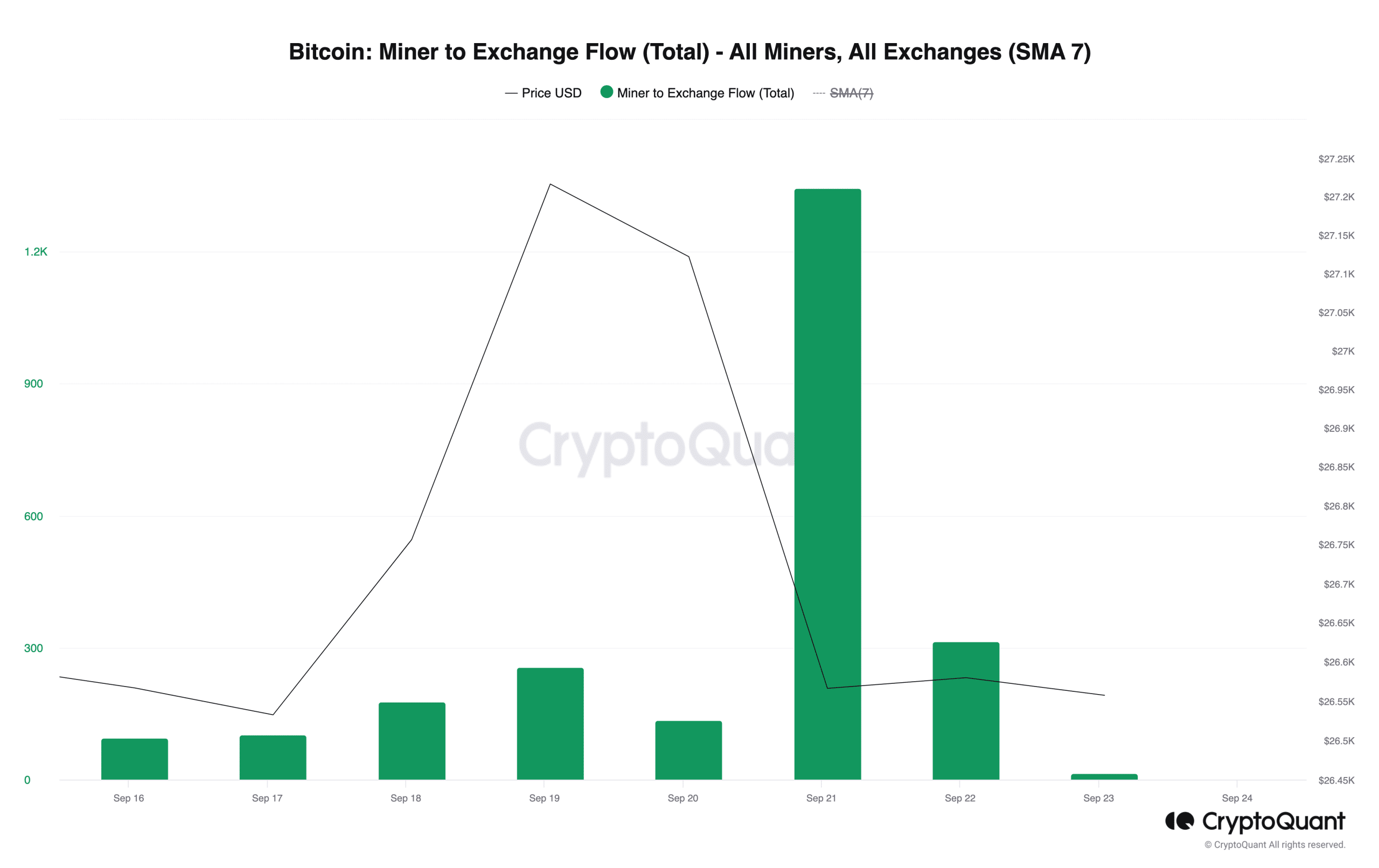

The fee surge spurred miners on the Bitcoin network to dispose of some of their coin holdings to book profits. An assessment of Bitcoin’s Miner to Exchange Flow on a 7-day moving average showed that the metric climbed to a one-week high of 1,343 BTC on September 21.

This suggested that miners were quickly offloading their coins on cryptocurrency exchanges as fees jumped.

The Miner to Exchange Flow metric measures the amount of BTC flowing from miners to exchanges. When this metric rallies, miners sell more BTC than they are mining. It often suggests that miners are bearish on the price of BTC and are looking to sell their holdings.

BTC’s Miner Reserve – which measures the number of coins held in affiliated miners’ wallets – declined within the period under review, confirming coin exits from miners’ wallets.

After peaking at a high of 1.844 million BTC when the coin briefly traded above $27,000, the Miner Reserve metric plummeted and dropped to 1.841 million BTC by 22 September, according to data from CryptoQuant.

Fees went up despite the fall in network activity

An assessment of user activity on the leading blockchain network within the period under consideration revealed that while it saw a hike in fees, it experienced a decrease in network activity.

According to data from Glassnode, the week was marked by a decline in new demand, as the daily count of new addresses that appeared for the first time in a transaction on the network cratered by 18%.

Likewise, the number of unique addresses that completed transactions involving BTC also dropped by 12%.

Read Bitcoin’s [BTC] Price Prediction

2023-2024The drop in network activity on the blockchain was spotted in a reduction in the number of daily Ordinals inscriptions made during the week. Data retrieved from a Dune Analytics dashboard revealed a 53% decline in daily inscriptions made on the Bitcoin network.

At press time, the leading crypto asset exchanged hands at $26,550. The coin returned to the $26,000 price region after its momentary stint above $27,000 on 19 September.