Bitcoin

Bitcoin network goes silent in 2023

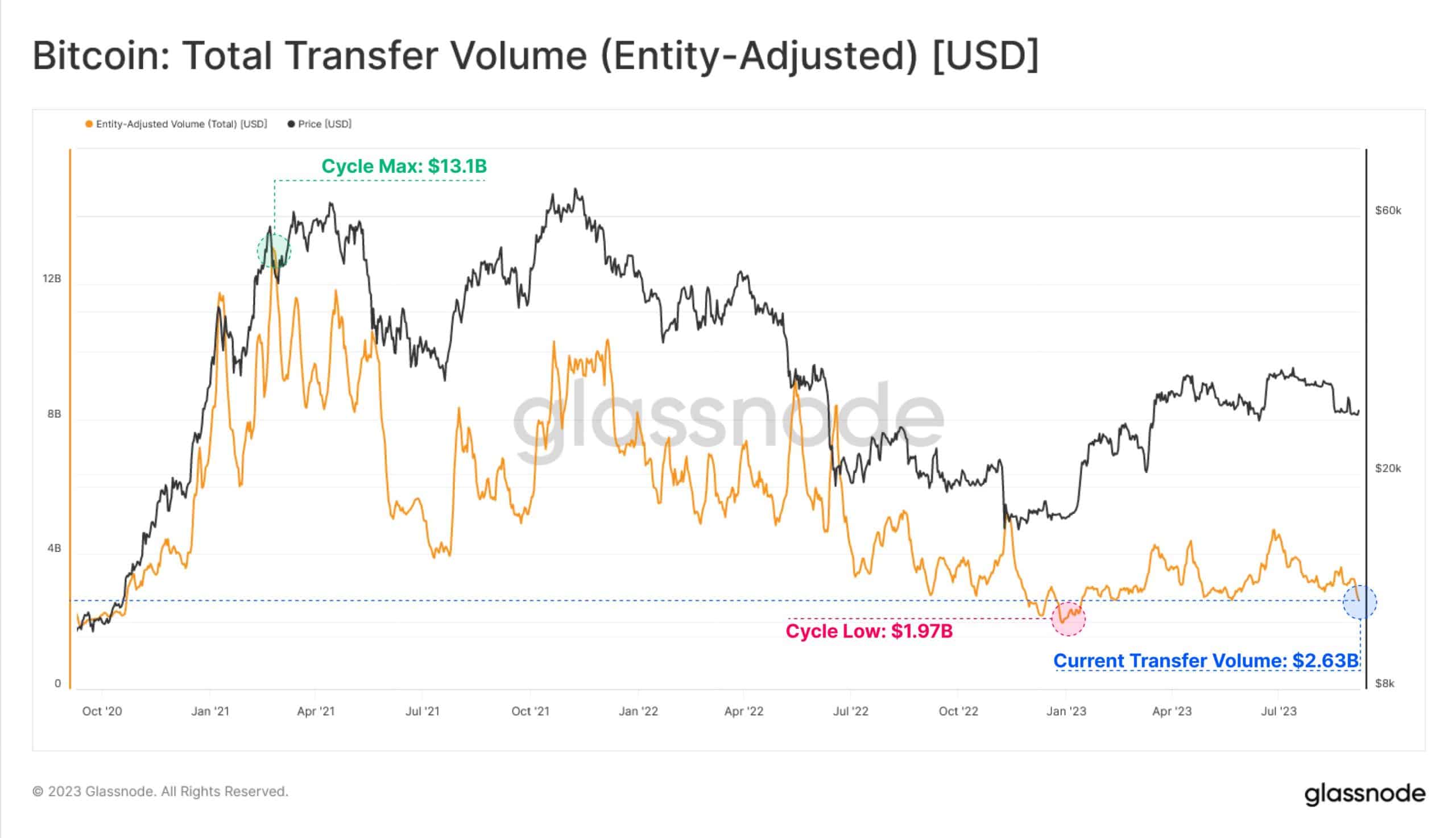

The total number of Bitcoins transferred on-chain was $2.63 billion/day in 2023, down nearly 80% from the peak attained during the 2021 bull market.

- Bitcoin’s transfer volume was just 25% higher than the cycle low.

- The monthly average of new addresses was significantly lower than the yearly average.

Once a beehive of intense activity, the Bitcoin [BTC] blockchain has become noticeably quieter in 2023.

Is your portfolio green? Check out the BTC Profit Calculator

As per a recent post by Glassnode dated 8 August, the total transfer volume i.e., the total number of coins transferred on-chain was $2.63 billion/day, nearly 80% down from the peak attained during the 2021 bull market.

In fact, the aforementioned value was just $600 million, or 25% higher than the cycle low of $1.97 billion, recorded during the historically low volatility period in early 2023.

Network adoption declines

Skepticism about the security of centralized exchanges, along with optimism in the king coin’s long-term potential, revived demand for self-custody. Consequently, HODLing rather than trading has been the norm lately.

The hallmark of a healthy network adoption is an uptick in the daily active users. A Glassnode chart, aimed at identifying broader trends in this regard, revealed some disappointing developments.

As can be seen, the monthly average of new addresses entering the Bitcoin blockchain was significantly lower than the yearly average. This indicated contraction of on-chain activity and less network usage.

Transaction count rises

Another important indicator to assess network demand was transaction throughput. Interestingly, transaction count on the Bitcoin chain has trended upwards in 2023, with May witnessing record-breaking traffic.

Although down from May peaks, the daily numbers were still promising. More than 483,000 transactions were processed on the network on 8 September.

Whales swim away from the network

However, transactions independently didn’t reveal the complete picture. While the transaction count was indeed up, the transfer volumes were low, as highlighted earlier. This suggested that the surge was driven by low-value transactions made by investors holding smaller quantities of BTC.

According to CryptoQuant, of the total inflows to the exchanges, the share of whales was just 39% on 8 September. In fact, the Exchange Whale Ratio indicator has climbed down considerably from previous years.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The lower interaction of whales with exchanges implied fewer high-value deals and, as a result, lower transfer volumes.

At the time of writing, Bitcoin shed 1.23% of its value in the 24-hour period to settle at 25,870, per CoinMarketCap. The market mood was neutral as per the last update of Bitcoin Fear and Greed Index.

Bitcoin Fear and Greed Index is 41 – Neutral

Current price: $25,905 pic.twitter.com/q0lKYwzIfg— Bitcoin Fear and Greed Index (@BitcoinFear) September 9, 2023