Bitcoin: No more support levels left – What lies below $59.4K?

- Bitcoin has a key level at $59.4k from both the technical and liquidity standpoints

- The one-sided sentiment in the futures market might see late bears trapped shortly

Bitcoin [BTC] saw a slump in demand and outflow from ETFs, which strongly suggested that a larger price correction was due for the crypto market.

Some ETF platforms saw zero flow days, but this was normal for exchange traded in any sector.

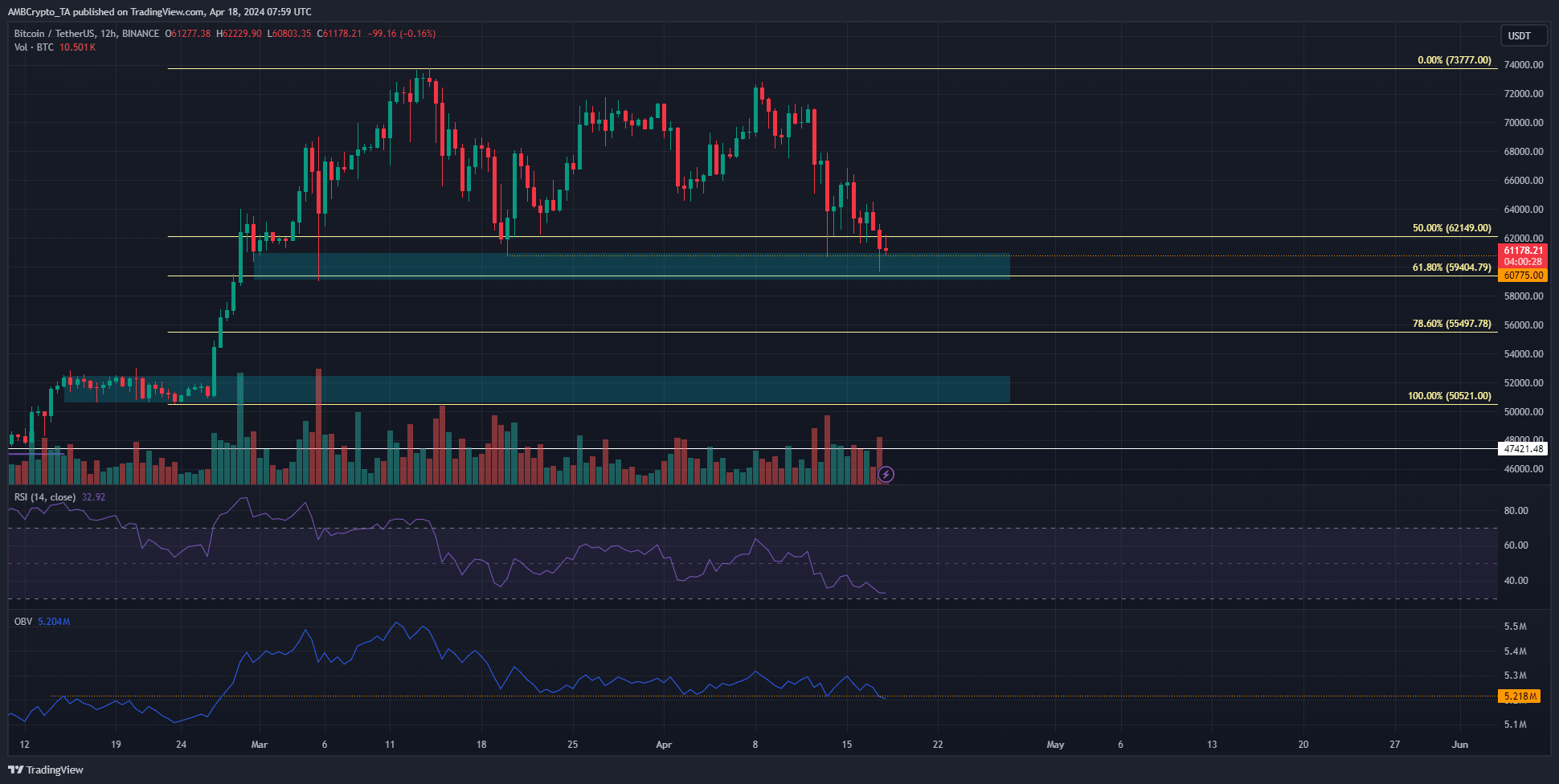

For the fourth time since late February, Bitcoin prices approached the support zone at $60k. The technical indicators suggested that the bulls might not succeed in holding on this time.

The demand zone and liquidity at $60k

The buyers have tenaciously held on to the $59.2k-$61k zone in the past seven weeks. During this time, the OBV had formed a support, marked in orange.

However, the recent selling volume drove the OBV below this key level.

This was an early signal that prices were likely to drop lower and that the $60k support zone might not be defended this time. The RSI underlined firm bearish momentum.

Beneath the $59.4k Fibonacci support level, $55.5k and $50.5k are the next higher timeframe areas of interest.

Therefore, if we see a slump below $60k this week, investors and traders should be prepared for further losses.

Short-term liquidation levels favor a sweep of this level before a bullish reversal

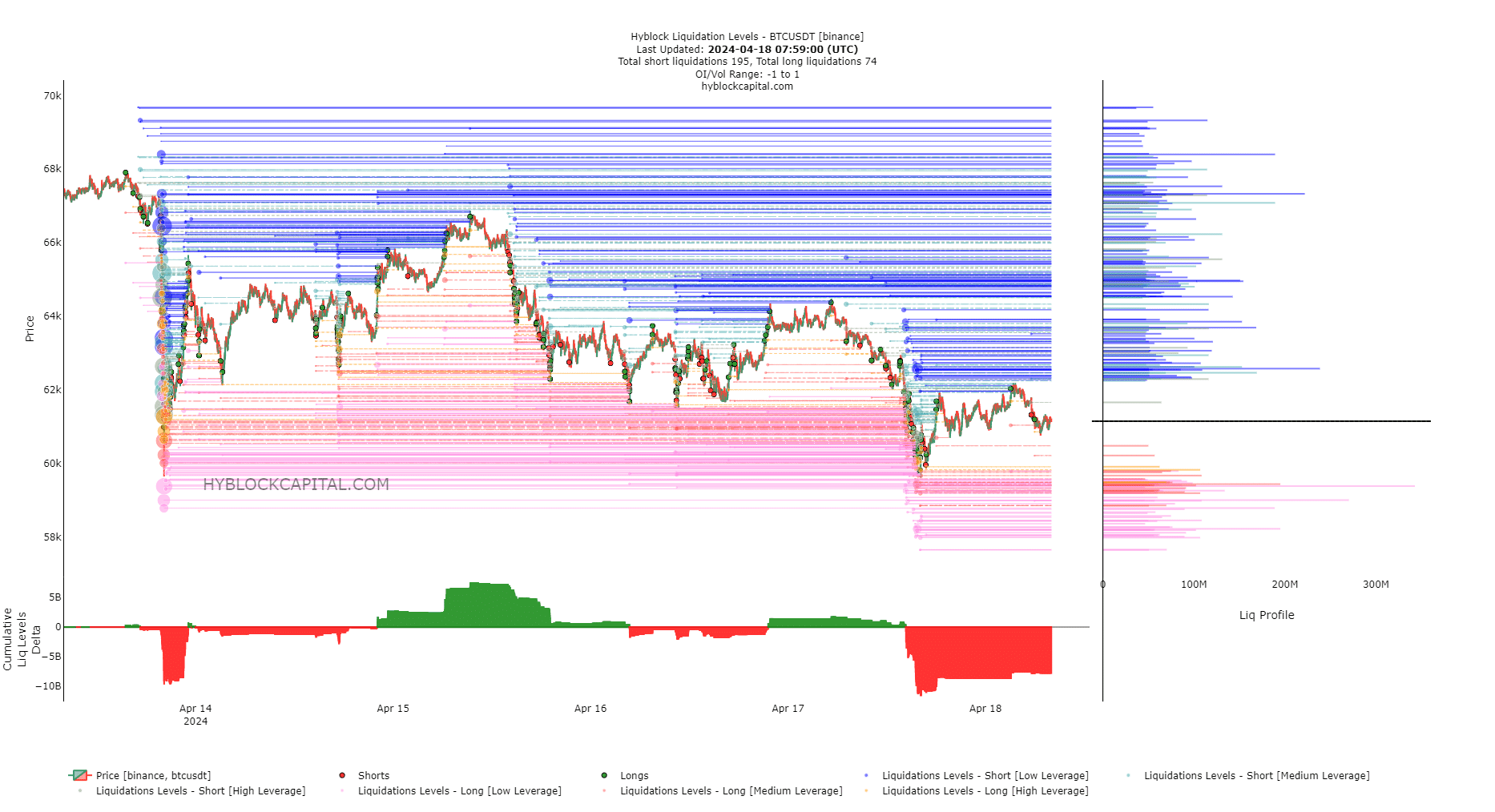

Source: Hyblock

The cumulative liquidation levels delta was negative, highlighting that short liquidation levels vastly outnumbered the long liquidation levels.

Since prices are attracted to liquidity pockets, a move upward was favored.

With that said, there was a $342 million liquidation cluster at $59.4k. Its confluence with the Fib level meant that a move to the $59k level to sweep these long liquidation levels was likely.

Is your portfolio green? Check the Bitcoin Profit Calculator

Thereafter, Bitcoin prices might surge higher to collect the liquidity to the north. However, we have seen that the selling pressure was intense.

A bounce from $59.4k was not a guarantee in these conditions, despite the lopsided cumulative liq levels delta.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.